Markets

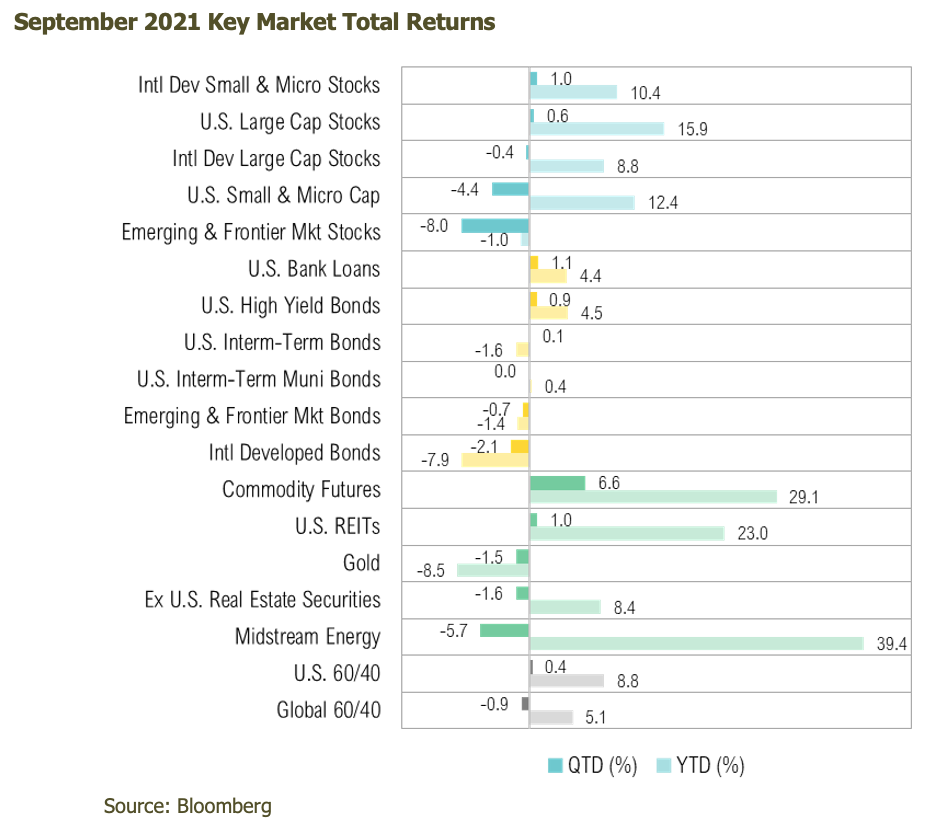

Markets delivered bland returns during the third quarter—a welcome development considering the stellar returns achieved earlier in the year. U.S. stocks, as proxied by the S&P 500, gained 0.6% while U.S. bonds, proxied by the Bloomberg U.S. Aggregate Bond Index, were nearly flat at 0.1%. Commodities were the top-performing asset class, up 7% in the quarter, leaving the Bloomberg Commodity Index up 29% for the year. Most of the commodity gains were generated by the energy complex, which was up 21% in the quarter and 17% in September alone. Energy is up 75% for the year, U.S. stocks are higher by 16% and U.S. bonds are down 2%.

In the U.S., larger companies outperformed smaller companies. In terms of investing style, equity returns showed no consistent differentiation between value and growth during the quarter. The Russell 1000 Growth Index, a proxy for large growth companies, gained 1% during the quarter, leaving it up 14% for the year. The Russell 1000 Value Index lost 1% in the quarter and is now up 16% so far in 2021. Within smaller companies, value slightly outperformed growth during the quarter. The Russell 2000 Value Index lost 3% in the quarter and is now up 23% for the year. The Russell 2000 Growth Index was lower by 6% for the quarter, leaving it up 3% for the year. From a sector perspective, materials and industrials were each down 4%. The strongest performing sectors were ones that are sensitive to interest rates, including financials, which were up 3%, and utilities, which were up 2%. Stocks outside of the U.S. trailed their U.S. counterparts during the quarter and so far in 2021. The MSCI EAFE Index was lower by 0.4% in the quarter and is up 9% for the year in U.S. dollar terms. In local currency terms, developed market equities were up 1% in the quarter and up 15% for the year. Emerging markets in U.S. dollar terms also lost 8% for the quarter, wiping out gains achieved earlier in the year. The MSCI China Index was down 18% during the quarter, as it dealt with Evergrande, one of its largest property developers, now facing default. It is also confronting energy supply issues that have caused power grids to ration energy to factories, thus curbing production.1 The MSCI China Index is now down 17% for the year. Emerging markets local currency returns have nearly matched U.S. dollar returns on a quarter and year-to-date basis.2

Municipal bonds, as measured by the Bloomberg Barclays Municipal 1-10 Year Bond Index, performed in-line with investment-grade taxable bonds during the quarter—they were both flat and ended up 0.4% for the year. The Bloomberg Barclays High Yield Index posted a gain 0.9% and is now up 4.5% for the year. Although fixed income securities are affected by many factors, it is noteworthy that municipal bonds, which have outperformed likeduration treasuries, have experienced a decline in debt issuance (-4%) so far this year. After issuing a record $2.3 trillion last year, corporations have issued just $1.3 trillion, a decline of 41% on a year-over-year basis.2

Pandemic Disequilibrium

It has been nearly 18 months since COVID-19 hit the U.S., and even with two-thirds of American adults fully vaccinated, the recovery is disjointed and will remain so for the foreseeable future.3 The virus forced many companies and people to make dramatic changes, and as time goes on, it appears that some of the changes may be more structural than temporary.

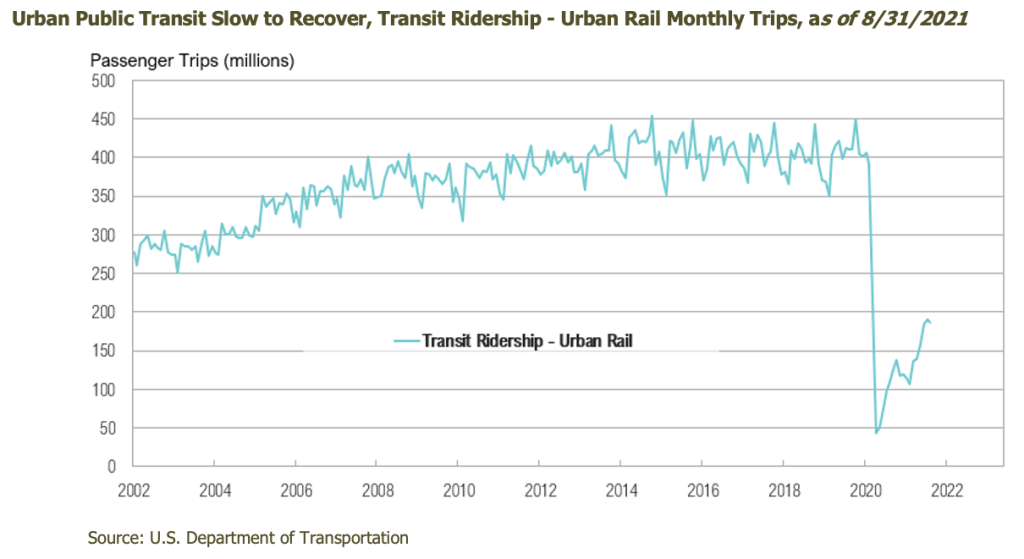

In the labor market, there remains a shortfall of nearly 5 million jobs relative to pre-pandemic levels, yet the recent Job Openings and Labor Turnover Survey report showed that current job openings continued to move parabolically higher to a record level of 11 million, nearly 2.5 million more than the pre-pandemic high.4 ,5 As evidence of the economy’s extreme situation, the quit rate, a measure of the number of workers voluntarily leaving their jobs, remained at record levels.6 In terms of travel, TSA checkpoint metrics remained below prepandemic levels. Relative to 2019, traveler throughput in the last week of September was down 23%, with more notable weakness during the week, suggesting suppressed business travel.7 Further, the Bureau of Transportation Statistics showed that urban rail transit ridership, although recovered from last year’s economic shutdowns, had not yet reached 50% of pre-pandemic levels.8 This speaks to both the durable trend of working from home as well as the meaningful migration patterns away from densely populated cities.

Cause-and-effect relationships are difficult to decipher, especially when factoring in a lingering pandemic, but the enormous re-orientation of business and consumer activity has created tremendous hurdles for economic growth, especially in supply chains. With fiscal stimulus effects wearing off, the Atlanta Federal Reserve’s GDPNow is forecasting third-quarter GDP growth of 1.3%, substantially lower than the second-quarter GDP growth rate of 6.7%.9,10

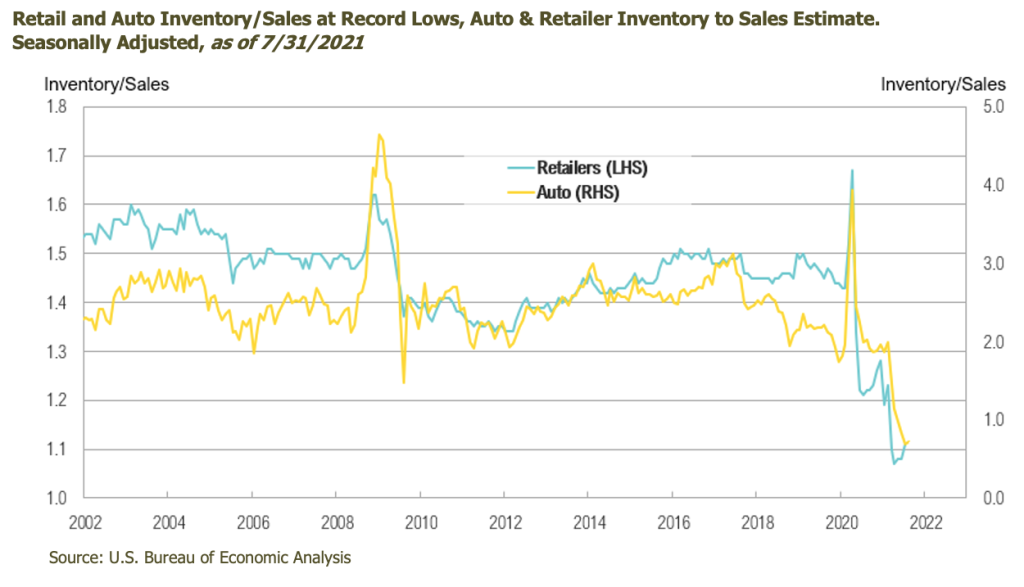

In another example of pandemic disequilibrium, there has been a record backup in containerships at major U.S. ports, further exacerbated by labor shortages in trucking and warehousing. Around 90% of all traded goods are carried by container ships, making ocean freight the main mode of transportation for global trade.11 Last year, the adjacent Los Angeles and Long Beach ports handled the equivalent of 8.8 million loaded import containers—more than double the 3 million loaded boxes that arrived at the nation’s next busiest port complex at New York and New Jersey.12 To keep up with the large inbound container volumes this year, the Port of Long Beach started 24-hour operations four days per week. The Port of Los Angeles, however, held off on a 24-hour operating policy because, according to executive director Gene Seroka, 30% of trucking appointment slots on average every day go unused despite record container volumes. He says the port can extend operating hours only if trucking, warehousing, and other industries also move toward 24-hour operations.13 The issues at ports go a long way in explaining why there are some bare shelves in stores as well as astonishing declines in the inventory-to-sales ratio of many U.S. retailers.14 It also suggests that the severe inflation levels seen in some parts of the economy will persist in coming months.

The automotive industry has been dealing with its own supply chain issues due to a semiconductor chip shortage, which is expected to cost the global auto industry more than $200 billion in 2021.15 The situation, it seems, has only gotten worse throughout the year. According to consulting firm AlixPartners, expectations were for a $100 billion hit earlier in 2021.13 In the U.S., automakers announced sales of 13 million vehicles for August.16 Outside of the pandemic, this was the lowest monthly sales since September 2011. The inventory-to-sales ratio for automakers highlights the same hurdles faced by retailers.17

Bond Vigilantes

Given this uncertain economic backdrop, policymakers are unwilling to withdraw a meaningful level of accommodation. This inaction could spur a certain class of fixed income investor, referred to as “the bond vigilantes,” to stir. When these investors deem monetary and fiscal policies as inflationary, they sell bonds, and yields rise in turn. Viewed over the long term, bond vigilantes are a positive force to maintain fiscal and financial stability; however, in the short term, they can create a skittish bond market and interest rate volatility, which can wreak havoc on financial asset returns. The interest rates of bonds reflect the marginal costs of a crucial source of funding for governments (Treasuries), businesses (corporate bonds), and even consumers (mortgage rates). The economic significance of large moves in interest rates cannot be overstated. However, so far, the bond vigilantes have not shown up. The 10-year U.S. Treasury yield was relatively unchanged during the quarter. The quarter started with a yield of 1.45% and subsequently declined to 1.19% on a closing basis in early August. Since then, the yield rose to end the quarter at 1.52%.18 This is remarkable, given the backdrop of massive fiscal spending and elevated inflation. Since COVID-19, the amount of fiscal debt has jumped to 125% of gross domestic product, while at the same time, the Congressional Budget Office estimates deficits will now average well over $1 trillion annually through 2031.19,20 This translates to net treasury debt issuance of more than $4 trillion last year and an estimated $2.1 trillion for this year. Perhaps even more astonishing, the last time the Consumer Price Index was up more than 5% on a year-over-year basis, as it has been for the last two months, was in September 2008.21 Back then, the 10-year U.S. Treasury yield was in the mid-to-high 3% range—more than double what it is today.22

Looking Ahead

Energy is another sector that plays a key role in economic growth and inflation and that has been impacted by supply chain issues. As of the end of the quarter, a barrel of WTI Crude Oil was trading at a little over $75, a price we have not exceeded since 2014. Similarly, the national average gas price is at just over $3 per gallon, a seven-year high.23 Finally, natural gas prices are at 13-year highs. Given these price levels, we expect market participants—and the bond vigilantes—will begin to pay more attention to future price moves in the energy complex.

We remain keenly interested in how Congress will deal with the federal debt ceiling and how this issue will affect Treasury issuance (supply) for the coming quarters. From an economic and market perspective, interest rates must remain contained. The Treasury has been unable to move forward with the majority of its scheduled second-half debt issuance, roughly $1 trillion, due to the debt ceiling.24 That said, we do not have concerns that the federal government will fail to pay its bills—the debt ceiling has been raised twenty-nine times since 1990.25 If bond vigilantes stay quiet, unsustainable policy accommodation can likely continue. If they do not, investors should expect elevated volatility, at least relative to what has been an extraordinarily good year for asset prices.

At RMB, we continue to recommend maintaining diversified portfolios of investments that have the potential to perform well in a broad range of market outcomes. As we move forward from here, we are closely watching the labor market dynamics in the U.S. as unemployment has continued to fall, yet job openings remain at historical highs. Consumers are faced with empty shelves in stores and long lead times for other purchases, such as vehicles, as labor and supply chain shortages have made delivery of goods difficult for companies. Many investors view these issues as a sign that the inflationary pressures seen over the last 6 months are likely to continue in coming months. Concerns about the job market, supply shortages, and inflation have all contributed to the uneven economic recovery, which is likely to persist in coming months. Corrections in equity markets and continued interest rate volatility remain a possibility in this environment. Given this, RMB believes investors should evaluate risk exposures in their portfolios. One way for investors to respond in this type of environment is to maintain long-term asset allocation targets to stocks and bonds but look to reduce risk through a focus on high-quality core investments within these allocations. While remaining cognizant of the increasing risks, we continue to focus on balancing opportunities in the current environment and taking advantage of niche markets that present attractive risk/reward opportunities.

3 CDC COVID Data Tracker

4 Johns Hopkins: https://coronavirus.jhu.edu/data/cumulative-cases

5 FRED: https://fred.stlouisfed.org/series/PAYEMS

6 FRED: https://fred.stlouisfed.org/series/JTSJOL

7 FRED: https://fred.stlouisfed.org/series/JTSQUR

8 TSA: https://www.tsa.gov/coronavirus/passenger-throughput

9 BTS: https://data.bts.gov/Research-and-Statistics/Transit-Ridership-Urban-Rail/rw9i-mdin

10 Atlanta Fed: https://www.atlantafed.org/cqer/research/gdpnow

11 BEA: https://www.bea.gov/data/gdp/gross-domestic-product

12 OECD: https://www.oecd.org/ocean/topics/ocean-shipping/

15 FRED: https://fred.stlouisfed.org/series/RETAILIRSA

17 FRED: https://fred.stlouisfed.org/series/TOTALSA

18 FRED: https://fred.stlouisfed.org/series/AISRSA

19 FRED: https://fred.stlouisfed.org/series/GFDEGDQ188S

20 CBO: https://www.cbo.gov/system/files/2021-02/56970-Outlook.pdf

21 FRED: https://fred.stlouisfed.org/series/CPIAUCSL

22 FRED: https://fred.stlouisfed.org/series/DGS10

23 EIA: https://www.eia.gov/petroleum/gasdiesel/

24 U.S. Department of the Treasury: https://home.treasury.gov/system/files/136/Sources-and-Uses-July-2021.pdf

25 Wikipedia: https://en.wikipedia.org/wiki/History_of_the_United_States_debt_ceiling

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience, and are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. The S&P 500 Index is widely regarded as the best single gauge of the U.S equity market. It includes 500 leading companies in leading industries of the U.S economy. The S&P 500 focuses on the large cap segment of the market and covers 75% of U.S. equities. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade. The Bloomberg Commodity Indices (BCOM) are a family of financial benchmarks designed to provide liquid and diversified exposure to physical commodities via futures contracts. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available The Russell 1000® Growth Index measures the performance of the large- cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russel 1000® companies with lower price-to-book ratios and lower expected growth values. The Russell 2000® Value Index measures the performance of small-cap value segment of the US equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values The Russell 2000® Growth Index measures the performance of the small- cap growth segment of the US equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the US and Canada. The Bloomberg Barclays 1-10 Year Municipal Blend Index is a market value-weighted index which covers the short and intermediate components of the Barclays Municipal Bond Index—an unmanaged, market value-weighted index which covers the U.S. investment-grade tax-exempt bond market. The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. The MSCI China Index is constructed based on the integrated China equity universe included in the MSCI Emerging Markets Index, providing a standardized definition of the China equity opportunity set.