Overview

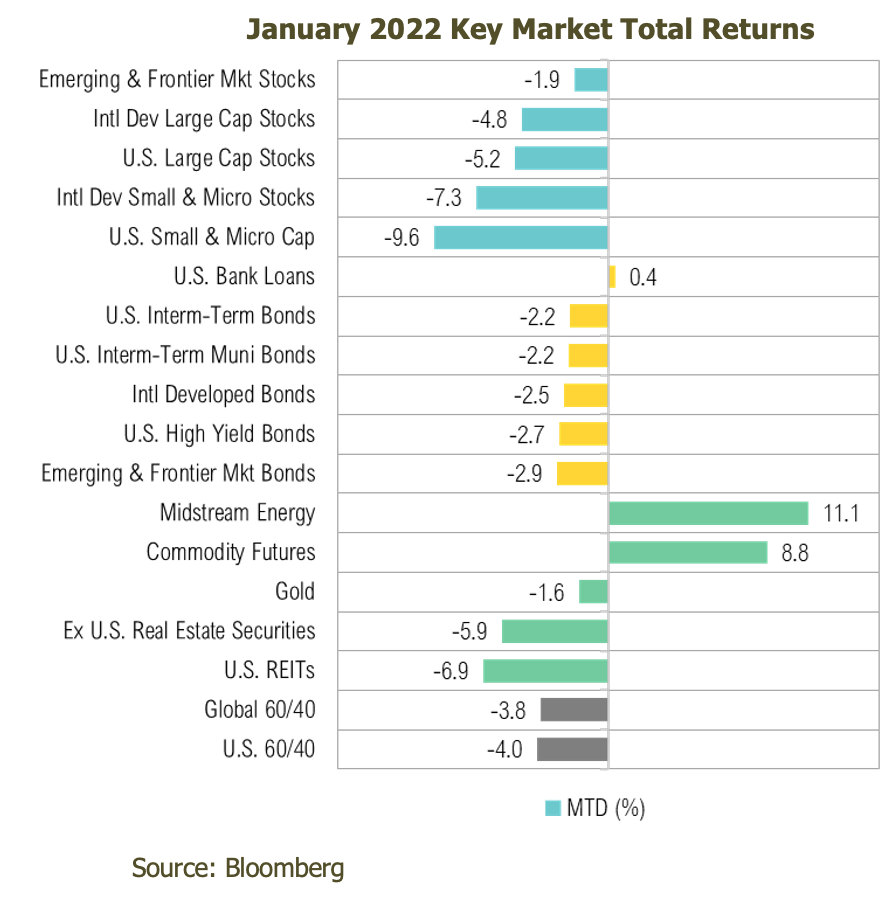

Volatility, which was absent in 2021, returned in dramatic fashion in January. Global stocks, as proxied by the MSCI All Country World Index, entered official correction territory during the month, but thanks to a late-January rebound, losses narrowed to -4.9%. U.S. stocks, as measured by the S&P 500 Index, experienced the largest monthly drawdown since the start of the pandemic (-5.2%). Geopolitical concerns continued supply-chain bottlenecks, and the imminent end of crisis-era monetary and fiscal policy support all hit during the month, leaving investors with few safe places to turn to. In fact, the Bloomberg U.S. Aggregate Bond Index returned -2.2% during the month.

Of all of these concerning factors, the anticipated pivot in monetary policy was perhaps the most jarring. Alarm bells first rang on January 5, when the minutes from the December Federal Open Market Committee (FOMC) meeting were released. The minutes suggested the Fed would hike rates sooner and potentially more aggressively than had previously been expected.1 In the ensuing weeks, markets began to adjust to the reality of potentially higher rates and lower levels of liquidity. By the end of the month, expectations were for five hikes over the course of 2022, with the first to occur in March.2

This environment has been broadly bad for bonds, as they have been forced to adjust to higher levels of inflation and the inevitability of rate hikes. The yield on the benchmark U.S. 10-year Treasury rose dramatically in January, from 1.51% to close the month at 1.78%. The yield on the 2-year Treasury also jumped substantially, from 0.75% to 1.22%. The spread between these two yields, often used as a proxy for the health of the economy, declined to just 61 basis points, the lowest level in over a year.

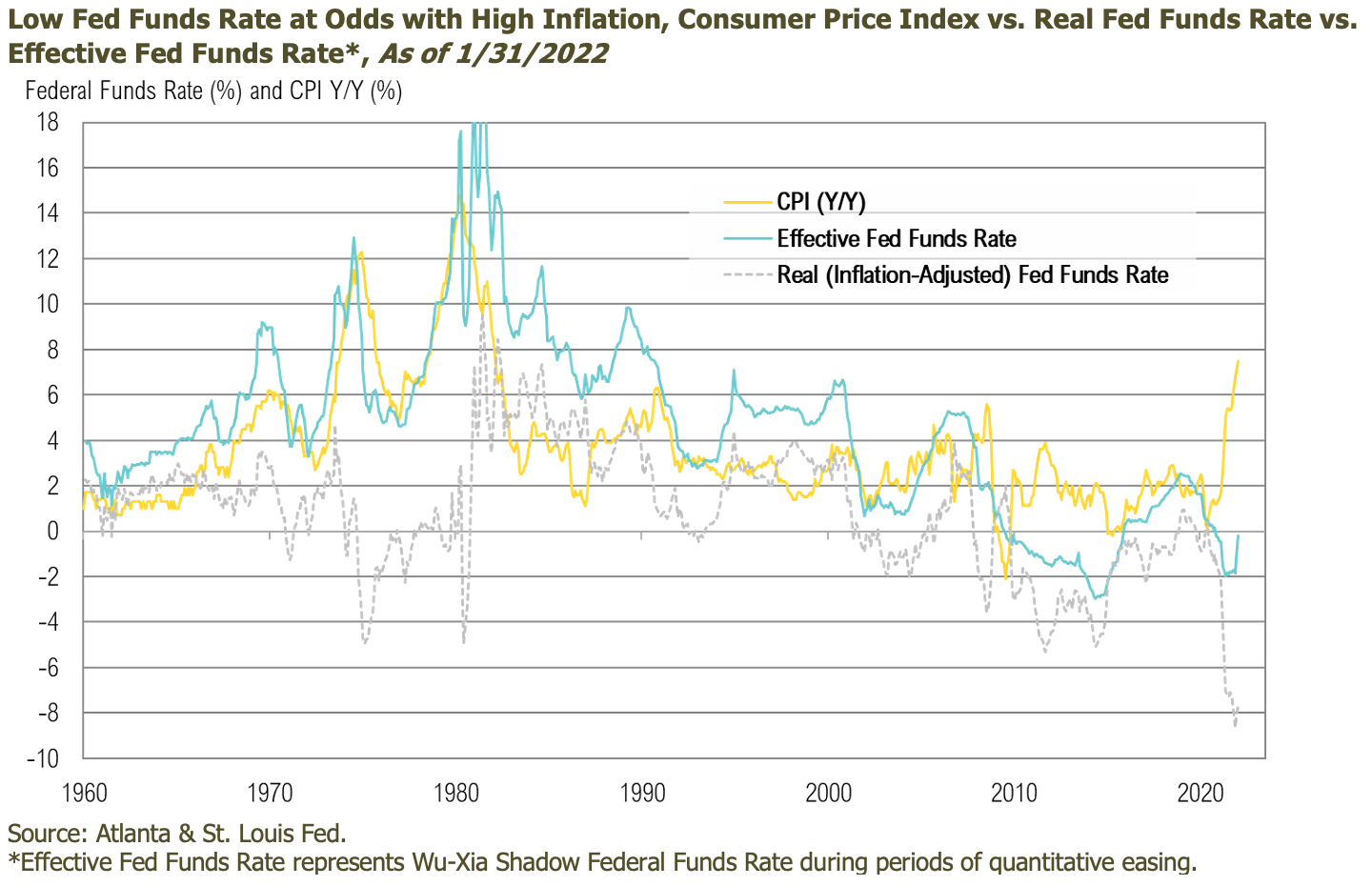

Behind the Curve

The January inflation reading (released on February 10) showed that the Consumer Price Index (CPI) rose to 7.5% on a year-over-year basis. Monetary policy orthodoxy suggests the Fed would normally be well into a hiking cycle by now. Rather than higher rates, however, the Fed Funds Rate is still at zero, and the Fed is actively engaged in large-scale asset purchases (quantitative easing) through March. This unusual situation is captured by the chart below, which shows the Fed Funds Rate adjusted for inflation (teal shaded area) going back to 1960. When viewed relative to the current inflation rate, the stance of monetary policy represents an astonishing outlier. As a result, investors may no longer be able to rely on the ‘Fed put’—the point at which the pain from a market decline exceeds the risks of the Fed pivoting policy back to easing. Today, inflation is clearly the larger concern, and it may be the Fed’s priority for the foreseeable future.

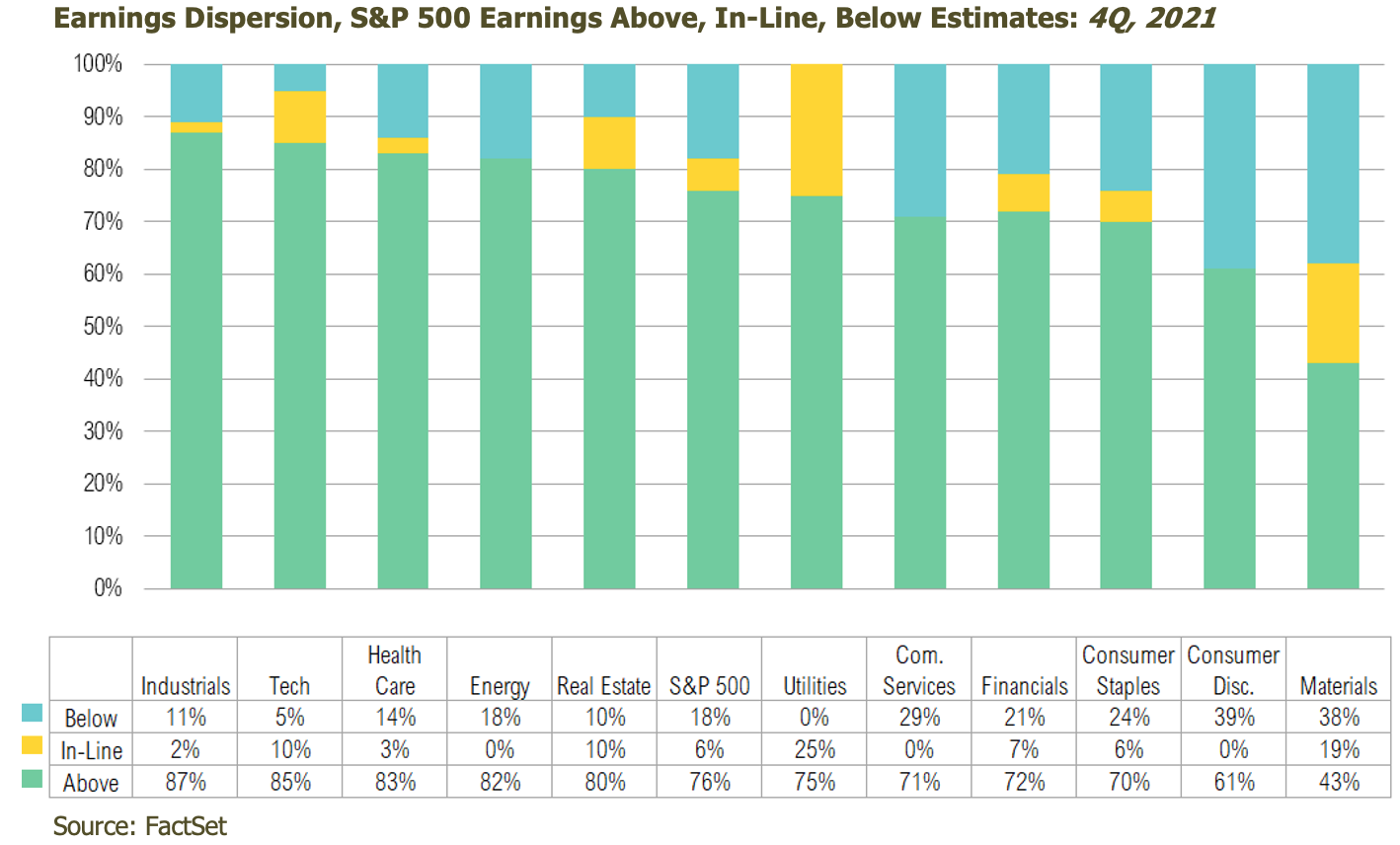

Earnings Update

As of Friday, February 4, roughly 60% of S&P 500 companies have reported earnings for the fourth quarter.3 Overall, the index is reporting higher earnings than were expected at the end of last year. Of the companies that have reported, 76% beat their analyst earnings estimates, equal to the five-year average.3 The estimated earnings growth rate is now 29% quarter-over-quarter and more than 45% year-over-year. If the 29% figure stands, it would mark the fourth straight quarter of at least 25% earnings growth; the last time this happened was from the fourth quarter of 2009 through the third quarter of 2010, as the economy recovered from the Global Financial Crisis. These outstanding average growth rates were mainly due to a combination of higher earnings in 2021 and an easier comparison to weaker earnings in 2020 due to COVID’s negative impact on several industries.

In contrast to the solid results of the fourth quarter, analysts decreased first-quarter earnings estimates for companies in the S&P 500 in January by 0.7%.4 This marked the first monthly decrease in analyst estimates since the height of the pandemic in the second quarter of 2020. At the sector level, four sectors recorded an increase in their earnings estimates for the first quarter during the first month of the quarter, led by energy (+5.9%). Seven sectors recorded a decline, led by industrials (-10.1%).

Two influential earnings announcements were Meta Platforms Inc. (formerly Facebook) and Amazon.com Inc. These two stocks represented over 5% of the S&P 500 at the end of January. Meta missed on earnings by 4.4%, and the stock subsequently plummeted by over 25% the next day.5 The company guided 3-11% sales growth for the first quarter, suggesting a sharp deceleration in social media ad spend, mainly because of Apple’s changes to its user privacy and data usage agreements, which restricted Meta from capitalizing on user data on both Facebook and Instagram. Amazon reported earnings per share of $27.75, far above the analyst consensus of $3.77.6 However, most of that was due to a mark-to-market of their investment in Rivian, an electric automaker, following its IPO on November 10. Even after controlling for this, the company still had a solid quarter, driven by 40% revenue growth in their Amazon Web Services segment. The company also announced that it will increase its Prime Membership fees by over 15%, sending the stock higher by 12% after dropping 8% the day prior, due to Meta's weak earnings release. The price hike by Amazon and favorable market reaction highlights a critical issue for companies this year—some will be able to successfully pass higher prices along to their customers, but it will not go this smoothly for everyone.

Looking Forward

We continue to believe that incoming inflation data will determine the path of monetary policy. We also believe the trajectory of interest rate hikes and balance sheet runoff, if pursued, will be crucial in determining the path of risky assets, such as equities. Further, because inflation is so elevated, we believe the “Fed put” may be meaningfully below current prices for many risky investments.

To kick off 2022, both equity and fixed income markets reacted in a very volatile way, primarily related to concerns over higher inflation and rising interest rates. The Federal Reserve has telegraphed that they will begin hiking interest rates at the March meeting and consumers are still facing higher prices and long delivery times, as shortages within the labor market and supply chain have made delivery of goods difficult for companies. In the short-term, the only thing that’s certain is that volatility is likely to remain elevated.

Longer-term, there are some positive developments that we believe will continue to support markets in the coming months. The economic recovery from the COVID-19 pandemic continues to gain steam, with a significant amount of pent up consumer demand. Fixed income investments will be facing an uphill climb of rising interest rates and a less accommodative Federal Reserve. But, for investors, higher interest rates translate into higher future returns from safe assets like core fixed income. Corporate fundamentals are generally strong and earnings are expected to grow again in 2022. In the long-run, earnings drive stock prices. In 2021, stock returns were driven largely by exceptionally strong EPS growth, with some valuation expansion. Thus far in 2022, valuations have compressed sharply to start the year but earnings reports in the first quarter have generally been positive and corporate earnings are expected to grow again, albeit at a slower pace than in 2021. If valuations remain flat and earnings grow as expected, U.S. stock returns from here could be in the mid-single digits.

Given this, RMB continues to advocate that investors remain diversified and utilize investment allocations that have the potential to perform well in a broad range of market outcomes. In an environment like this, we recommended sticking to long-term asset allocation targets, while focusing on high-quality core investments that have the ability to weather through rising interest rates and higher levels of inflation. Our team continues to focus on balancing opportunities in the current environment and taking advantage of opportunities that present attractive risk/reward profiles, while remaining cognizant of the ever-changing market dynamics.

1Federal Reserve: https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20211215.pdf

2CME: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

3Factset: https://insight.factset.com/sp-500-earnings-season-update-february-4-2022

5CNBC: https://www.cnbc.com/2022/02/02/facebook-parent-meta-fb-q4-2021-earnings.html

6Investopedia: https://www.investopedia.com/amazon-q4-fy2021-earnings-report-recap-5217982

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience, and are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. The S&P 500 Index is widely regarded as the best single gauge of the U.S equity market. It includes 500 leading companies in leading industries of the U.S economy. The S&P 500 focuses on the large cap segment of the market and covers 75% of U.S. equities. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available. The MSCI All Country World Index (ACWI) is a stock index designed to track broad global equity-market performance. Maintained by Morgan Stanley Capital International (MSCI), the index comprises the stocks of nearly 3,000 companies from 23 developed countries and 25 emerging markets.