Over the years, stocks of companies that initiate and consistently grow their dividends have outperformed the broader market, and have significantly outperformed stocks that cut or don’t pay dividends (Exhibit 1). This article explains why these “dividend growth” stocks have performed so well and why they are poised to continue to perform well in the future by discussing why companies pay dividends, exploring the benefits of a strategy that focuses specifically on companies growing their dividends, and considering how such a strategy might fit into an investor’s portfolio today.

There are countless factors that go into a stock’s performance, but a simple way to think about expected return is to break it down into three components:

The yield on a stock is calculated as the dividend paid divided by the share price. Analysts project growth in earnings and growth in dividends by using financial statements and projections about the future to model expected results. The earnings multiple, or price-to-earnings (P/E) ratio, is determined by the market, and changes in that multiple are difficult to predict. While P/E multiples tend to mean-revert over longer time frames, they can be significantly higher or lower than normal for extended periods of time. Therefore, a focus on dividend and earnings growth is often a more reliable predictor of future stock performance.

When a company pays a dividend, it is returning the profits it earned to its shareholders via a cash distribution. While often important, the payment of a dividend is not a prerequisite for a stock to be a good investment. Companies early in their life cycle typically use retained earnings to reinvest in the business. For example, shareholders of fast-growing Amazon would prefer the company reinvest in its business to further its competitive advantages in physical distribution and cloud computing rather than pay a cash dividend.

There are many reasons, however, that shareholders of more mature companies like to receive dividends and pressure companies to pay them. For one, a cash dividend shows a company’s earnings are real and not accounting manipulations. Dividends provide protection in down markets, giving investors access to cash, either to spend or to buy more stock after prices have fallen. This phenomenon creates more demand for dividend-paying stocks in down markets and can help to further stabilize prices. Paying a dividend also serves as a limitation on management’s ability to spend cash on marginal projects, forcing them to focus only on the highest return opportunities. However, if a company pays too large a dividend, it may be a sign that management has run out of good projects to invest in and doesn’t need the cash for operations, typically a bad indication for the future growth prospects of the company.

It is important to distinguish between companies that pay a high dividend and companies that steadily and consistently increase their dividend over time. Very mature companies, and sectors such as utilities and telecom, tend to have above-market dividend yields. Some investors favor these stocks for their current income and more stable prices. Others use a high dividend yield as an indication that a stock is undervalued. But a high dividend yield can also be a warning that the dividend is unsustainable and may be cut in the future, which usually leads to a severe decline in the stock’s price. Companies that steadily grow their dividends over time still have future growth prospects, but they have hit their stride and are able to return cash to shareholders, too. Thinking back to our return equation, these stocks provide attractive and growing dividend yields, along with growing earnings. When owned for long periods of time, the yield on cost increases as the dividend increases, while the share price increases as earnings grow.

Once a company enters a cycle of increasing dividends, it is highly motivated to maintain the trend. It is constantly under pressure to increase profits and cash flow every year, because if it doesn’t, it will be forced to decrease or suspend its dividend, which usually leads to a sharp sell-off in the stock. Management works hard to avoid hurting the stock price since they are often paid in stock options. The best indicator of a company’s ability to grow its dividend in the future is typically its track record of growing it in the past. A low payout ratio, the ratio of dividends to earnings, is also an indicator of a company’s ability to grow dividends. Companies with high dividend yields may find their dividends unsustainable during difficult times, exactly when investors need the income stream most. Companies with a history of growing dividends have proved they can not only sustain but also grow dividends, even during down markets. From a portfolio management perspective, dividend growth portfolios can be well diversified since companies steadily growing their dividend tend to exist across industries. This is an advantage over portfolios focusing on high dividend yields, which tend to be concentrated in mature sectors like utilities and, prior to 2007, financials.

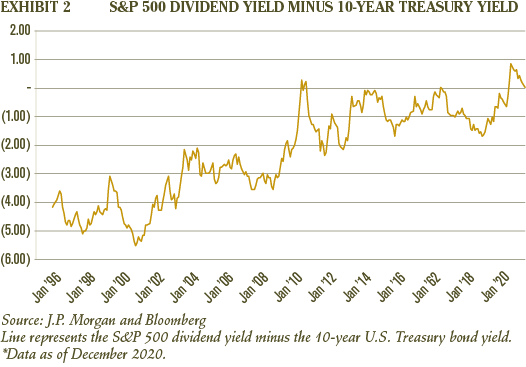

Today, dividends are as important as ever, and by many measures dividends look to be cheap relative to the income available in bonds. For example, Exhibit 2 shows the yield of the S&P 500 minus the yield of the 10-year U.S. Treasury. With the exception of the peak of the financial crisis three years ago, the yield on the S&P 500 is higher than it has ever been relative to the yield on Treasury bonds.

Looking ahead, there may be increased demand for companies that pay dividends as an aging U.S. population looks for new sources of current income. That being said, it is important to properly consider the role of dividend growth stocks in an investor’s portfolio. Dividend growth stocks are not a fixed income substitute and should not be used as a “safety net” investment for investors who cannot handle the volatility of owning stocks; while they have been stable and offered good downside protection and long-term outperformance relative to other stocks, they will be much more volatile and exposed to more significant and permanent losses versus high-quality bonds. However, for investors with sufficient time horizons, investing in dividend growth stocks is a great way to compound wealth over time, with the added benefit of providing a stream of cash along the way.

Disclaimers

This article was originally written in January 2012 and updated to be current as of February 2021.

The opinions and analyses expressed in this communication are based on RMB Capital Management, LLC’s research and professional experience, and are expressed as of the date of our mailing of this communication. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this communication. The information and data in this communication does not constitute legal, tax, accounting, investment, or other professional advice.