Video: Ann Guntli, CFA® discusses the current state of inflation and where things might go from here.

After decades of low and falling inflation, we saw a stark reversal as inflation rates started rising dramatically in 2021 and spiked further in 2022. The last two years have brought a dramatically different inflation environment than what the U.S. has experienced over the last 40 years. Though this can be unnerving for many investors and everyday consumers, understanding how the Fed is approaching fiscal policy in the U.S. can help contextualize what’s happening today and where policy may go in the near future. As inflation continues to decline, the pace of the decline and where inflation stabilizes will be key to future Federal Reserve policy.

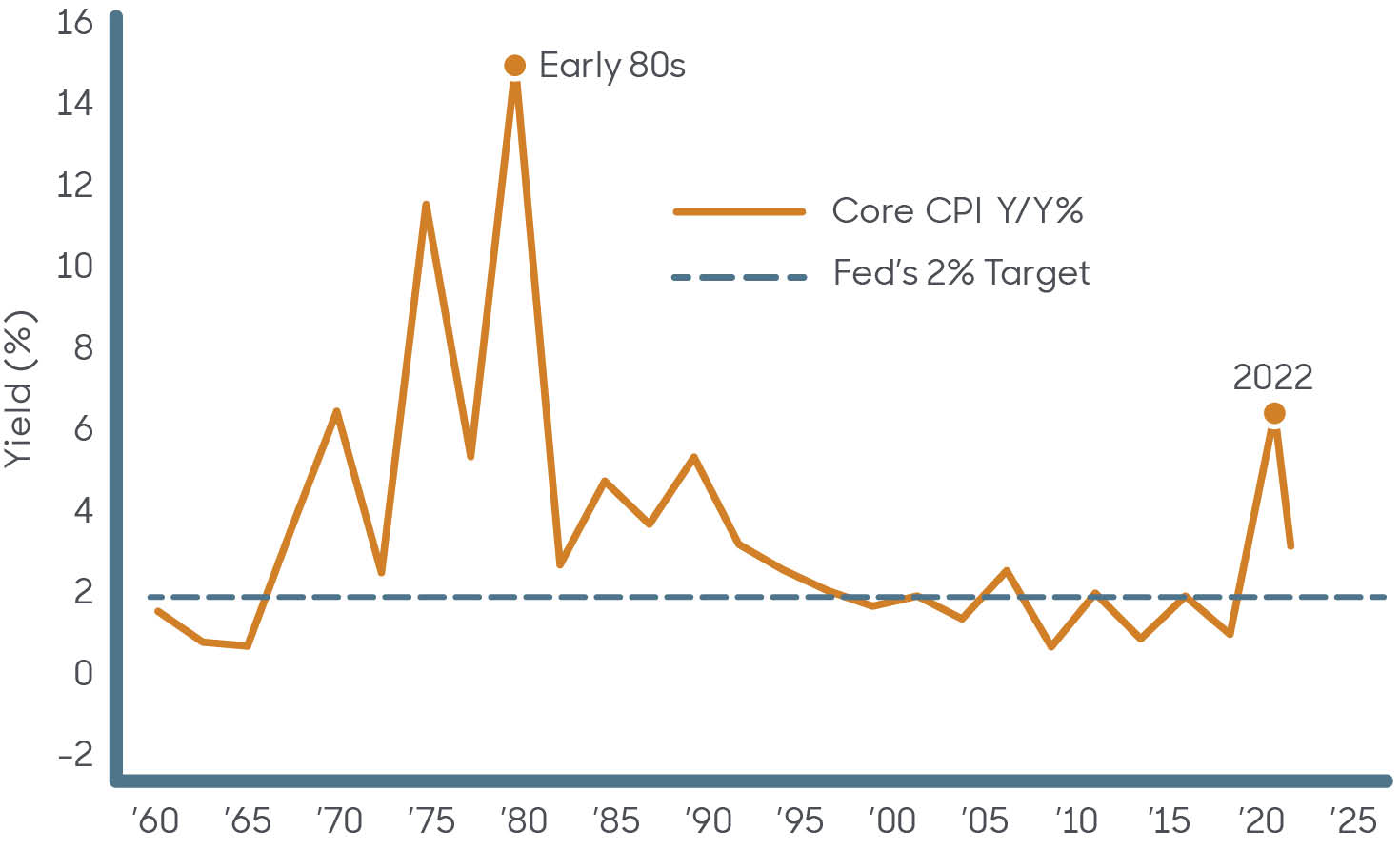

In 2021, inflation reached levels not seen since the 1980s.

Since the period of extremely high inflation in the 1970s and 1980s, the U.S. has enjoyed moderate inflation and low interest rates for much of the last three decades. For many Americans, including virtually anyone born after 1982, this is the first time they’ve experienced significant and sustained high inflation. Policymakers face the unfamiliar problem of dealing with inflation that hit a 40-year high last summer and remains stubbornly high.

With inflation trending down, focus now shifts to the economic toll of the Federal Reserve’s efforts to slow inflation and determine fiscal policy going forward.

We started to see a meaningful shift in the inflationary environment starting in the second quarter of 2021. Prior to that, the inflation rate had been around the Fed’s target rate. But in the last two years, it has more than doubled, reaching a maximum of 9.1% in June 2022.

The rate of the increase was also alarming, following inflation rates under 2% over the preceding few years. Much of this inflation was the result of global events such as the COVID-19 pandemic and the war in Ukraine. The Federal Reserve has been fighting to bring inflation down through a series of interest rate increases. Estimates for inflation are being revised down, but Fed policy will be a major factor in the trend of inflation going forward.

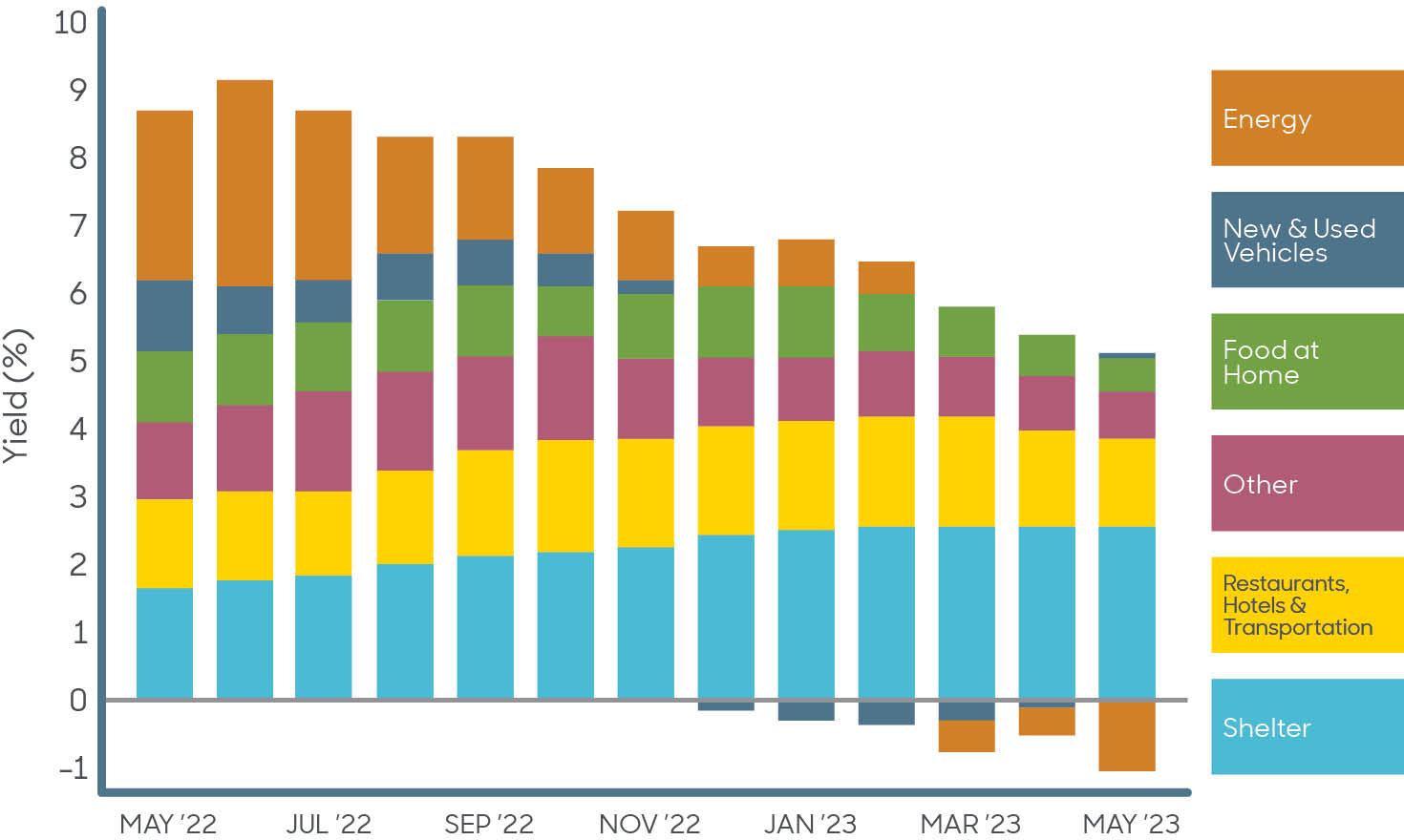

The Fed has been effective at reducing inflation through fiscal policy over the last 12–18 months.

The Federal Reserve has focused on bringing down inflation through a series of interest rate increases that began in spring 2022. The Fed increased rates 10 times from March 2022 to May 2023, increasing the Federal Funds Rate from 0.00–0.25% to 5.00–5.25% over that period—the second fastest rate increase cycle on record. These interest rate increases have been effective at slowing economic activity and bringing inflation down to lower levels; the challenge now is addressing the specific dynamics that are contributing to inflation.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. RMB Asset Management is a division of RMB Capital Management.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

The CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.