Markets

Real assets were the top performers for the month of May, due to the continuation of the U.S. economic reopening and historic levels of stimulus flowing from Washington. Commodity futures and midstream energy assets rose 2.7% and 7.6%, respectively, as crude oil hit a 52-week high in May. Gold rallied 7% during the month, helped by a stabilization in longer term Treasury rates and rising inflation. The 10-year Treasury note ended the month at 1.58%, slightly lower than the 1.63% level at the end of April. Among equity bourses, foreign stocks outperformed their U.S. peers as the U.S. dollar declined 1.4%. The S&P 500 index was up 0.55% for the month of May and the Russell 2000 ended at 0.21%. EAFE and EM indices had a return of about 3.3% and 2.3%, respectively. U.S. High Yield Bonds increased 0.3% for the month, resulting in a year-to-date return of 2.3%.

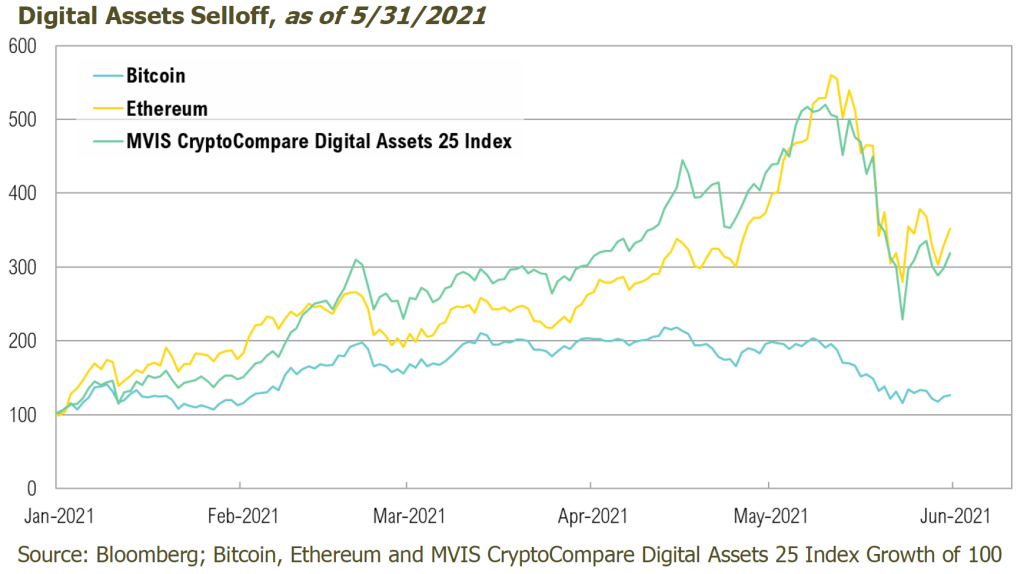

One area that did experience substantial losses, in an otherwise benign market environment, was cryptocurrencies. While many of these digital assets remain up for the year, Bitcoin, the largest cryptocurrency by market capitalization, declined a nerve-wracking 36% in May. At the same time, Ethereum dropped 12%, and the MVIS CryptoCompare Digital Assets 25 Index, a broad proxy for some of the largest cryptocurrencies, dropped 27%. The decline came on the heels of news out of China that miners would face increased regulatory pressure, including a ban on financial firms and payment institutions from engaging in transactions denominated in cryptocurrencies.1 News out of a prominent Bitcoin bull, Tesla CEO Elon Musk, didn’t help, either. On May 12, Musk tweeted that Tesla had “suspended vehicle purchasing using bitcoin,” citing concerns about “rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.” Bitcoin closed the month of May at $36,691, after hitting an all-time high of $64,870 on April 14.

Vaccine Rollout and Growth

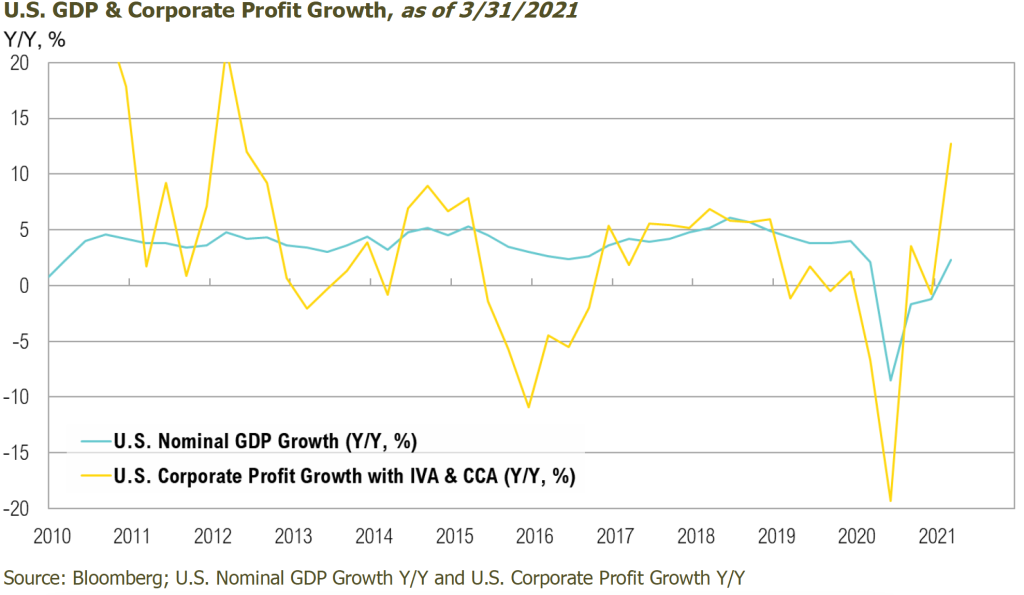

According to the Organization for Economic Cooperation and Development (OECD), global economic growth is now expected to be 5.8% in 2021, a sharp upwards revision from the 4.2% growth rate forecasted at the end of last year. The upgrade in the forecast was the result of historic government stimulus and the impressive vaccine rollout in the U.S. and other developed economies.2

As of May 31, over 50% of the U.S. population had received at least one vaccine dose, and approximately 41% of the population was fully vaccinated. In Europe, 31.7% had received at least one dose, and 16.8% were fully vaccinated. Key emerging markets fell significantly short of these vaccination rates. Through May, India, Brazil, Russia, and South Africa had 3.1%, 8.2%, 10.4% and 0.8%, respectively, of their populations fully vaccinated.3 Comparative data for China was not available, but the Middle Kingdom had administered an astonishing 661 million vaccine doses as of May 31, more than twice as many as any other single country.3

According to the Institute for Supply Management® (ISM®), the May U.S. Manufacturing Purchasing Managers’ Index® (PMI®) came in at 61.2%, signifying solid growth and the 12th consecutive month of manufacturing expansion (readings over 50 signal expansion).4 The ISM® U.S. Services PMI® also demonstrated strong growth (64%) and a similarly impressive string of monthly increases. Although other PMI readings from around the world also improved in May, especially relative to the stalled readings of the pandemic era, the surveys also noted mounting frustrations. Manufacturers across the developed world griped about exploding material costs, delivery delays, and capacity limitations – many linked to tight labor markets.4 Conversely, in emerging markets like Mexico and India, manufacturing PMIs dropped, as these countries continued to battle COVID-19.5,6 An excerpt from the OECD May report duly summarized the mixed state of the global economy:

“Prospects for the world economy have brightened but this is no ordinary recovery. It is likely to remain uneven and dependent on the effectiveness of vaccination programs and public health policies. Some countries are recovering much faster than others. Korea and the United States are reaching pre-pandemic per capita income levels after about 18 months. Much of Europe is expected to take nearly 3 years to recover. In Mexico and South Africa, it could take between 3 and 5 years.”7

In the U.S., the rapid pace of the rebound has come at the cost of growing economic pressures. U.S. inflation data for May showed the Consumer Price Index (CPI) rising 5.0% on a year-over-year basis.8 Excluding the more volatile food and energy components, core inflation rose by 3.8%, the highest rate since June 1992.8

Help Wanted

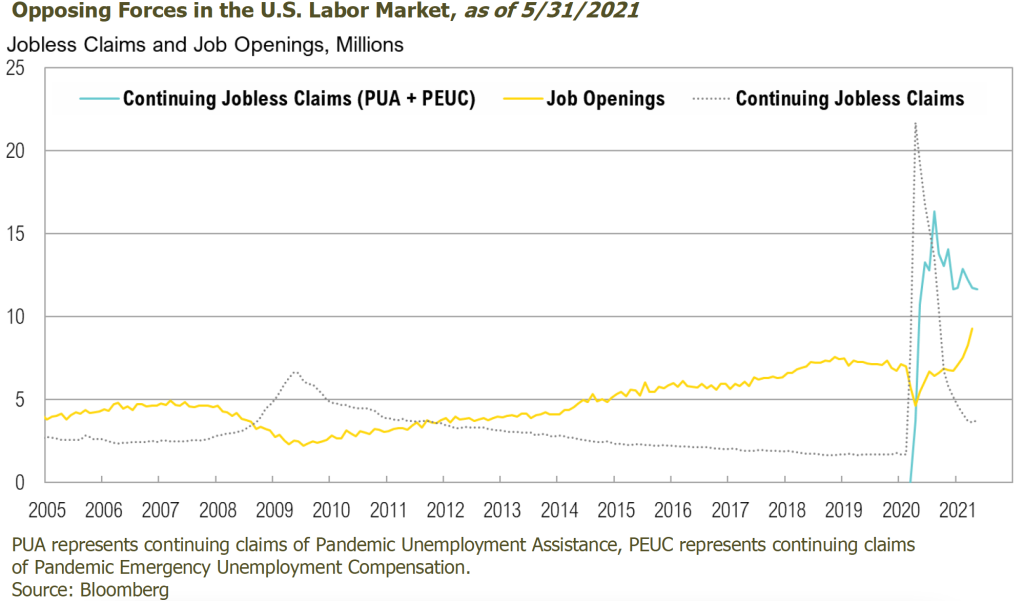

The U.S. unemployment rate dropped to 5.8% in May.9 This is a pivotal improvement from the 14.8% level hit in April 2020, but it remains a far cry from the 3.5% level of February 2020.10 Under the surface, however, this improvement hides a perplexing and potentially unhealthy cross-current that is creating a disconnect between millions of out-of-work Americans and millions of “help wanted” signs.

At the end of April, Federal Reserve chairman Jerome Powell referred to this disconnect as a “labor shortage,” caused by skills mismatches, geographical disconnects, and still-closed schools forcing parents to stay home to care for their children. The phrase “labor shortage” hit the mark. In May, those words saw a seven-fold increase in Google search activity relative to the long-term average.11

But there is more to the disconnect than closed schools and skills mismatches. Indeed, the acceleration of the economy and need for workers caught employers flat-footed, with many scaling down during the pandemic only to have to reverse course this year. This is evidenced by the 9.3 million job openings reported by the Labor Department in the May jobs report (shown below), by far the highest number ever recorded for this series.12

The pandemic also changed workers’ conditions, too. The shifting sands of the post-COVID global economy, new remote work possibilities, and a range of powerful macroeconomic trends have changed people’s habits, mindsets, and plans for the future. According to the Bureau of Labor Statistics, the number of Americans who quit their jobs rose 11% to almost 4 million in April, also the highest number ever recorded for this series.12 According to a 2021 survey by Prudential Financial, slightly more than one in four U.S. workers plan to switch jobs in the wake of the pandemic.13 The trend is global. According to Microsoft’s Work Trend Index report released in March – which was based on interviews with 30,000 people across 31 countries and trillions of emails, messages, Teams meetings, and other activity across Microsoft 365 – 40% of the global workforce hopes to change jobs this year.14

One oft-cited reason for the labor shortage is record amounts of government stimulus. In Washington state, for instance, the maximum total weekly benefit available via various unemployment support programs is $1,141 per week, the equivalent of over $28 per hour for a 40-hour work week. That’s double Washington’s current minimum wage of $13.69 per hour.15 While there is more to the story, it is not hard to see how such a large mismatch could slow the pace of job gains. While it may be tempting to blame businesses for offering low wages, many of them are already feeling the pinch of higher inflation. According to the National Federation of Independent Businesses (NFIB), small business optimism fell 0.2% in May, the first decline in four months.16 NFIB’s May jobs report revealed that an incredible 48% of small business owners reported unfilled job openings, yet another all-time high for a series. Further, 8% noted that their largest problem was inflation, a four-fold increase from the average over the last five years.17

Looking Forward

It will come as no surprise to anyone that the U.S. economy is expanding at a rapid pace and inflation is a growing concern. Markets, however, are forward looking, and as investors, we must also try to be. As we do that, we must consider that today’s inflationary pressures could fade in the coming months, as fiscal stimulus wanes and the inflationary effects of a post-COVID-19 rebound begin to moderate. Indeed, the uninspiring 1.58% yield on the 10-year Treasury note at the end of May suggests that the bond market may be anticipating this very dynamic. The pandemic accelerated some of the most powerful deflationary forces of the last few decades; higher government debt levels and increased technology adoption, to name a few, are arguably more deflationary today than they have ever been.

That said, we also believe investors should take policymakers at their word. In a recent press release following the G7 finance ministers meeting in London, Treasury Secretary Janet Yellen shared her thoughts about inflation and interest rates, as she made her case for President Biden’s colossal $4 trillion fiscal spending proposal: “If we ended up with a slightly higher interest rate environment, it would actually be a plus for society’s point of view and the Fed’s point of view.”18 Yellen continued, “We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade.” Policymakers appear to believe that higher prices are what this economy needs, and in time, that may be what they get.

Our Recommendations

As inflation becomes more widely anticipated, the stock and bond markets will increasingly reflect that expectation. To that end, we recommend maintaining diversified portfolios of investments that have the potential to perform well in a broad range of market outcomes. Given this, RMB believes now is a good time for investors to evaluate exposures in portfolios. We recently recommended a reduction in client’s opportunistic fixed income allocations. Since the end of 2020, spreads in this sector of the bond market have tightened and valuations are approaching all-time tights. While we are not bearish on these sectors today, we do not feel investors are being well compensated for the risks associated with these investments. Hence, we are reducing risk now with the goal of adding back to these investments again when the opportunity arises. This is one example of how we strive to balance opportunities in the current environment while remaining cognizant of the increasing risks. We will continue to focus on opportunities to balance our client portfolios for the current environment, while also taking advantage of niche markets that present attractive risk/reward opportunities.

2OECD: https://www.oecd.org/economic-outlook/

3Our World in Data: https://ourworldindata.org/covid-vaccinations

4ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/may/

5Markit: https://www.markiteconomics.com/Public/Home/PressRelease/5bdbb8917fea4e7c80a4e9c0a4b94729

6Markit: https://www.markiteconomics.com/Public/Home/PressRelease/418788445b984af3800606c179645b2e

7OECD: https://www.oecd.org/economic-outlook/may-2021/

8BLS: https://www.bls.gov/news.release/pdf/cpi.pdf

9BLS: https://www.bls.gov/news.release/archives/empsit_06042021.pdf

10BLS: https://www.bls.gov/news.release/archives/empsit_03062020.pdf

11Google Trends: https://trends.google.com/trends/explore?date=all&geo=US&q=labor%20shortage

12BLS: https://www.bls.gov/news.release/pdf/jolts.pdf

13Prudential: https://news.prudential.com/increasingly-workers-expect-pandemic-workplace-adaptations-to-stick.htm

14TechRepublic: https://www.techrepublic.com/article/microsoft-remote-work-is-exhausting-and-we-need-to-take-action-now/

15Washington State Department: https://lni.wa.gov/workers-rights/wages/minimum-wage/

17NFIB: https://www.nfib.com/foundations/research-center/monthly-reports/jobs-report/

18Bloomberg: https://www.bloomberg.com/news/articles/2021-06-06/yellen-says-higher-interest-rates-would-be-plus-for-u-s-fed

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience, and are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. The S&P 500 Index is widely regarded as the best single gauge of the U.S equity market. It includes 500 leading companies in leading industries of the U.S economy. The S&P 500 focuses on the large cap segment of the market and covers 75% of U.S. equities. The MVIS CryptoCompare Digital Assets 25 Index is a modified market cap-weighted index which tracks the performance of the 25 largest and most liquid digital assets. Most demanding size and liquidity screenings are applied to potential index components to ensure investability.