What Makes Us Different

We believe Curi RMB Capital Wealth Management is able to offer you a rare combination of capabilities when it comes to in-house planning and investment expertise. Our advisory and investment professionals work together to craft and deliver an integrated wealth plan—including financial planning tactics, customized asset allocation recommendations, and sophisticated investment solutions—that is designed to manage risk, seize opportunity, and drive results.

Financial & Life Planning

- Retirement Analysis

We formulate individualized projections grounded in conservative assumptions, constructing a practical roadmap towards your aspirations. By examining numerous "what if" scenarios and probabilities, we empower you to make informed, present decisions about savings strategies and spending behaviors that will influence your future

- Tax Planning

While not tax professionals, we adopt a tax-sensitive approach to your financial situation, seeking opportunities to minimize your current and future tax responsibilities. Additionally, we collaborate with your accountant to ensure that our actions are transparent and aligned with your overall financial strategy.

- Estate Planning

We believe your financial plan should endure beyond your lifetime. Working alongside your estate planning attorney, we help create a customized plan tailored to your unique circumstances, regardless of how simple or complex.

- Education Funding

We guide funding for your children's or grandchildren's education by suggesting suitable savings options, strategies, and investments. Our process involves crafting personalized projections, assisting plan execution, and tracking progress toward your goals.

- Insurance Analysis

Our goal is to ensure your and your family’s safety and peace of mind. To do so, we assess your existing insurance coverage while identifying any coverage gaps that might heighten your exposure to insurable risks. If gaps are identified, we will work with you and your insurance professionals to address it.

- Charitable Giving Strategy

Once we understand your philanthropic aims and gifting approaches, we seek to enhance execution and tax efficiency. This involves identifying appreciated securities in your portfolio for gifting and aiding in the transfer process.

- Compensation & Benefits

We assist in optimizing your entire compensation package, integrating it seamlessly with your other assets and income streams. Our guidance includes strategies for stock option exercises, investment allocations, and compensation choices.

Asset Management

- Investment Philosophy

Our investment philosophy is simple yet purposeful. We seek long-term returns measured in years, not quarters or months. We focus on the fundamentals, performing intensive research and meeting with management and company leaders, and evaluating cash flows, not just prices. Our approach is conservative, yet opportunistic – balancing safety and risk while seeking to capitalize on market dislocations. Above all, we are disciplined in our approach, remaining true to our principles and staying the course of our investment philosophy.

- Asset Allocation

Asset allocation is one of the most important determinants of long-term returns. We carefully consider risk and return potential across asset classes, focusing on long term strategic allocations and thoughtful tactical allocations.

- Investment Strategy & Implementation

We execute investment plans in the what we believe is the most effective and efficient way possible, building portfolios from the bottom‐up with an emphasis on layering in risk to achieve our investment objectives. This includes careful consideration of some of the most effective ways to mitigate risks, depending on the asset class or investment category.

- Individual Security Selection

Our Asset Management team works to identify what we believe are the appropriate securities to meet investment objectives, with careful consideration of individual stocks, bonds, and other securities. We believe that investment assets, like stocks or bonds, should be carefully evaluated on their own merits and should be concentrated in best ideas.

- Tax Efficiency

Being tax aware helps us to deliver better after-tax returns. Our team focuses on thoughtfully navigating gain realizations or harvesting losses, depending on market conditions.

- Cost Mitigation

Simply put, lower costs help improve returns. We’re committed to mitigating transaction costs and management fees through a long-term philosophy and low turnover approach aimed at reducing trading frequency and transaction costs. We also try to carefully manage trading activity to help reduce transaction costs in markets where liquidity is more limited.

Standard of Service

- Team Approach

Curi RMB Capital’s success is built on the commitment of individuals who care deeply about serving your best interests. With a network of experienced professionals throughout the organization, you can benefit from having the full force of dedicated advisors and teams working to turn your goals into reality.

- Values-Based Culture

Our culture's cornerstone is a tireless commitment to our values of: accountability, curiosity, teamwork, inclusion, and service commitment. Together, these values act as a gauge for assessing potential employees' alignment with our company and current employees' individual and team performance, ensuring that our clients’ goals and wellbeing are anchored at the center of each team’s work.

- Customized Solutions

Our portfolios and services are designed to meet the specific needs and objectives of our clients. We align asset allocation targets with clients’ longer-term goals and investment objectives, constructing portfolios that target their specific investment objectives. We also build solutions to match the tax and legal considerations faced by each unique client.

- Market Psychology Guidance

Staying true to your long-term goals and objectives can be challenging in the face of an ever-changing world. We help clients stay the course despite short-term market noise, while seizing opportunities to strategically adjust and rebalance when they present themselves. Our approach is rooted in keeping clients focused and on track for what matters most to them.

Considering Your Short and Long-Term

Your financial plan consists of different parts, and how each of these parts affects your overall strategy depends on your personal situation. To ensure this, we take a comprehensive look at your plan and create strategies that address both your short and long-term objectives. On an ongoing basis, we collaborate with your legal, accounting, and insurance partners to optimize an integrated financial plan, while also aiming to minimize any potential burdens on your end.

Integrating Your Plan and Portfolio

Considering the range of factors involved–both those universal and those specific to you–you and your advisor will engage in conversation regarding your overall portfolio and ultimately formulate suggestions regarding asset allocation. This allocation of assets serves as the foundational structure for your underlying investments.

Driven by a High Standard

The foundation of our entire organization rests on individuals who wholeheartedly embrace our shared values. With everyone aligned to Curi RMB Capital’s culture, each team can concentrate intensely on our clients, delivering a high standard of service that we pride ourselves on.

Your best interest is our best interest, and through fusing our culture and universal investment philosophy, we can offer ongoing guidance that steers clear of impulsive decision-making during the market’s fluctuations.

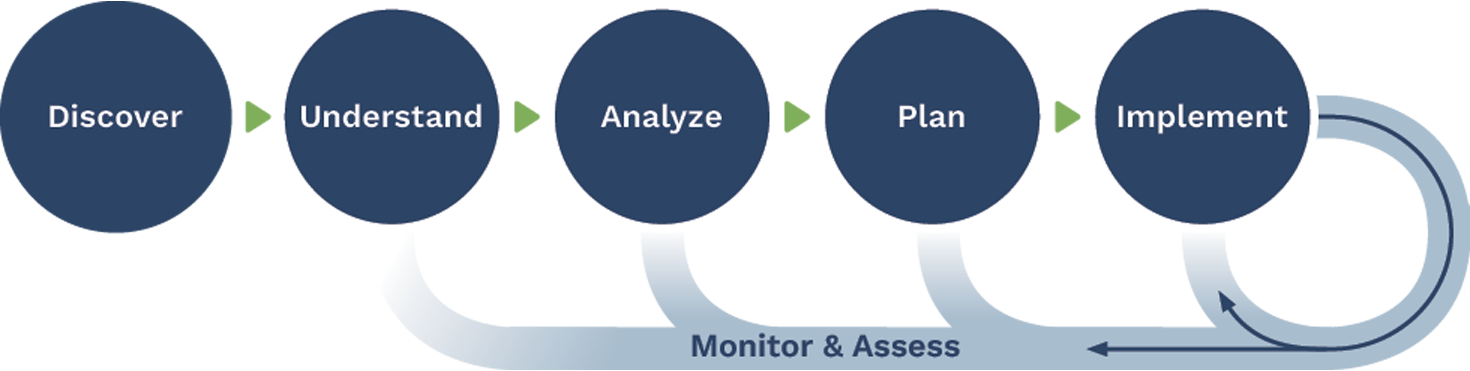

Our Wealth Management Process

Our iterative, planning-through-implementation process establishes the foundation for managing your complex financial picture, even as market conditions and personal circumstances change.

Discover

Exploring the service areas and capabilities that could make Curi RMB Capital the right fit for your needs.

Understand

Getting to know you and your family—on paper and in person

Analyze

Conducting comprehensive analysis of your financial picture, identifying potential risks and opportunities

Plan

Designing a customized, long-term financial plan built around our understanding of what you want your wealth to do for you and your beneficiaries

Implement

Implementing your plan, coordinating with your other trusted advisors when necessary

Monitor & Assess

Monitoring and refining your plan as circumstances evolve so that it continues to support the life and legacy you want

Corporate Executive Services

Our Corporate Executive Services offering is designed to help your company’s executives not only understand and optimize their total compensation package, but also address other financial planning and investment needs they may have, creating meaningful value for your employees and your business.

We have the experience, agility, and dedication to make a difference in ways that are most relevant to your organization and your people. We aim to provide your executives with the same comprehensive planning and investment solutions that our wealth management clients receive. The distinction is that our analysis and guidance take the complex elements of their total compensation package, such as captive corporate assets, into consideration.