Setting realistic and achievable new year’s resolutions can be a challenge. We are constantly trying to “better ourselves” and improve in all aspects of our lives, especially at the start of a new year. So, instead of waiting until the last day of the year to hit the “refresh button,” why not implement practices throughout the year we can work at daily?

Arguably, one of the most essential items on your new year’s resolution list should be creating a fresh budget and finding new ways to stick to it. A budget is crucial for financial stability and ensures our money executes the priorities which we have outlined for ourselves. Creating a budget customized to your needs helps you stay on track to reach your financial goals. Here are a few things to keep in mind when making a budget:

- Simply put, a budget helps you keep track of money coming in and out, so you don’t overspend. There are three important items to consider when creating your ideal budget:

- What is your income after taxes?

- How much are you spending?

- How much are you saving?

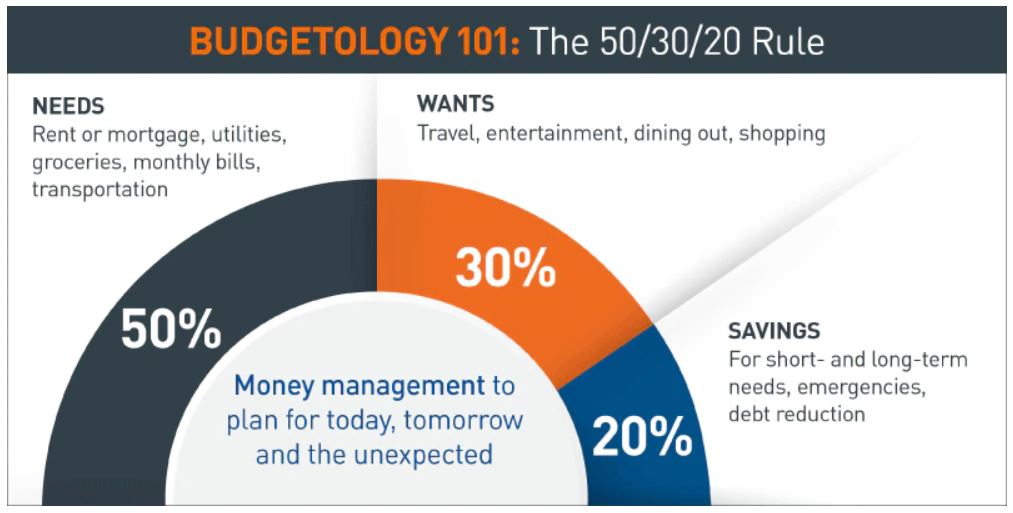

- Financial experts often recommend following the 50/30/20 rule: allocate 50% of your monthly income for necessities, 30% for things you want, and 20% for savings. Depending on your current financial situation, these percentages may need to be adjusted to fit your needs.

Source: “4 Powerful financial New Year’s Resolutions for 2023,” PNC, Dec 21, 2022

- One of the main reasons we fail to stick to a budget is that we underestimate how much we spend. Start by tracking your expenses for 30 days using a Google spreadsheet or a budgeting app. If you find yourself frantic about the amount of money you are spending on dining out or on your monthly streaming service, for example, you may want to consider pausing your subscription for a few months and/or opting for more home-cooked meals. Every dollar counts!

- One of the best pieces of advice is to be prepared for the unexpected. Setting aside money in an emergency fund (e.g. medical bills, car repairs, etc.) can help provide peace of mind for the “what-ifs” in life.

Thinking about the bigger picture, what are your financial goals? Are you saving up for a car? Or maybe a down payment on a house? Whatever it may be, try creating a new year vision board to help you stay motivated to stick to the budget you have created. Now, you can picture a new year with financial success!

The opinions and analyses expressed in this communication are based on RMB Capital’s research and professional experience and are expressed as of the mailing date of this communication. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this communication. The information and data in this communication do not constitute legal, tax, accounting, investment, or other professional advice. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account.