Overview

The late, great artist formerly known as Prince released “When Doves Cry” in 1984, and it ultimately spent five weeks as the number-one hit song in the U.S. In the song, he writes, “How can you just leave me standing? Alone in a world that’s so cold? Maybe I’m just too demanding.” In what has been an incredibly challenging year for capital markets, Prince’s lyrics eerily echo the mood of many investors. After benefiting from a 40-year decline in interest rates, capped off by far-above-average gains of 17.8% per year for a traditional “60/40” portfolio (60% U.S. stocks/40% U.S. bonds) for the three years ending December 2021, investors are now faced with the harsh reality of inflation and the terrible toll it takes on the value of financial assets.

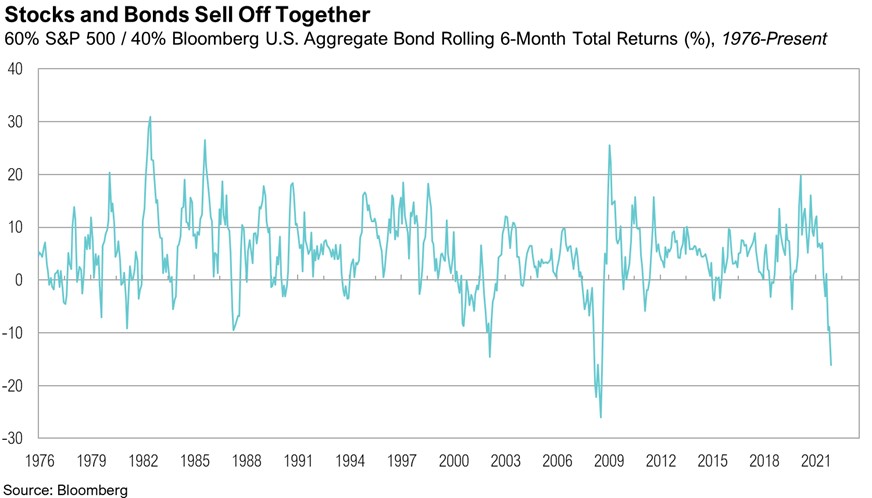

It’s not only that investors may have been too demanding, but the pivot by the Fed from one extreme to the other has exacerbated the situation, taking markets from “party like it’s 1999” to being “left in a world so cold.” By any standard, the first half of 2022 has been extremely difficult for markets. Both stocks and bonds suffered historic concurrent drawdowns. The S&P 500 Index, a proxy for the U.S. stock market, declined 20%, the third-worst start to a year since 1926 and the worst since 1962. For bonds, 2022 represents the worst start to a year ever, with the Bloomberg U.S. Aggregate Bond Index down 10.4% at the mid-year mark. Looking at six-month rolling returns, this period is the third-worst since the creation of the U.S. Aggregate Bond Index in 1976. The only two six-month periods with lower returns were in 1980 when annual inflation was above 14%.1 The only year when a 60/40 portfolio had an even worse start was 1932 when the U.S. economy was in the Great Depression.2

Commodities and energy stocks served as some of the only bright spots in the first half of 2022. Commodities as measured by the Bloomberg Commodity Index, were up 18%, and the energy sector, as proxied by the S&P Energy Select Sector Index, was up 32%. The macro environment presented perfect conditions for a commodity boom. Fiscal and monetary stimulus during the COVID-19 pandemic capped off years of dovish monetary policy around the world, and as a result, aggregate demand increased dramatically at a time when supply was constrained.

Doves and Hawks

The Federal Reserve has a dual mandate of price stability and maximum sustainable employment.3 To achieve these two goals, members of the Federal Open Market Committee (FOMC) decide what the appropriate interest rate should be given the levels of inflation and unemployment. If inflation is low and unemployment is high, the FOMC stimulates the economy by lowering interest rates, which lowers the hurdle rate for the deployment of capital into both the economy and financial assets. This policy stance is widely referred to as being “dovish.” Conversely, during periods like today when inflation is high and unemployment is low, the FOMC cools off the economy by raising interest rates. This policy stance is widely referred to as being “hawkish.”

Based on the stance of monetary policy, Fed Chairman Jerome Powell and his predecessors have been dovish since the Global Financial Crisis (GFC), effectively keeping interest rates at or only slightly above zero for most of that time. Since the FOMC first cut interest rates to zero in 2008, the Federal Funds Rate has averaged 0.5% for nearly 13 years.4 Also, during the GFC, the FOMC took its extraordinary policy a step further and introduced quantitative easing, a policy whereby they purchased Treasuries and mortgage-backed securities to further stimulate the economy. Since then, the Fed’s balance sheet has grown tenfold from around $900 billion to just shy of $9 trillion by June 2022.5

With inflation running below the Fed’s 2% target during most of the 2010s and the global pandemic that wreaked economic havoc, the Fed had no incentive to materially change its policy stance and become hawkish.1 But things have changed. Artificially buoyed demand, pandemic-related supply chain disruptions, and commodity price shocks - which were made worse by Russia’s invasion of Ukraine in February - have all sent inflation soaring. The price of oil and food, two important costs to consumers, have exploded. Since the start of the year, a barrel of West Texas Intermediate (WTI) crude oil is up 39%, rising from $76 per barrel to $106 per barrel today. The U.N. Food Price Index is up 23% from a year ago.6 Now, with year-over-year inflation for the month of June at 9.1%, a four-decade high, and a multi-generational low unemployment rate of 3.6%, Chairman Powell and the rest of the FOMC are struggling to change their dovish reputation by becoming increasingly hawkish. At the most recent FOMC meeting in June, the Fed raised interest rates by 0.75%, the largest rate hike since January 2006 and in his press conference following the decision, Powell’s tune was decidedly hawkish.

Tightening Cycle

Interest rate hiking cycles have occurred many times, but the timing of the current cycle is unique. Normally, the Fed raises rates during economic booms when demand is high and stocks are in a bull market. In fact, the Fed has only hiked rates once since 1987 when stocks were down more than 5% from the previous rate hike. That happened in December 2018 when the S&P 500 was down -13.6% from the previous interest rate hike.8 This ended up being the last interest rate increase of that cycle. After pausing, the Fed further pivoted by cutting rates in July of the following year, due to deteriorating economic conditions. On June 15, when the Fed hiked interest rates 0.75%, the S&P 500 was down -11.6% from the previous rate hike on May 4.

Today, stocks are in a bear market, and the economy is clearly slowing. In the most recent GDPNow projections released by the Atlanta Fed, second-quarter GDP growth is expected to come in at -1.2%.9 This comes on the heels of the first-quarter GDP growth of -1.6%.10 Real personal consumption expenditures have also slowed to 2.1% year-over-year, amid signs that consumers are starting to overextend themselves.12 Revolving consumer credit increased at an annual rate of 19.6% to an all-time high at the end of April (the most recent data available).13 It appears that consumers, squeezed by higher prices, are stretching to fund even their reduced spending levels. Wage gains are not keeping pace with inflation; real wage growth dropped to a new low of -3.9% in May relative to the year prior.14

The slower economic activity is occurring very early in the cycle of tighter monetary policy. The FOMC first started to raise interest rates just three months ago in March, and with the most recent increase, the current level is still only at a relatively low 1.5%. If market expectations are accurate, this may only be the halfway point of interest rate hikes; the Fed Funds Futures market currently anticipates the Fed will hike all the way to 3.25% by the end of 2022.15 Further, the FOMC only recently started to reduce its balance sheet in June, by a target of $50 billion. This is a long way from the over $500 billion contraction they have told the market to expect of them by year end.16

Markets

The S&P 500 fell -16.1% in the second quarter, resulting in its worst quarterly return since the first quarter of 2020. From a style perspective, value stocks fared better than growth stocks, as the Russell 1000® Value Index fell -12.2% while the Russell 1000® Growth Index fell -20.9%. This marked the worst quarter for growth stocks since the fourth quarter of 2008 during the GFC. Small cap stocks slightly lagged behind their large cap counterparts, returning -17.2%, as proxied by the Russell 2000® Index. Despite this dramatic market sell-off, valuations for the S&P 500 are still not cheap compared to history.1

According to data from Refinitiv, second-quarter earnings growth for S&P 500 companies are expected to increase by 5.7% on a year-over-year basis.18 Excluding the energy sector, that estimate drops to -3.0%. In more traditional recessionary periods, oil and energy stocks tend to underperform due to lower demand for the commodity as the economy contracts. However, given the challenged global supply backdrop, unseasonably low U.S. inventory levels, Chinese demand coming back after months of lockdowns, and an oil futures curve in steep backwardation (suggesting a persistently tight market), oil may not decline as much as in prior recessions. Even with strong energy sector profits, second-quarter earnings are expected to come in lower than projections. Entering the year, analysts expected 8.2% earnings growth for the second quarter of 2022.19 Regardless of slightly lowered expectations, positive earnings growth relative to the same quarter last year is a welcomed dynamic, given the slowdown in the economy, even if that growth is below the rate of inflation.

International equities outperformed the U.S. in the second quarter, with the MSCI EAFE Index down -14.3% and MSCI Emerging Markets Index down -11.3%. This is despite the U.S. dollar strengthening 6.5% over the quarter. The U.S. Dollar Index is now at its highest level since November 2002. Conversely, the Yen has underperformed dramatically this year, with the yen-dollar exchange rate down -15.2% for the year-to-date, including a -10.7% drop in the second quarter. The weakening Yen can be attributed to ultra-dovish monetary policy by the Bank of Japan, including overnight interest rates at -0.1% and a policy called “yield curve control,” which is designed to cap the ten-year Japanese Government Bond yield at just 0.25%.20

Within fixed income, the Bloomberg U.S. Aggregate Bond Index was down -4.7% in the second quarter. The 10-Year Treasury yield peaked at 3.48% on June 13, its highest yield since April 2011 and right before the FOMC’s June 15 meeting when it raised interest rates by 0.75%. Credit spreads widened throughout the quarter, leading to poor returns in high yield bonds, which were down -9.8%, as proxied by the Bloomberg U.S. High Yield Bond Index. The option-adjusted spread for the high yield index is now at 569 basis points, up from 325 basis points at the beginning of the quarter. Finally, due to both a strengthening U.S. Dollar and wider credit spreads, emerging market bonds underperformed, down -11.4% over the quarter, as measured by the JPM EMBI Global Diversified Index.2

1 Source: Bloomberg.

2 Source: Bloomberg.

Looking Forward

The Fed has just begun the process of withdrawing its unusually accommodative monetary policy over the past 13 years. It is attempting to slow demand, cool the red-hot labor market, and hopefully reduce inflation. Recent economic developments suggest the odds of a “soft landing”—a scenario where the Fed is able to cool the market just enough to stop inflation without doing harm to the economy—are too low to bet capital on. As a result, we think investors should still err on the side of patience when it comes to deploying capital. Although stocks and bonds are meaningfully below their record highs, the policy-goosed prices of the past few years may have anchored investors to unsustainable levels of economic activity and market prices. In order to get more comfortable deploying more risk in stocks, we would like to see more compelling valuations (lower prices) or enough evidence of a material improvement in the inflation backdrop that would suggest an imminent pivot in monetary policy.

Despite this far-from-optimistic backdrop, there is good news. Lower prices are creating opportunities. Investors can now earn a 2.8% yield on a two-Year Treasury that yielded just 0.1% early last year. Further, the average high yield bond, as proxied by the Bloomberg High Yield Bond Index, now yields approximately 8%, its highest since February 2012. The pain felt today via lower prices (and higher yields) increases the return potential of all financial assets. To paraphrase the late great Prince, “Dearly beloved, we’re gathered here today to get through this thing called… the bear market.”

At RMB, we believe there will be continued volatility in both equity and fixed income markets, as the Federal Reserve continues with their plan to increase interest rates in the face of raising inflation. Markets continue to price in additional interest rate hikes through the rest of 2022. We believe that fundamentals will be a key driver of markets over the longer-term but the risks in the short-term are continuing to rise. While earnings growth estimates remain positive, we are starting to see signs of that growth slowing down, as companies are grappling with continued headwinds such as high inflation, supply chain disruptions, labor shortages, and the ongoing conflict in Europe. We continue to believe that the income component of our client’s investment portfolios – the interest paid from owning bonds and stock dividends – will be a more important factor of investment returns going forward. To help weather the on-going volatility we are likely to experience in the coming months, we continue to recommend that clients stick to their long-term investment allocation targets and use the market volatility to their benefit by taking advantage of rebalancing opportunities to selectively make changes within portfolios. During volatile times, the key to successful investing is often remaining calm and committed to long-term investment plans. We remain optimistic that the strategies we have in place for our clients will drive long-term success, despite the volatility we are currently experiencing.

Citations

1. U.S. BLS: https://fred.stlouisfed.org/series/CPIAUCSL

2. Ibbotson Associates

3. Chicago Fed: https://www.chicagofed.org/research/dual-mandate/dual-mandate

4. FRED: https://fred.stlouisfed.org/series/FEDFUNDS

5. Federal Reserve: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

6. United Nations FAO: https://www.fao.org/worldfoodsituation/foodpricesindex/en/

7. Federal Reserve: https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220615.pdf

8. SpringTide Partners

9. ATL Fed: https://www.atlantafed.org/cqer/research/gdpnow

10. U.S. BEA: https://www.bea.gov/news/2022/gross-domestic-product-third-estimate-gdp-industry-and-corporate-profits-revised-first

11. ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/

12. U.S. BEA: https://fred.stlouisfed.org/series/PCEC96#

13. Federal Reserve: https://www.federalreserve.gov/releases/g19/20220607/g19.pdf

14. U.S. BLS: https://www.bls.gov/news.release/realer.htm

15. CME Group: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

16. Federal Reserve: https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm

17. Yale: http://www.econ.yale.edu/~shiller/data.htm

18. Refinitiv: https://lipperalpha.refinitiv.com/2022/07/this-week-in-earnings-22q2-july-8-2022/

19. FactSet: https://insight.factset.com/industry-analysts-expect-sp-500-to-report-record-high-eps-in-2022#:~:text=Earnings&text=For%202022%2C%20the%20bottom%2Dup,in%20the%20index)%20is%20%24222.32.

20. Financial Times: https://www.ft.com/content/004990e9-d756-4cfe-9be2-be2ec6fc8dcd

Performance Disclosures

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

Index Definitions

- The S&P 500 Index is widely regarded as the best single gauge of the United States equity market. It includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 focuses on the large cap segment of the market and covers approximately 75% of U.S. equities.

- The Bloomberg Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Duration is roughly 5 years.

- The Bloomberg Commodity Index is a broadly diversified commodity price index calculated on an excess return basis and reflects commodity futures price movement.

- The Bloomberg Barclays U.S. High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from emerging market countries are excluded, but Canadian and global bonds of issuers in non-emerging market countries are included. The index consists of both corporate and non-corporate sectors. The corporate sectors are industrial, utility and finance, which include both US and non-US corporations. The securities within the index must have at least one year to final maturity, must have at least $150 million par amount outstanding and must be rated as high-yield (BB+ or lower). They must also be fixed rate, dollar-denominated and non-convertible.

- The S&P Energy Select Sector Index seeks to measure S&P 500 constituents in the Energy sector, using capping to ensure diversification among companies within the index.

- The U.N. Food Price Index is compiled by the Food and Agriculture Organization (FAO) of the United Nations as a measure of the monthly change in international prices of a basket of food commodities.

- The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

- The Russell 1000® Growth Index measures the performance of the large- cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

- The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. It includes approximately 2000 of the smallest US equity securities in the Russell 3000 Index based on a combination of market capitalization and current index membership. The Russell 2000 Index represents approximately 10% of the total market capitalization of the Russell 3000 Index. Because the Russell 2000 serves as a proxy for lower quality, small cap stocks, it provides an appropriate benchmark for RMB Special Situations.

- MSCI EAFE Index*: an equity index which captures large and mid-cap representation across 21 of 23 Developed Markets countries around the world, excluding the U.S. and Canada. With 926 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

- The MSCI Emerging Markets Index* measures equity market performance in the global emerging markets universe. It covers over 2,700 securities in 21 markets that are currently classified as EM countries. The MSCI EM Index universe spans large, mid and small cap securities and can be segmented across all styles and sectors.

- The U.S. Dollar Index is used to measure the value of the dollar against a basket of six foreign currencies: the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

- The J.P. Morgan ESG EMBI Global Diversified Index (JESG EMBIG) tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

*Source: MSCI.MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.