According to Callan Associates, an investment consulting firm, “A diversified real return portfolio can be an important component to investor portfolios, given the potential long-term threat of inflation. Inflation erodes purchasing power cumulatively and exponentially by increasing the cost of future spending. While many asset classes perform poorly in an inflationary environment, a portfolio of real assets provides a hedge for inflation-driven liabilities and protects against losses in rising or high-inflation scenarios.”1 This article will explain how real return, or real assets, fits within our asset allocation framework, discuss some of the characteristics of real asset investments, and highlight commodities, typically one of the centerpieces of a real asset portfolio.

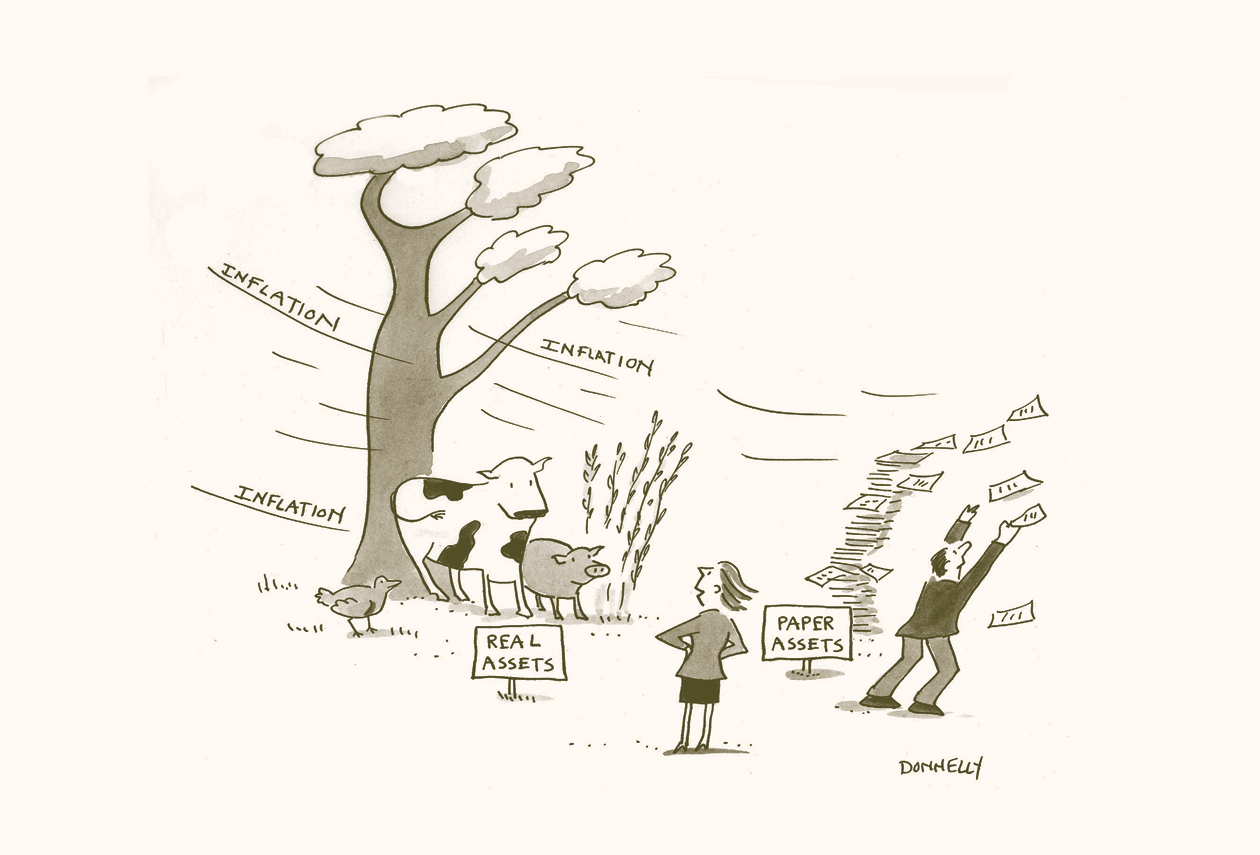

We believe asset allocation is the primary method for positioning portfolios to best meet their risk-reward objectives. Many factors determine how different asset classes will perform, but two of the most fundamental drivers are the pace at which the economy is growing or shrinking, and whether the economy is experiencing inflation or deflation. At its roots, our asset allocation framework considers expectations for both factors, then determines how to allocate assets to four primary categories, each of which serves a different purpose in an investor’s portfolio.

-

Fixed Income: Preserves capital, limits volatility, provides liquidity, and hedges against unexpected deflation

-

Absolute Return: Generates uncorrelated returns less dependent on the direction of equity and fixed income markets

-

Equities: Offers long-term capital appreciation

-

Real Assets: Hedges against unexpected inflation and produces long-term total return

Inflation has been contained over the last 25 years in the U.S., with a peak reading of 5.3% in July 2008 and an average of just 2.1%.2 We still do not believe that inflation is on the verge of spiking in the near term, but due to a number of factors, principally easy monetary policy across the world, future inflation is a more relevant risk today than it has been for a long time.

The principal purpose of real asset investments in a portfolio is to serve as a hedge against rising inflation. Real asset investments should provide a return in excess of inflation, and their performance should be sensitive to changes in inflation or expectations for future levels of inflation. A properly sized investment in real assets can help reduce total portfolio risk by performing well in an inflationary environment and countering the potential negative effects investors can expect in their fixed income portfolios. Fixed income investments are typically a portfolio’s lowest-risk allocation, and of the four asset classes, they tend to perform best in a variety of risk environments, such as economic and financial market turmoil, and during periods of deflation. However, due to historically low interest-rate levels across the world today, fixed income portfolios are particularly vulnerable to inflation and the rising interest rates that tend to accompany it. Because inflation is currently measuring higher than the yield of many high-quality fixed income investments, buy-and-hold investors today can expect a small loss of purchasing power in the future. Thus real asset investments may help sustain the purchasing power of an investor’s portfolio.

The real asset category is made up of many different underlying sectors. Among those sectors are agriculture, commodities, gold, infrastructure, private energy, private real estate, REITs (Real Estate Investment Trusts), timberland, and TIPS (Treasury Inflation Protected Securities). Each of these sectors tends to have a high degree of sensitivity to inflation and be less correlated with traditional equities and fixed income. Many of them also benefit from current cash flow.

The last time the U.S. experienced significant inflation was the late 1970s and early 1980s. From October 1977 through September 1981, CPI went from 6.3% to 11.1%, peaking at 14.6% in the spring of 1980.3 The yield on government bonds went from 7.3% to a peak of 16.3% (Exhibit 1).4

While each sector had positive nominal (before inflation) returns, on a real (after inflation) basis, investments in stocks and bonds both decreased. In particular, government bonds suffered a 23% price decline during the period. The total return was positive due to the very high starting coupon rate, much different than today’s low-interest-rate environment. On the other hand, the real asset sectors—commodities, real estate and gold—all provided attractive nominal and real returns.

Investments in commodities are frequently a centerpiece to a real asset investment. The universe of commodities can be categorized in many ways; we consider three main categories: agriculture (e.g., corn, wheat); energy (e.g., crude oil, natural gas); and metals (e.g., gold, copper). From an investment perspective, there are three ways to invest in commodities, and each has its pros and cons.

The first method is to purchase actual hard assets, for example gold bullion or barrels of oil. This method provides pure exposure to the asset, and the performance of the investment simply fluctuates with changes in price. However, most investments in physical commodities are extremely cumbersome and expensive due to storage, transportation, and spoilage costs; for example, most investors do not have the ability to purchase and store 10,000 bushels of wheat. There is also no ready market for most physical commodities. Therefore, with the exception of certain precious metals, this method is usually not an option.

The second method is via futures contracts on commodities. Futures are exchange traded, meaning they are very liquid, they have a known price, and contracts exist for many different types of commodities. However, the return on owning futures is not dictated simply by the change in the price of the underlying commodity, due to the intricacies of the way futures are traded and priced along the futures curve. Commodity futures are a common tool used by investors to gain exposure to commodities, but due to their complexity are best managed by specialists.

The third method for investing in commodities is by purchasing the stock of commodity producers and other commodity-related companies. Commodity-related stocks are abundant and easy to trade, and they allow investors the ability to attempt to select better companies over lesser performers. However, the performance of commodity-related stocks is driven by company-specific and broader equity market factors, not simply the value of the commodity they produce. Like commodity futures, purchasing commodity-related stocks is a common method to gain commodity exposure, but due to its equity characteristics should be considered in other contexts in addition to a real asset investment.

While commodity investments can form an important part of a real asset portfolio, there are a number of risks that should be considered. First, commodities typically do not provide cash flow, so not only do investors not benefit from a current cash flow, but also the lack of income means commodities can’t be valued on a fundamental basis, causing them to be more of a speculative investment. Additionally, in real terms, some commodities have tended to decline in price over longer periods of time, frequently due to improvements in technology related to how they are extracted and consumed. Commodities also tend to be quite economically sensitive, meaning they can perform well when the economy is expected to be strong, but can perform very poorly when a slowdown is expected.

As the quote from Callan suggests, a diversified real asset portfolio can be an important component to investor portfolios. Real asset investments have played a lesser role in recent years due to the low inflation environment in the U.S., meaning some investors are less familiar with their benefits. Easy global monetary policy has not yet resulted in high inflation, but now may be a good time for investors to consider how their portfolios would react if inflation were to rise. We believe a properly sized and well diversified investment in real assets can serve as a good way to reduce risk across an investor’s portfolio.

- Callan Associates, “Real Return Strategies: A Closer Look,” January 2011.

- Bloomberg; inflation measured by Headline CPI; data as of December 31, 2020.

- ibid

- Ibbotson Intermediate Government Bond

This article was originally written in July 2013 and updated to be current as of February 2021.

The opinions and analyses expressed in this communication are based on RMB Capital Management, LLC’s research and professional experience and are expressed as of the date of our mailing of this communication. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this communication. The information and data in this communication does not constitute legal, tax, accounting, investment, or other professional advice.