Whether you’re giving to what you know or are inspired by current events to support a particular cause, your charitable dollars help shape the multi-billion-dollar philanthropy industry. Here are some of the recent trends shaping philanthropy and thoughts for donors considering a gift this year.

The State of Charitable Giving

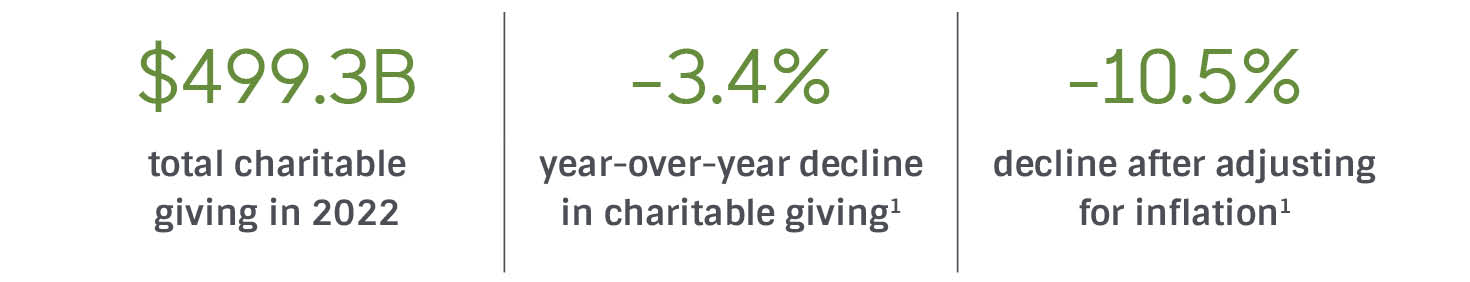

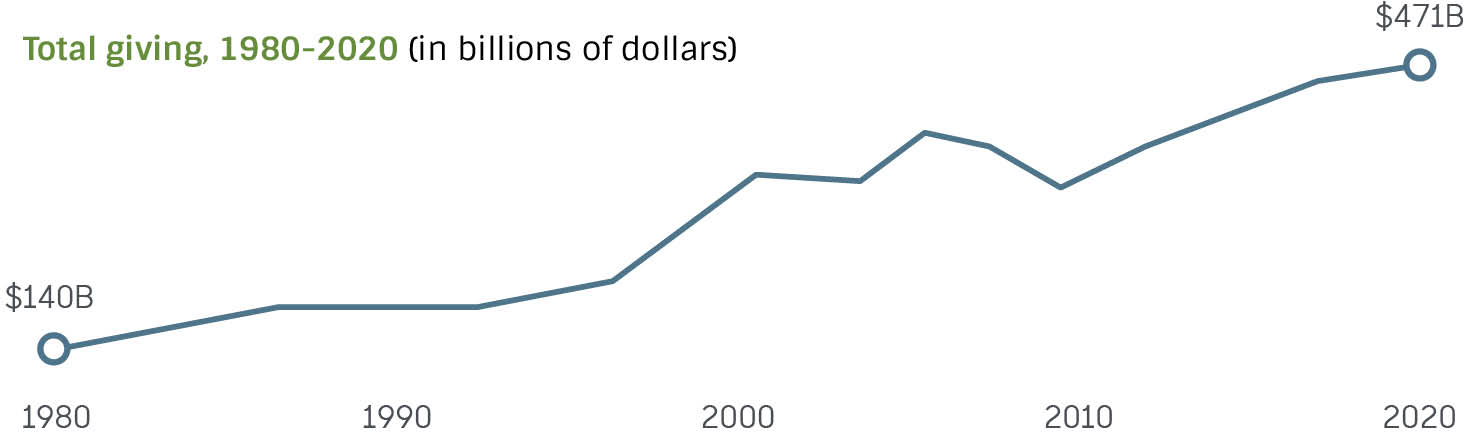

As it did in so many other areas, 2022 brought major changes in philanthropy. Charitable giving dropped off significantly, with market performance, geopolitics, and inflation likely driving the decline. After two years of record highs, 2022 stands out as only the fourth decline in annual giving in 50 years.1 Charitable giving tends to correlate with economic well-being. It’s not surprising that gifts dropped significantly last year, when you look at how the stock market performed in 2022.

However, giving patterns tend to rebound after periods of decline, which is exactly what we saw following the financial crisis of 2008 and other economic downturns.

Growing Sectors of Philanthropy

People continue to give to what they know, with religion, education, and human services remaining the top sectors for giving. However, donor funds are increasingly being directed to issues dominating news headlines:

- Humanitarian crises such as the war in Ukraine

- Climate change and sustainability efforts

- Ongoing social issues such as racial justice and LGBTQ rights

Donor-advised funds reached new records in 2021:

Going Beyond Cash Gifts

Savvy donors are employing strategic tactics with their giving by making non-cash contributions to charities.

- 57% of Fidelity Charitable’s contributions in 2022 were in the form of non-cash donations.3

- Contributions of illiquid assets to Fidelity Charitable such as restricted stock, private equity, and limited partnership interests totaled over $1.4 billion in 2022.3

- Fidelity Charitable’s cryptocurrency contributions exceed $500 million, $38 million of which was contributed in 2022.3 Cryptocurrency donations currently total over $300 million annually and are only predicted to grow in coming years.4

Gifting highly appreciated securities can be a strategic way to eliminate capital gains taxes.

Is this the right time to explore the charitable or legacy gift you’ve been contemplating? Let RMB’s team of experienced advisors help you consider the ways in which your giving can shape the world around you.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. RMB Asset Management is a division of RMB Capital Management.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

The CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.