Key Takeaways

- The Federal Reserve hiked interest rates by another 25 basis points at the May 3 FOMC meeting. Fed officials paused increases at the June meeting, though it is unclear if the pause will continue in coming months.

- In late May, an agreement was made to suspend the debt ceiling until January 1, 2025. As part of the agreement, student loan payments will resume within the coming months, barring a Supreme Court ruling in favor of Biden’s forgiveness plan.

- On par with the debt ceiling debate was the ongoing buzz surrounding AI applications, which has gained increasing attention since the release of ChatGPT in November of last year, even though it is not a novel technology.

- U.S. consumer spending remains resilient, but increasingly reliant on a rapidly dwindling supply of COVID-era savings accumulations, as well as rising levels of consumer debt.

Overview

The month started off with the collapse of the third significant U.S. bank this year, First Republic. In mid-May, Pacific Western raised alarm bells as it reported that investors withdrew $1.8 billion in deposits in the week ending May 12.1 However, PacWest seems to have avoided disaster and pulled itself from the brink of collapse by selling $2.7 billion in real estate loans.2 The Federal Reserve hiked interest rates by another 25 basis points at its May 3 FOMC meeting, then left rates unchanged at the June meeting.3

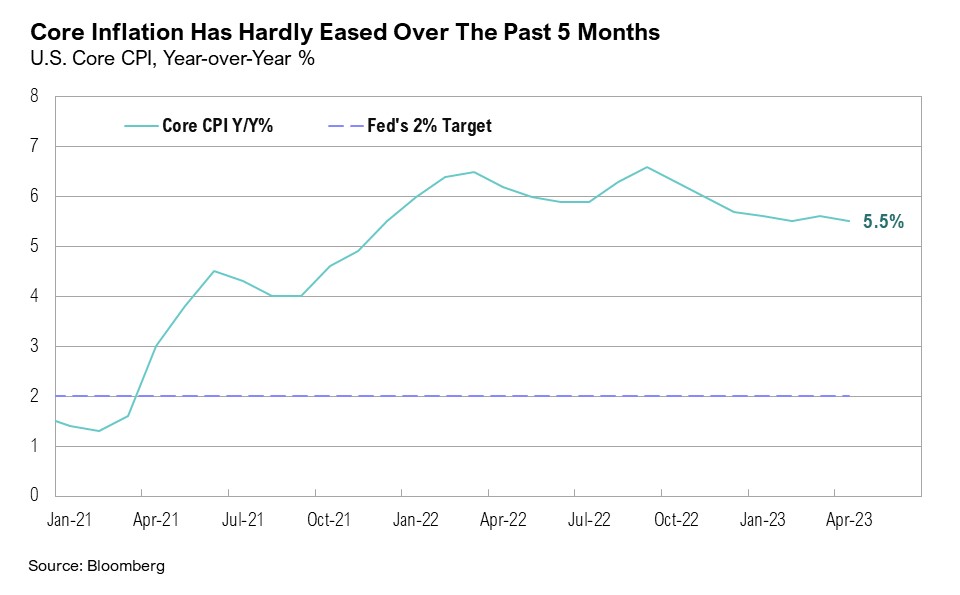

Complicating the FOMC’s future rate hike decisions were mixed economic reports throughout May. April’s inflation print showed that while headline year-over-year inflation is easing (as it dropped to 4.9%—the smallest 12-month increase since April 2021), it remains elevated. Additionally, with a 5.5% annual increase, Core CPI, which excludes the more volatile food and energy components, has hardly eased over the past five months.4 Furthermore, the Personal Consumption Expenditure (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, also remained stubbornly high, as it rose by 4.4% in April. The May unemployment rate increased modestly to 3.7%, from 3.4% the prior month. Despite that, the payroll survey showed the labor market added 339,000 new jobs in May, far outpacing the expected 190,000 and once again proving its strength.5

Throughout May, the debt ceiling debate continued to dominate headlines, as politicians on both sides refused to budge. On May 1, Treasury Secretary Janet Yellen wrote a letter to Congress in which she laid out the urgency of a resolution: The U.S. would run out of cash and be forced to default on its debt by as soon as June 1 if the debt ceiling was not raised as soon as possible.6 On May 30, with Treasury’s cash balance dropping below $50 billion, a tentative agreement was finally reached between President Biden and House Speaker McCarthy.7 The agreement, which was formalized in early June, suspended the debt ceiling until January 1, 2025, with several spending conditions worked into the deal.7

One of these conditions was restarting federal student loan payments.8 In March 2020, federal student loan payments were paused as part of COVID-19 relief efforts. Now, more than three years later, these student loan payments are set to resume within the next few months, barring a Supreme Court decision to pass President Biden’s loan forgiveness plan.9 As a result, in the coming months, a larger proportion of incomes may be diverted to debt servicing, which may mean less spending and lower consumption.

Bulls, Bears, and Bots

May was also dominated by the Artificial Intelligence (AI) boom, even though AI is not a new technology. As a concept, its roots date back to the mid-20th century, emerging from a combination of various disciplines, including computer science, philosophy, mathematics, and neuroscience.10 AI has long been embedded in many everyday technologies, ranging from internet search optimization to autonomous driving vehicles (in Tesla’s, for example), Apple’s Siri, and Amazon’s Alexa.11

The recent spike in interest surrounding AI can largely be attributed to the launch of ChatGPT in November last year. ChatGPT, developed by a company called OpenAI, is a generative pre-trained transformer (GPT) model designed to generate human-like text. As a concept, ChatGPT is also not novel. In 2011, IBM released a question-answering computer system, called Watson. Able to answer questions in natural language, Watson was built on the same idea as ChatGPT, yet has been a disappointment for IBM for more than a decade.12 But ChatGPT is not Watson, thanks to recent improvements in computing speed and the broad availability of training data via the internet, both of which have turbo-charged generative AI. In a rapid response to the launch of ChatGPT, Google launched Bard, another natural language processing model in March this year.13 Suddenly, generative AI was everywhere.

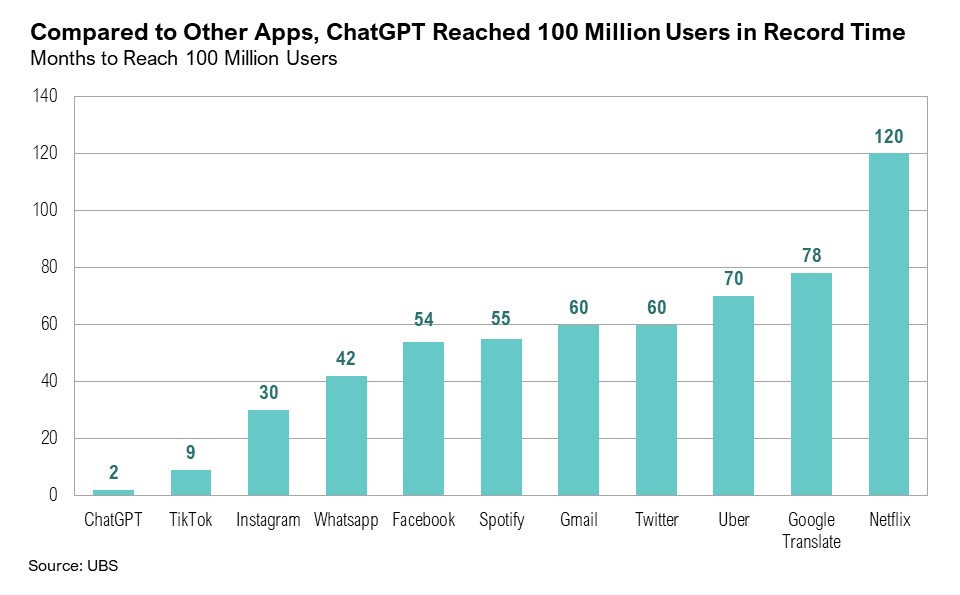

The buzz around AI is unavoidable. Since the launch of ChatGPT six months ago, Google searches for both ‘AI’ and ‘ChatGPT’ have exploded to new highs.14 During first-quarter earnings calls, 110 S&P 500 companies mentioned the term ‘AI’—a 41% increase from the fourth quarter of 2022.15 It took ChatGPT only two months since its launch to reach 100 million global users. For comparison, it took Instagram 30 months, Gmail 60 months, and Netflix 120 months to reach the same milestone.16 If famous venture capitalist Marc Andreessen was right when he opined that software was eating the world, Nvidia CEO Jensen Huang may also be right in his quip that AI is eating software.17,18

Markets, in particular technology stocks, have been benefitting from the recent AI buzz. Overall, U.S. equity funds witnessed inflows of around $3 billion in the last week of May—the first weekly inflows in more than 10 weeks.19 In particular, U.S. equity sector funds that invest primarily in the tech sector saw inflows of $1.1 billion in the last week of May.19 Considering that, year-to-date, nearly $1.3 billion has flowed out of these funds, the last three weeks have been a meaningful reversal.19

Golden Goose or Chaos Agent?

Why the excitement? By some estimates, AI could contribute as much as $15 trillion to the global economy by 2030.20 Businesses that can capture a significant share of this potential growth could become industry leaders. Nvidia, a manufacturer of graphics processing units (GPUs) for other tech companies, including Microsoft and Google, may be one such business. Following strong future guidance in its first-quarter earnings call, Nvidia briefly joined the $1 trillion market cap club on May 30 before dropping back to $990 billion by the end of the trading day.21 Nvidia has been working on AI since the early 2000s and is currently one of the very few manufacturers of cutting-edge AI components.22 This, combined with the company’s highly effective CUDA software (a user-friendly computing platform and programming model), has helped Nvidia emerge as one of the biggest winners of the recent AI boom.23 In fact, the company has gained such attention over the past few years that the host of a popular financial show on CNBC (Jim Cramer) named his dog Nvidia.24

Smaller companies may also be poised to benefit from the strong deployment of AI. Hock E. Tan, the CEO of Broadcom, an American semiconductor manufacturer, sees the opportunity for his company’s revenue growth over the next two years:

“Our revenue today from this opportunity represents about 15% of our semiconductor business… We believe it could be over 25% of our semiconductor revenue in fiscal 2024. In fact, over the course of fiscal 2023 that we’re in, we are seeing a trajectory where our quarterly revenue entering the year doubles by the time we exit 2023.”25

Although others see opportunities in the AI buzz, Microsoft founder Bill Gates sees a winner-takes-all scenario in the industry. According to him:

“There will be one company that creates a personal agent that will understand all your activities and read your messages… that’s a big thing because you’ll never go to a search site again. Everything will be mediated through your agent. Whoever wins that will take the current dispersed, high-profit areas, and move them into a single area.”26

AI isn't just about super genius personal assistants, though. Indeed, these exciting and novel uses of AI are gaining the most attention today, but AI has a much broader range of potential uses that are more quotidian, but arguably no less important. Case studies reveal that AI has already increased worker productivity in certain sectors. Researchers from Stanford and MIT found that generative AI tools such as chatbots boosted the productivity of tech support agents by between 14% and 35%.27 According to the study, AI tools particularly helped improve the productivity of entry-level and low-skilled workers.27 The study also found that generative AI-based conversational assistants improved customer sentiment and lowered the need for intervention from managers.27

On the other hand, AI could significantly disrupt precisely this segment of the labor force. AI has long been used to streamline multiple business operations, including evaluating potential job applications, monitoring productivity, and dealing with simple customer queries via chatbots. It’s easy to imagine that generative AI could lead to flatter organizations, as it further automates many of the tasks performed by entry-level workers.28 AI’s impact on the labor market could lead to structural changes in the distribution of jobs and skills, which could exacerbate income inequality and unemployment, particularly in developing economies. Throughout history, economies have, for the most part, been good at adapting and creating new jobs, particularly as technology has raised living standards. For now, the impact of generative AI on the labor force remains unclear.

But AI is not without its flaws. Often, because generative AI systems such as ChatGPT and Google’s Bard deliver information with such confidence, it may be difficult to separate fact from fiction. As Wharton School of Business professor Ethan Mollick said:

“The best way to think about this is you are chatting with an omniscient, eager-to-please intern who sometimes lies to you.”29

A recent real-life example best illustrates this risk of disinformation. A New York lawyer is now facing a court hearing after he admitted that his firm used ChatGPT for legal research in a case against an airline. Further investigation revealed that ChatGPT created several fictional case studies, which the lawyer then used in court as evidence. When asked by the judge why he had used ChatGPT, the lawyer admitted that he was “unaware that its content could be false.”30

Concerns about the implications of AI extend beyond simple economic metrics, too. A group of more than 350 industry leaders, including the chief executives of OpenAI and Google DeepMind, have signed an open letter warning of its risks. In the letter, the signatories warn that “mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks, such as pandemics and nuclear war”.31 In particular, the issue of how to regulate AI has become a topic of increasingly heated debate.

Markets

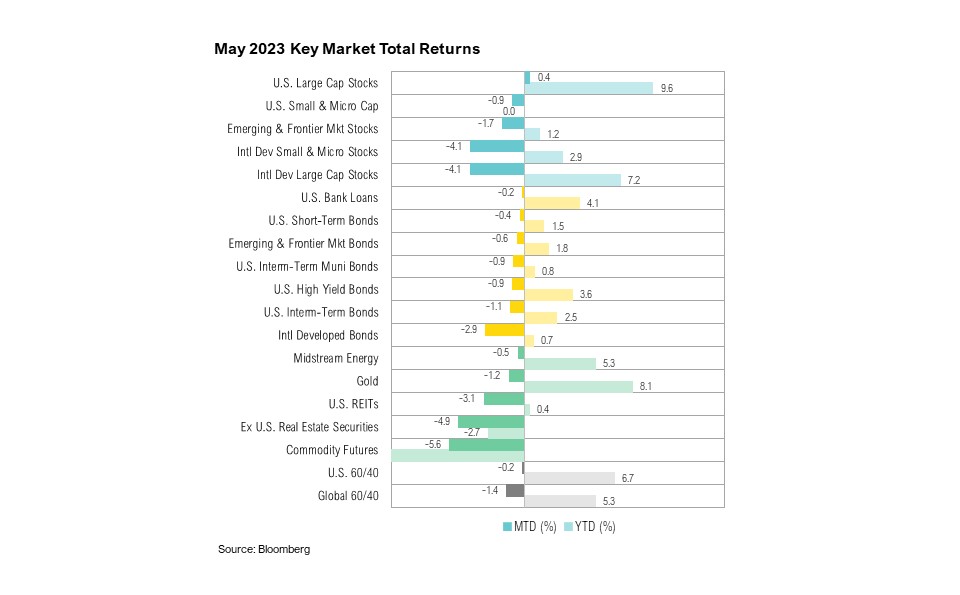

The only asset class that ended May with positive returns was U.S. large-cap stocks; the S&P 500 ended the month up 9.6% year-to-date. In general, U.S. markets fared better than their international counterparts, as the MSCI EAFE ended the month down 4.1%. The Bloomberg U.S. Aggregate Bond Index ended the month down 1.1%, while international developed market bonds ended May down 2.9%. International developed market bonds are now only up 0.7% year-to-date.

Despite maintaining its accommodative fiscal and monetary policies, Japan’s CPI rose to 3.5% year-over-year in April, trending back towards 40-year highs. The Bank of Japan has, on a constant currency basis, implemented around $80 billion of quantitative easing over the past two months and has enacted no significant quantitative tightening since September 2022.32 After hitting a new year-to-date high of 140.9 on May 28, the USD/JPY dropped back below the 140 mark to end the month at 139.2.32 In other news from Asia, China’s reopening and post-COVID recovery have faltered, as the country’s factory activity shrank faster than expected in May.33 Year-over-year CPI dropped to 0.1% in April, while PPI dropped to -3.6%, from -2.5% the prior month.33

Looking Forward

We view the consumer as the lynchpin of the U.S. economy. While parts of the economy are clearly slowing, U.S. consumer spending has remained resilient, although focused more on travel and experiences than goods. This spending has been largely sustained by a gradual dwindling of COVID-era excess savings, as well as a rapid expansion in credit card debt. Excess savings have been depleted by $1.6 trillion from a peak of about $2.1 trillion to around $500 billion in May—and are being spent at a nearly $100-billion-per-month pace.34 Revolving consumer credit is up nearly $150 billion in the past year.35 The rapidly deteriorating backdrop for the consumer reminds us of a colloquial version of a famous Herbert Stein quote:

“Things that can’t go on forever, don’t.”36

Furthermore, since last March, S&P 500 earnings expectations for 2023 have dropped by 12%, from $252 per share to $222 per share, which has driven valuations up to over 20 times operating earnings.37

Although there is no predefined path for policy or markets, we remain focused on the risks and opportunities this environment is presenting. At RMB, we believe there will be continued volatility in both equity and fixed income markets, as the Federal Reserve continues with their plan to increase interest rates in order to mitigate above average inflation. The labor market has thus far remained resilient but initial jobless claims are showing signs of weakness over the last few weeks. Inflation continues to decline from peak levels experienced last summer but remain above historical average. The trajectory of inflation from here appears to be downward, but the pace at which the declines occur remains a key component to Federal Reserve policy going forward.

Incoming economic data and the policy developments they help shape are fluid and highly uncertain. While we wait for clarity on these topics, for the first time in more than 15 years, we can earn 4% to 5% on short-term government bonds. We continue to believe that strong fundamentals should help markets over the longer term and that the income component of our clients’ investment portfolios – the interest paid from owning bonds and stock dividends – will be a more important factor of investment returns going forward. While we think that the longer-term outlook will continue to improve with higher yields and the potential for stocks to get cheaper, we are still cautious about the investment environment from here. We recommend sticking to long-term investment allocation targets through a diversified portfolio of assets that emphasizes quality and cash flow and taking advantage of rebalancing opportunities as they emerge amongst the volatility. Most of all, if a recession does occur, we want to be able to take advantage of any opportunities if and when they arise. We remain optimistic that the strategies we have in place for our clients will drive long-term success despite the volatility we are currently experiencing.

- Bloomberg: https://www.bloomberg.com/news/articles/2023-05-11/pacwest-deposits-dropped-9-5-after-report-of-investor-talks#xj4y7vzkg

- Wall Street Journal: https://www.wsj.com/articles/pacwest-sells-real-estate-lending-unit-39b4294f

- Federal Reserve: https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20230503.pdf

- Bureau of Labor Statistics: https://www.bls.gov/news.release/cpi.nr0.htm

- Bureau of Labor Statistics: https://www.bls.gov/news.release/empsit.nr0.htm

- Treasury: https://home.treasury.gov/news/press-releases/jy1454

- Washington Post: https://www.washingtonpost.com/business/2023/05/31/whats-in-debt-ceiling-deal/

- Federal Student Aid: https://studentaid.gov/debt-relief-announcement

- WSJ: https://www.wsj.com/articles/debt-ceiling-deal-locks-in-restart-of-student-loan-payments-5ec24f99

- Our World in Data: https://ourworldindata.org/brief-history-of-ai

- Fortune: https://fortune.com/2023/03/06/microsoft-ceo-satya-nadella-virtual-assistants-dumb-as-a-rock-ai-future/

- Engadget: https://www.engadget.com/ibms-watson-returns-as-an-ai-development-studio-195717082.html

- Google: https://blog.google/technology/ai/bard-google-ai-search-updates/

- Google Trends: https://trends.google.com/trends/explore?date=today%205-y&q=AI,ChatGPT&hl=en

- FactSet: https://insight.factset.com/highest-number-of-sp-500-companies-citing-ai-on-q1-earnings-calls-in-over-10-years

- AI Business: https://aibusiness.com/nlp/ubs-chatgpt-is-the-fastest-growing-app-of-all-time

- Andreessen Horowitz: https://a16z.com/2011/08/20/why-software-is-eating-the-world/

- MIT: https://www.technologyreview.com/2017/05/12/151722/nvidia-ceo-software-is-eating-the-world-but-ai-is-going-to-eat-software/

- Reuters: https://www.reuters.com/markets/us/us-equity-funds-draw-first-weekly-inflow-10-weeks-2023-06-05/

- PwC: https://www.pwc.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-study.html

- CNBC: https://www.cnbc.com/2023/05/30/nvidia-on-track-to-hit-1-trillion-market-cap-when-market-opens.html

- Nvidia: https://www.nvidia.com/en-us/about-nvidia/corporate-timeline/

- Nvidia: https://www.nvidia.com/en-us/technologies/cuda-x/

- CNBC: https://www.cnbc.com/2023/05/25/nvidias-big-break-has-been-a-long-time-coming-jim-cramer-says.html

- Seeking Alpha: https://seekingalpha.com/article/4608932-broadcom-inc-avgo-q2-2023-earnings-call-transcript

- Goldman Sachs: https://www.goldmansachs.com/intelligence/pages/bill-gates-on-the-ai-revolution.html

- NBER: https://www.nber.org/papers/w31161

- Wall Street Journal: https://www.wsj.com/articles/how-ai-change-workplace-af2162ee

- NPR: https://www.npr.org/2022/12/19/1143912956/chatgpt-ai-chatbot-homework-academia

- BBC: https://www.bbc.com/news/world-us-canada-65735769

- New York Times: https://www.nytimes.com/2023/05/30/technology/ai-threat-warning.html

- FX Street: https://www.fxstreet.com/news/usd-jpy-aims-to-recapture-14000-as-fed-to-continue-policy-tightening-spell-further-202306080721

- Reuters: https://www.reuters.com/markets/asia/chinas-factory-activity-falls-faster-than-expected-weak-demand-pmi-2023-05-31/

- FRBSF: https://www.frbsf.org/economic-research/publications/economic-letter/2023/may/rise-and-fall-of-pandemic-excess-savings/

- FRED: https://fred.stlouisfed.org/series/REVOLSL

- Quote Investigator: https://quoteinvestigator.com/2018/04/28/go-on/

- FactSet: https://insight.factset.com/what-is-driving-the-expected-rebound-in-sp-500-earnings-growth-in-q4-2023

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.