Key Takeaways

- U.S. equities rallied post-election. Large-cap stocks rose 6% and small-cap stocks increased by 11% in November. International equities not only underperformed, but ended the month in the red.

- The Federal Reserve cut rates by 0.25% in November, and another 0.25% reduction is expected in December. Inflation edged higher in October, primarily due to rising housing costs.

- Donald Trump won the 2024 presidential election with 312 electoral votes to Kamala Harris’s 226, and the Republican Party gained control of Congress.

- The appointment of Scott Bessent to the Treasury brings a renewed focus on the deficit and better alignment with the Fed’s policy of trying to grow the U.S. out of massive deficits.

Overview

Markets posted mixed returns in November. U.S. large-cap stocks, represented by the S&P 500 index, ended the month up 5.9%, while the small cap Russell 2000 index ended the month up 11.0%. In contrast, international equities underperformed their U.S. counterparts and ended the month in the red. International developed market large cap stocks declined 0.6%, and emerging market stocks ended November down 3.6%. U.S. intermediate-term bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, ended the month up 1.1%.

GDP estimates show the U.S. economy growing at an annualized rate of 2.8% quarter-over-quarter in the third quarter, supported by robust consumer and government spending. Consumer spending posted its best quarter so far this year as it increased by 3.5%, while government spending increased by 5.0%. 1 The services sector of the economy continues to expand, with the ISM Services PMI registering 52.1 in November. 2

Although notably lower than its June 2022 peak of 9.0% year-over-year, inflation, as measured by CPI, remains sticky and above the Fed’s stated target of 2%. In October, headline inflation increased slightly to 2.6% year-over-year from 2.4% the prior month, while core inflation remained at 3.3% and has averaged 3.5% throughout 2024. 3 Housing inflation continues to be the main driver of higher inflation, as the shelter component of inflation rose by 0.4% month-over-month (accounting for over half of all the monthly increase) and 4.9% year-over-year. 3

October marked the start of the U.S. government’s 2025 fiscal year, and the budget deficit has already reached $257 billion—the second-largest October deficit since at least 1981, surpassed only by October 2020. 4 The Congressional Budget Office projects the fiscal 2025 deficit will closely align with 2024 levels, hitting approximately $1.9 trillion. 5 Net interest payments remain a substantial component of federal outlays at 14%. 4

As widely anticipated, the Federal Reserve cut interest rates by 0.25% at the November Federal Open Market Committee (FOMC) meeting. 6 Another 0.25% rate reduction is expected at the December FOMC meeting. This would bring the total rate reduction for the year to 1.0%. 7 Given strong economic growth and sticky inflation, one 0.25% rate cut has been priced out for 2025, and markets expect the equivalent of three 0.25% cuts next year. 7 On November 14, at a speech in Dallas, Fed Chair Jerome Powell stated that the Fed isn’t in a hurry to cut rates:

“I expect inflation to continue to come down toward our 2% objective, albeit on a sometimes-bumpy path… The economy is not sending any signals that we need to be in a hurry to lower rates.” 8

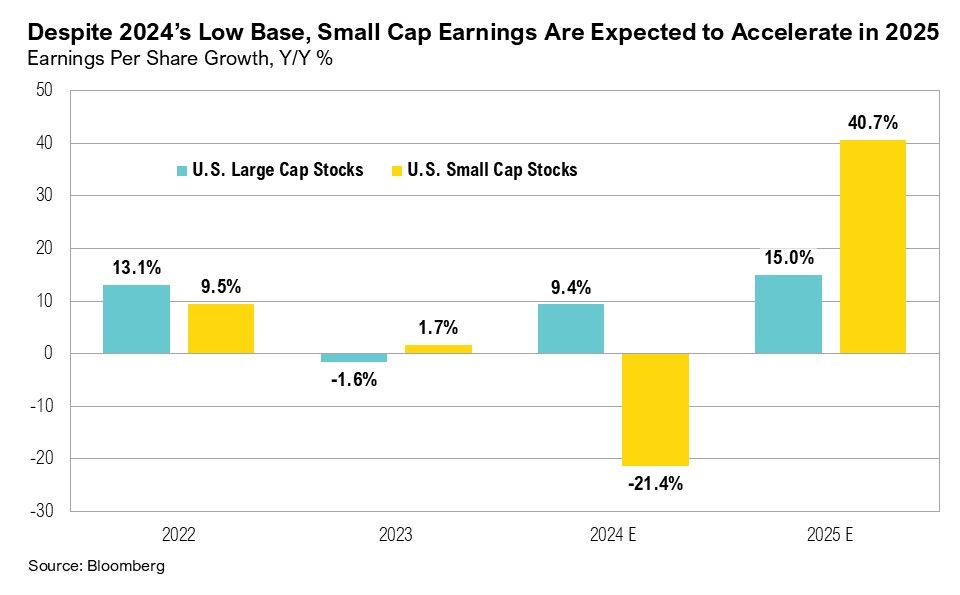

Over 95% of S&P 500 companies have reported third-quarter earnings results. Earnings growth estimates improved over the quarter, increasing from 4.2% to 5.8%, primarily driven by a handful of mega-cap technology companies and select sectors, such as communication services (+23%), consumer discretionary (+9%), and financials (+7%). 9 Full-year earnings growth for the S&P 500 in 2024 is projected to reach 9.4% due to significant contributions from the communication services, financials, and consumer discretionary sectors. 9 Earnings growth estimates for 2025 are currently expected to be 15.0%, which would be the best growth rate since 2021, when it was over 35%. 9 As of the end of November, the S&P 500’s price-to-earnings (P/E) ratio was at 22.5x, compared to 30.1x at the peak of the tech bubble. However, the top 10 S&P 50 companies account for 34.8% of the Index, compared to 25% at the tech bubble peak. 10

Red

On November 6, with 277 of the 270 required electoral college votes, Donald Trump was announced the winner of the 2024 presidential election. By the final count on November 10, Trump amassed 312 electoral votes to Kamala Harris’s 226. 11 The Republican party has also kept control of the House and gained a majority in the Senate. Trump won each of the seven swing states, and the race in Pennsylvania—widely considered the key determinant—was called in the early hours of November 6. Exit polls showed that for the first time in at least 20 years, self-identified independents accounted for a larger share of voters (34%) than Democrats (32%) and were tied with Republicans (34%). 12 Trump is also the first Republican president to win the popular vote in 20 years.

Historically, markets tend to rally following elections as uncertainty subsides, and 2024 has proven no different. In fact, 2024 market returns are above average: between 1924 and 2020, U.S. large cap stocks have increased 2% during the month in which an election was held, while U.S. small cap stocks have increased 3%. In 2024, U.S. large-cap stocks gained 5.9% during election month, while U.S. small-cap stocks gained an impressive 11.0%. U.S. intermediate-term bonds also outperformed historical norms, rising 1.1% over the election month compared to the historical average gain of 0.5%.

While U.S. small-cap stocks outperformed large-cap peers by 4.1% since Election Day, they lag by an annualized 6.4% over the past three years. A similar pattern occurred when President Trump won the election in 2016 and small-cap stocks outperformed large-cap stocks by 7.6%. Historical precedent aside, small-cap stocks could benefit from contained interest rates, onshoring initiatives, and reduced regulation under the new administration. By the end of November, full-year 2025 earnings growth estimates for the Russell 2000 stood at 41%, compared to 15% for the S&P 500.

Long-term Treasury yields declined in November. After peaking at 4.5% on November 13, the 10-year Treasury yield ended the month at 4.2%. The bond market appeared to respond positively to the nomination of Scott Bessent as U.S. Treasury Secretary. Bessent has a decades-long career in finance, including his role as a partner at Soros Fund Management and as the founder of Key Square Group, both global macro hedge funds. 13,14 His platform includes advocating for tax cuts, reducing government spending (and deficits), strong national defense, targeted and gradual tariffs, and a focus on lowering inflation. Bessent has proposed a “3-3-3” target, aiming to achieve 3% economic growth, a reduction in the deficit to 3% by 2028, and an increase in daily oil production by 3 million barrels, which is about a 20% increase from current levels. 15,16,17 When asked about his decision to accept the nomination, Bessent remarked:

“This election cycle is the last chance for the U.S. to grow our way out of this mountain of debt…” 18

We believe the new administration will usher in a more supportive regulatory regime for digital assets. Both Trump and Vice President-Elect J.D. Vance have expressed strong support for cryptocurrencies. 19,20,21,22 Bitcoin surged 39% in November and is up 119% year-to-date. With a pro-crypto administration taking office in 2025, expectations are rising for eased regulations on exchange-traded funds for cryptocurrencies, such as Ethereum and Solana. 23,24 There is also speculation about the establishment of a U.S. strategic bitcoin reserve. 25 Regulatory clarity introduced by the new administration could pave the way for broader institutional and advisory adoption of digital assets. This perspective is best captured by incoming Charles Schwab CEO Rick Wurster, who recently stated that:

“We will get into spot crypto when the regulatory environment changes, and we do anticipate that it will change, and we’re getting ready for that eventuality.” 26

Markets

U.S. equity markets fared significantly better than their international counterparts in November. U.S. large-cap stocks ended the month up 5.9%, but international, developed-market, large-cap stocks saw red as they ended the month down 0.6%. Similarly, while U.S. small-cap stocks ended the month up 11.0%, international developed market small-cap stocks ended the month up 0.1%. Emerging market stocks ended November down 3.6%, driven by declines in Brazil, South Korea, and Taiwan. A similar pattern occurred in fixed income markets. U.S. intermediate-term bonds gained 1.1%, but international developed market bonds ended November up only 0.2%.

Looking Forward

Our position on the markets remains unchanged. We continue to be cautious with risk assets as the current cycle plays out. With a decisive red sweep, market participants have more clarity on the direction of U.S. policy. Most importantly, the appointment of Scott Bessent to the Treasury brings a renewed focus on the deficit and better alignment with the Fed’s policy of trying to grow the U.S. out of massive deficits. We expect the yield curve to continue to normalize and Inflation appears to be contained, but risk to the upside has increased. U.S. markets responded positively to the election results over the last month, but we would note that stock and bond returns are typically not too sensitive to election outcomes over the longer term.

We expect the increased volatility in markets to continue in the coming weeks and months. Although lower asset prices would be a welcome development and an opportunity to put additional capital to work, equity valuations suggest that there is no rush. Stock returns and corporate earnings have been very concentrated and equity valuation continues to be above average, even when excluding the top performing stocks. We remain biased towards high-quality companies within our core stock portfolios. We have been well-positioned within core bond portfolios with a low weight toward shorter-duration corporate bonds and a higher weight toward longer-duration treasury bonds. We believe clients are best served reminding themselves of the timeless principles of patience and diversification. The key to successful investing is often remaining committed to long-term investment plans.

Citations

- BEA: https://www.bea.gov/sites/default/files/2024-11/gdp3q24-2nd.pdf

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/november/

- BLS: https://www.bls.gov/news.release/cpi.nr0.htm

- Bureau of the Fiscal Service: https://www.fiscal.treasury.gov/files/reports-statements/mts/mts1024.pdf

- Congressional Budget Office: https://www.cbo.gov/system/files/2024-06/60039-Outlook-2024.pdf

- Federal Reserve: https://www.federalreserve.gov/monetarypolicy/files/monetary20241107a1.pdf

- CME FedWatch: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- Federal Reserve: https://www.federalreserve.gov/newsevents/speech/powell20241114a.htm

- FactSet: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_112224.pdf

- S&P Global: https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

- CNN: https://edition.cnn.com/election/2024

- Reuters: https://www.reuters.com/world/us/first-us-independent-turnout-tops-democrats-ties-republicans-edison-research-2024-11-06/

- Forbes: https://www.forbes.com/sites/dereksaul/2024/11/22/what-to-know-about-scott-bessent-trumps-pro-tariff-treasury-pick/

- CNBC: https://www.cnbc.com/2024/11/22/donald-trump-chooses-hedge-fund-executive-scott-bessent-for-treasury-secretary.html

- CNBC: https://www.cnbc.com/2024/11/25/scott-bessent-what-trumps-treasury-pick-could-mean-for-markets.html

- Wall Street Journal: https://www.wsj.com/politics/policy/scott-bessent-sees-a-coming-global-economic-reordering-he-wants-to-be-part-of-it-533d6e71

- EIA: https://www.eia.gov/dnav/pet/hist/leafhandler.ashx?n=pet&s=mcrfpus2&f=m

- AP News: https://apnews.com/article/treasury-trump-biden-finance-elections-bessent-transition-8df8be88e4c83df4b9f3c4238966e79d

- Politico: https://www.politico.com/news/2024/06/26/vance-crypto-00164859

- Barrons: https://www.barrons.com/articles/jd-vance-investments-millions-worth-tech-bitcoin-oil-5d7b7857

- CNBC: https://www.cnbc.com/2024/11/06/trump-claims-presidential-win-here-is-what-he-promised-the-crypto-industry-ahead-of-the-election.html

- Reuters: https://www.reuters.com/technology/bitcoin-surges-record-high-trump-bets-2024-11-11/

- CNN: https://edition.cnn.com/2024/12/04/tech/bitcoin-100k-trump-hnk-intl/index.html

- Bloomberg: https://www.bloomberg.com/news/videos/2024-12-03/solana-etf-approvals-coming-bi-video

- Decrypt: https://decrypt.co/290811/bitcoin-strategic-reserve-us-how-could-work

- Bloomberg: https://www.bloomberg.com/news/articles/2024-11-21/charles-schwab-eyes-spot-crypto-trading-once-regulations-change

Index Definitions

The S&P 500 Index is widely regarded as the best single gauge of the United States equity market. It includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 focuses on the large cap segment of the market and covers approximately 75% of U.S. equities.

The Bloomberg Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Duration is roughly 5 years.

The Bloomberg U.S. Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded.

The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

The Russell 1000® Growth Index measures the performance of the large- cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. It includes approximately 2000 of the smallest US equity securities in the Russell 3000 Index based on a combination of market capitalization and current index membership. The Russell 2000 Index represents approximately 10% of the total market capitalization of the Russell 3000 Index. Because the Russell 2000 serves as a proxy for lower quality, small cap stocks, it provides an appropriate benchmark for RMB Special Situations.

MSCI EAFE Index*: an equity index which captures large and mid-cap representation across 21 of 23 Developed Markets countries around the world, excluding the U.S. and Canada. With 926 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index* measures equity market performance in the global emerging markets universe. It covers over 2,700 securities in 21 markets that are currently classified as EM countries. The MSCI EM Index universe spans large, mid and small cap securities and can be segmented across all styles and sectors.

The U.S. Dollar Index is used to measure the value of the dollar against a basket of six foreign currencies: the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

The Deutsche Bank EM FX Equally Weighted Spot Index, an equal-weighted basket of 21 emerging market currencies.

MSCI U.S. REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (REITs). The index is based on the MSCI USA Investable Market Index (IMI), its parent index, which captures the large, mid and small cap segments of the USA market. With 150 constituents, it represents about 99% of the US REIT universe and securities are classified under the Equity REITs Industry (under the Real Estate Sector) according to the Global Industry Classification Standard (GICS®), have core real estate exposure (i.e., only selected Specialized REITs are eligible) and carry REIT tax status.

MSCI China NR Index: designed to measure the performance of the large and mid cap segments of the Chilean market. With 12 constituents, the index covers approximately 85% of the Chile equity universe.

MSCI South Africa NR Index: designed to measure the performance of the large and mid cap segments of the South African market. With 37 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in South Africa.

Disclaimers

Performance Disclosures

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

The opinions and analyses expressed in this newsletter are based on Curi RMB Capital, LLC’s (“Curi RMB Capital”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. Curi RMB Capital makes no warranty or representation, express or implied, nor does Curi RMB Capital accept any liability, with respect to the information and data set forth herein, and Curi RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. RMB Asset Management is a division of Curi RMB Capital.