Even before the leaves began to change, and the calendar turned to fall, the nation’s focus has already shifted to a pivotal event: the 2024 presidential election. Anticipation and concern are growing, with clients and investors wondering how the election might impact financial markets. It’s evident that, this year, more than usual, there is a collective sense of urgency about the potential outcomes.

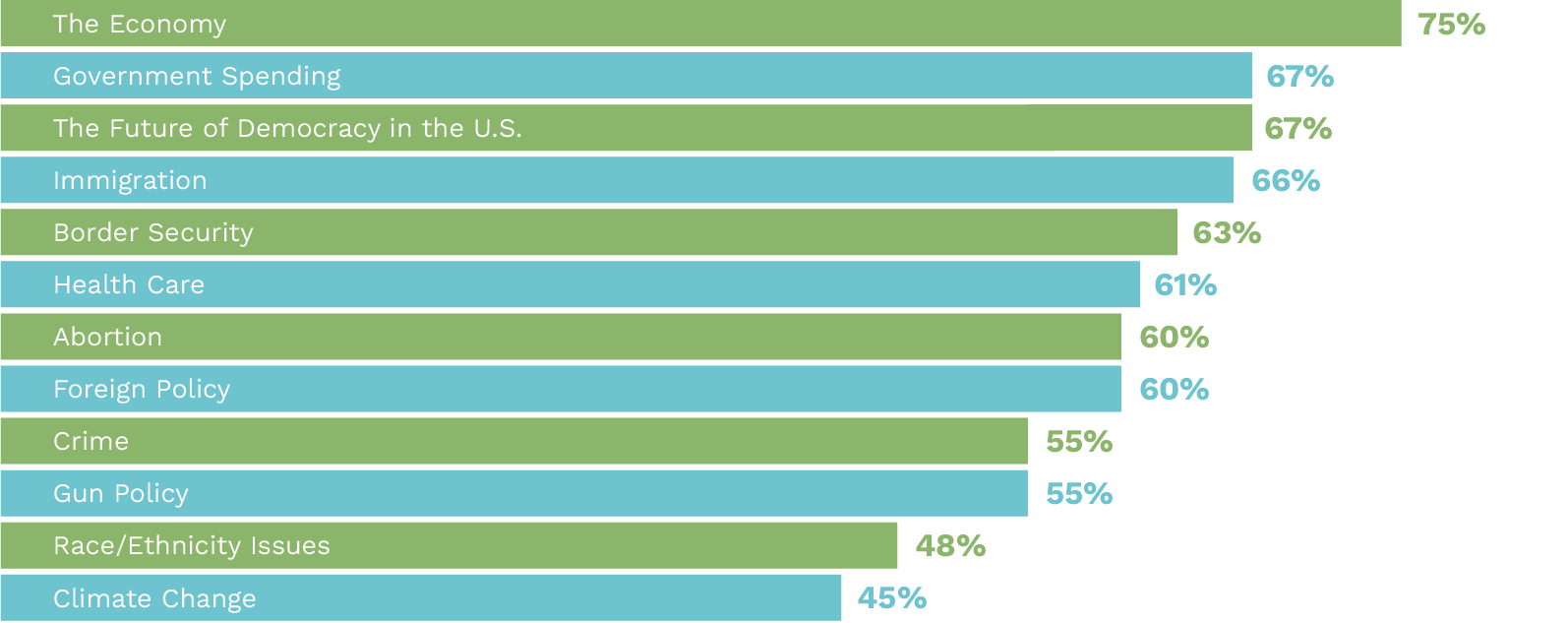

Voters tend to focus on a few key issues during each election cycle. Based on client questions and voter polls, there seems to be a longer list of key issues on voters’ minds. The issues range from the economy and government spending to immigration and climate change.

We tend to view government spending as one of the most important issues in each election cycle, even though it is often not directly discussed by candidates. The federal government spends over $6T per year on initiatives including health care, social security, and defense spending—expenditures that the government does not generate enough income to fully fund. In the 2023 federal budget cycle, spending exceeded income by about $1.7T. To bridge this significant shortfall, the government turns to borrowing money to fund the excess spending.

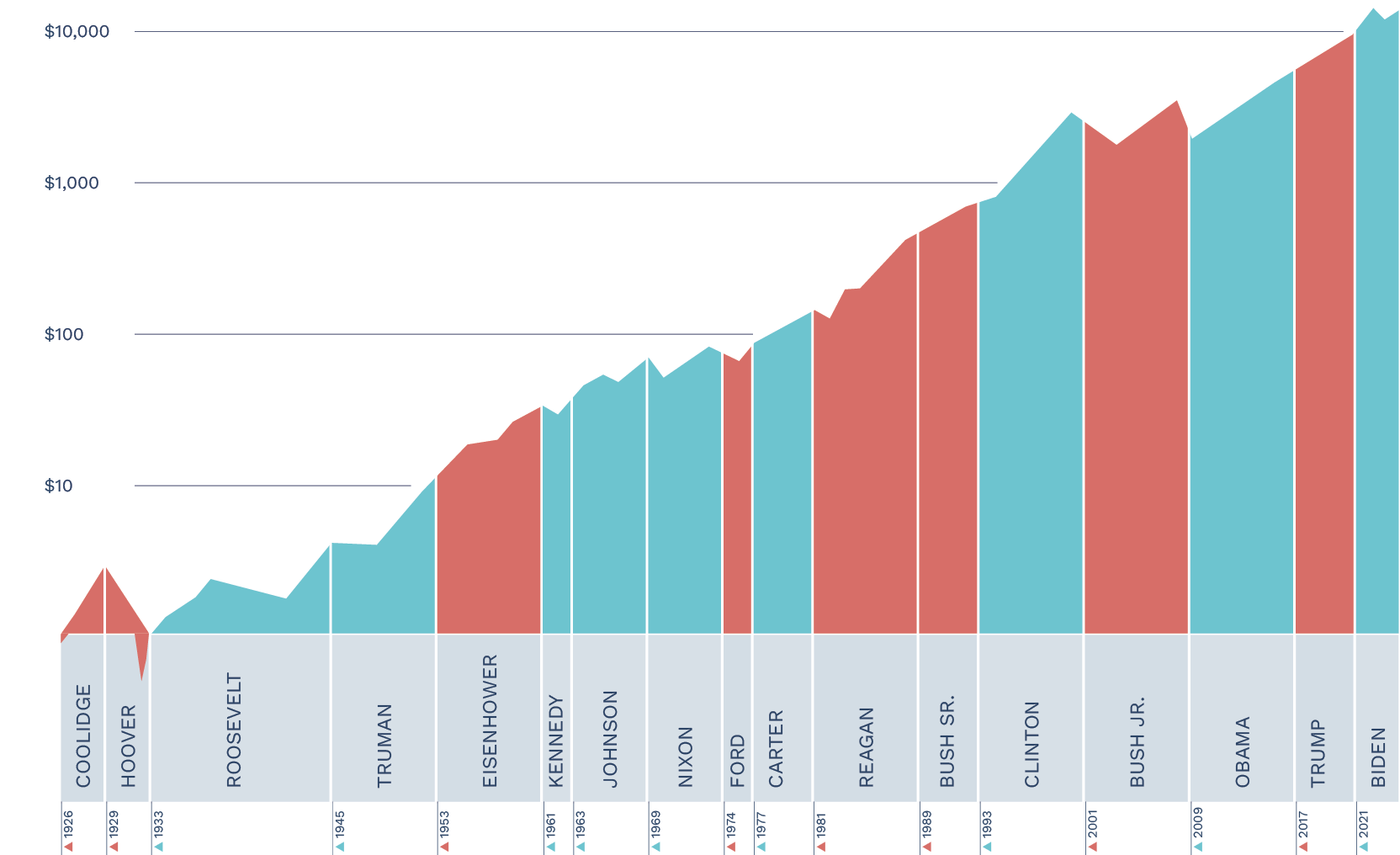

Deficit spending has been a persistent problem for many decades. Except for a brief surplus in the late 1990s, budget shortfalls have been the norm, accumulating to a staggering federal debt that now equals the size of the economy—about $34 trillion, or roughly $100,000 per person in the United States.

The dynamics around government spending aren’t likely to improve in the near term. Medicare-related spending is expected to double in the next decade, reaching $2 trillion per year, while defense spending is trending toward $1 trillion annually. With rising interest rates, the cost of servicing this debt is projected to exceed $800 billion this year alone.

Voters tend to believe that some of these issues could be resolved if their preferred political party had full control of the legislative agenda—meaning the ability to determine fiscal policy priorities such as taxing and spending initiatives. However, historical analysis shows that political party control is not a strong predictor of outcomes. Most of the time, the government is divided between political parties.

Even during longer stretches of time with one party in full control, there has been no clear correlation with better economic outcomes or higher stock market returns. And when looking at stock market returns, there is evenless of a relationship apparent with political party control. In the long run, the stock market has continued to appreciate, regardless of who was in the White House.

So, what can we expect this election cycle? While we have no idea who the ultimate winners will be, the rhetoric of the current candidates tells us that neither party is heavily focused on the issues around federal budget deficits and accumulated debt. We believe excess government spending and borrowing are unsustainable in the long run, and something will have to change eventually-but no one knows when that is likely to happen. In the meantime, we expect more frequent episodes of concern around funding the government and debt ceiling debates, compared with what we have experienced in recent years. It is possible that these episodes could start to result in an increasing amount of volatility in both the bond and stock markets when they occur.

How should clients and investors prepare for that possibility? We suggest starting by making a strong financial plan with your advisor, and having a high-quality, diversified asset allocation. This will help clients be prepared to weather volatility and potentially take advantage of any market dislocations and investment opportunities that could arise.

And remember that, while the party in control matters for a range of issues, history suggests that economic growth and stock market returns tend to be much more apolitical in their outcomes.

The opinions and analyses expressed in this presentation are based on Curi RMB Capital, LLC’s (“Curi RMB Capital”) research and professional experience are expressed as of the date of this presentation. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future performance, nor is it intended to speak to any future time periods. Curi RMB Capital makes no warranty or representation, express or implied, nor does Curi RMB Capital accept any liability, with respect to the information and data set forth herein, and Curi RMB Capital specifically disclaims any duty to update any of the information and data contained in this presentation. The information and data in this presentation does not constitute legal, tax, accounting, investment or other professional advice.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.