The Financials sector is currently experiencing tailwinds not seen in some time. Unlike many parts of the market, this sector should flourish with higher rates. We believe that bank stock appreciation is still in front of us.

The Backdrop

Trillions of dollars in additional stimulus should lead to a meaningful increase in GDP, which generally leads to lending growth.

The Fed is maintaining low short-term interest rates.

An expanding economy generally leads to rising, mid-yield curve rates, with short rates anchored for the foreseeable future.

Implications for Banks

Increased revenue seems likely due to:

- Increasing loan growth, thanks to government stimulus

- Rising interest rates, which should benefit margins and stimulate loan growth

Increased economic activity should lead to decreased credit concerns.

Lower credit costs should lead to improving operating leverage.

Improving operating leverage should lead to increased profitability ratios, e.g. ROE, which, in turn, should lead to improved valuation, e.g. P/BV.

This argument only strengthens when viewed through the lens of a M&A overlay. 2020 was one of the quietest years for merger activity in a very long time, as management teams were unsure of the depths of a potential economic downturn. With the historic stimulus efforts from the government, confidence has been restored. In a recent note, KBW stated:

“The aftermath of COVID-19 has amplified the need for bank M&A given PPNR pressure from lower NII/NIM, the need to realize efficiencies, weaker loan growth, the need to compete against FinTechs, etc. FinTech competition is real with names like PayPal and Chime easing their way to the top of the ladder and becoming forceful competitors to banks, banks need scale to compete. We expect much of the bank M&A to be focused in the southeast and southwest regions. After underperformance from most bank M&A in ‘18/’19, we believe ’21 M&A could be more appreciated.”

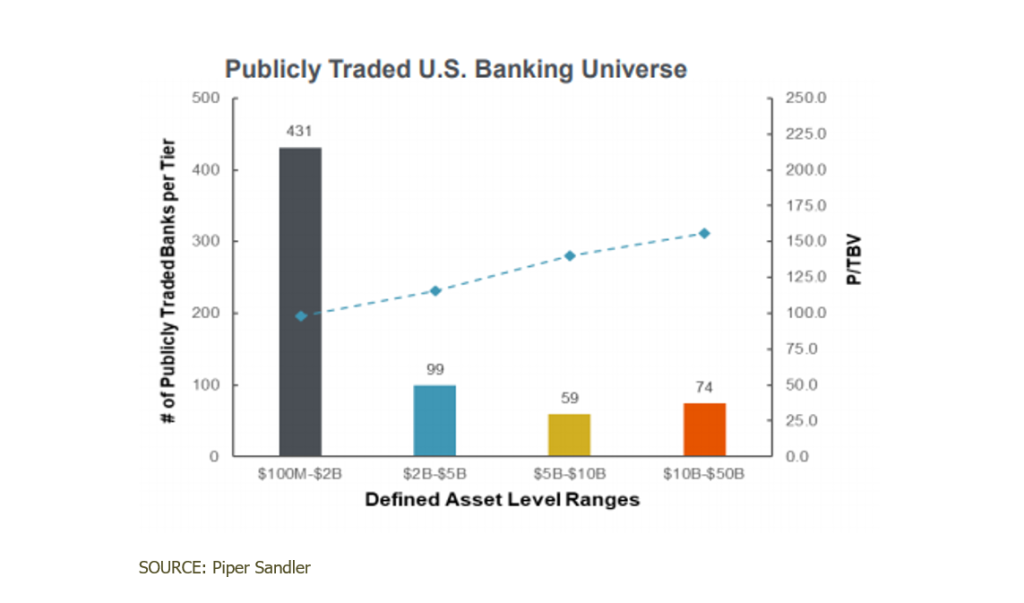

The recent PBCT/MTB announcement is a prime example of this M&A activity. The valuation discrepancy between larger acquirors and smaller targets, shown on the chart below, makes M&A more interesting, as it creates powerful economics in combined entities that the market has been rewarding.

We believe the tailwinds for Financials are many and robust and that a stronger economy, with higher rates and elevated M&A activity, may lead to continued outperformance for the sector.

The opinions and analyses expressed in this presentation are based on RMB Capital Management, LLC's ("RMB Capital") research and professional experience and are expressed as of the date of this presentation. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future performance, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this presentation. The information and data in this presentation does not constitute legal, tax, accounting, investment, or other professional advice. Past performance is not indicative of future results, and there is a risk of loss of all or part of your investment. This information is confidential and may not be reproduced or redistributed to any other party without the permission of RMB Capital.

Opinions set forth are as of March 1, 2021, and are subject to change. All investing involves risk including the possible loss of principal. There can be no assurance that the Fund will achieve its investment objective.