Key Takeaways

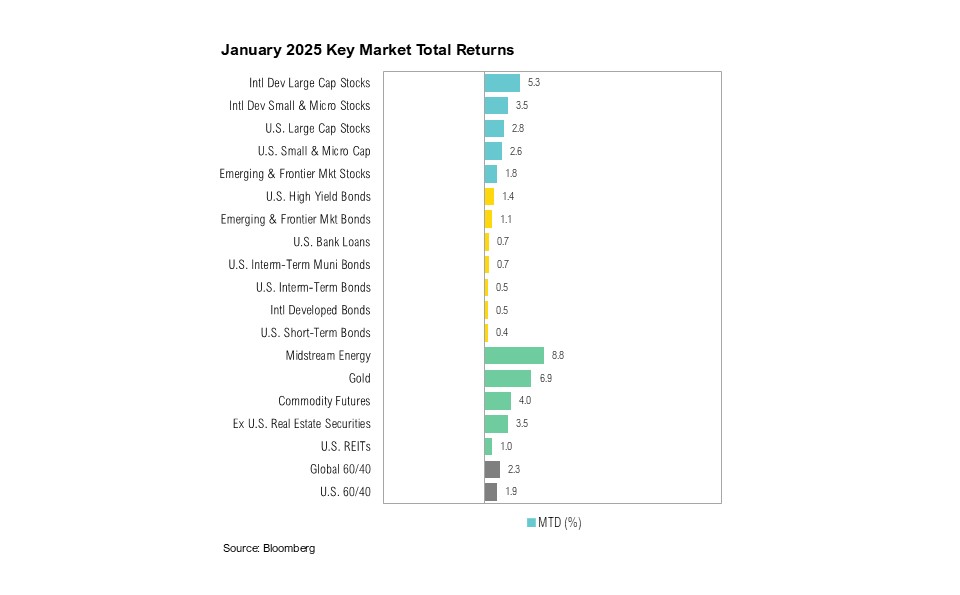

- U.S. large-cap stocks gained 2.8% in the first month of 2025, while U.S. small-cap stocks rose by 2.6%. U.S. intermediate-term bonds rose by a modest 0.5%.

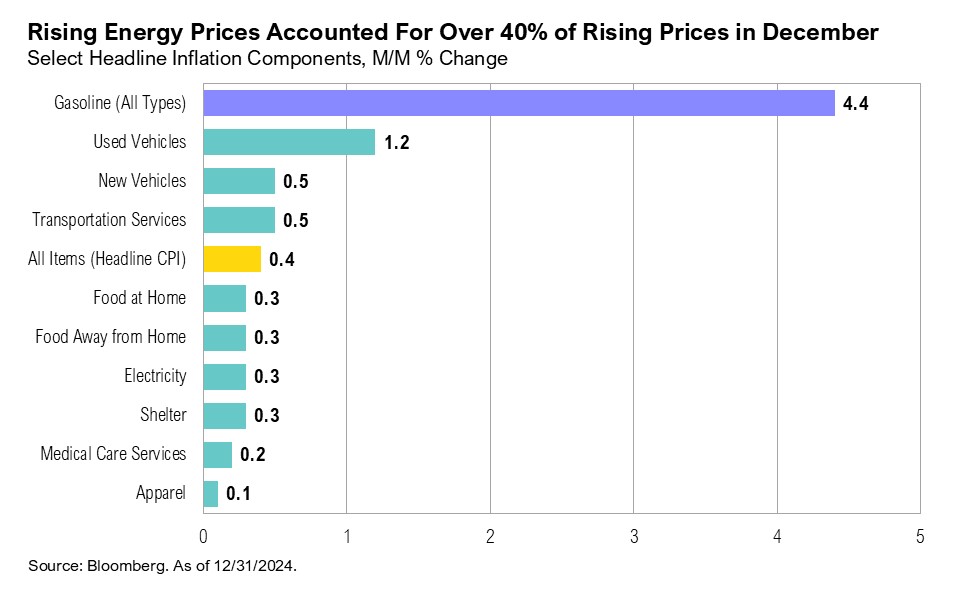

- Preliminary reports show the U.S. economy growing at a slower-than-expected pace in the fourth quarter of 2024. Headline inflation, driven by rising energy prices, rose to 2.9% in December.

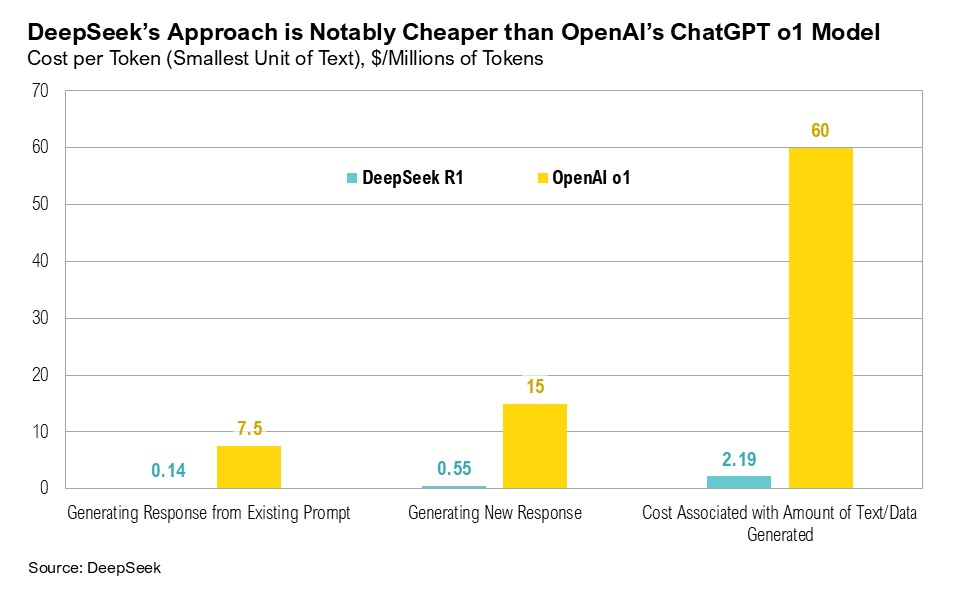

- DeepSeek’s open-sourced AI model rivals OpenAI’s ChatGPT at a lower cost, potentially reshaping the AI landscape by making advanced AI more accessible.

- Trump’s return to the White House generated over 100 executive orders, including withdrawals from the World Health Organization and Paris Agreement on climate change, major immigration changes, and the creation of the Department of Government Efficiency (DOGE) to address the U.S. fiscal deficit.

Overview

Markets produced compelling gains in the first month of 2025. U.S. large-cap stocks, as represented by the S&P 500 Index, ended January up 2.8%, while the U.S. small-cap Russell 2000 Index gained 2.6%. U.S. intermediate-term bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, ended January up a modest 0.5%.

Preliminary estimates for the fourth-quarter GDP showed the U.S. economy growing at an annualized rate of 2.3% quarter-over-quarter, slightly below the expected 2.7%. 1 This slowdown was largely due to a record-high goods trade deficit and an unexpected decline in inventories. 2 Consumer spending posted its strongest quarter of the year, rising by an estimated 4.2%, while government spending increased by 2.5%. 1

The ISM Manufacturing PMI showed manufacturing sector activity moving into expansionary territory for the first time since October 2022, registering a reading of 50.9 in January. 3 The ISM Services PMI showed services sector activity continuing to grow for the seventh consecutive month, with a reading of 52.8 in January. 4

After declining to 2.3% year-over-year in September 2024, headline inflation rose to 2.9% in December. 5 Housing inflation continues to be the main driver of elevated inflation, while energy prices have started to reaccelerate. Energy prices contributed 40% to the overall monthly increase in December, and gasoline prices increased by 4.4% in December. 5

Nearly 50% of S&P 500 companies have reported their fourth-quarter earnings results. As the earnings season has progressed, growth estimates have steadily increased, rising from 11.8% at the end of December to 13.2% in the last week of January, marking the halfway point. The financials sector contributed the most to earnings growth, increasing 51%, followed by the communication services sector at 29%, and the tech sector at 16%. 6 Full-year 2024 earnings growth for the S&P 500 is projected to reach 9.4%, driven largely by significant contributions from these three sectors. 6 For 2025, earnings growth estimates currently stand at 14.3%, which would be the highest growth rate since 2021 when it exceeded 35%. Notably, the proportion of S&P 500 members outperforming the broader index over the past month rose to 52% at the end of January, a significant improvement from 20% at the end of December. 7

AI Wars

The year did not start quietly. January not only ushered in a new administration taking office (and over 100 executive orders being carried out), but also a potential shift in the future of artificial intelligence (AI).

On January 20, 2025, DeepSeek—a Chinese artificial intelligence startup—launched an advanced AI model that first caught the attention of Silicon Valley, and then broader global capital markets. DeepSeek’s new model, R1, demonstrated high performance in various benchmarks, making it competitive with top U.S. AI models such as OpenAI’s ChatGPT. 8,9 More importantly, the company claimed that it trained its models at a fraction of the cost of incumbent models. 9,10 Venture investor Marc Andreessen called it “AI’s Sputnik moment.” 11

DeepSeek’s R1 AI model introduces several advancements over traditional AI models, enhancing efficiency and maintaining accuracy. It enhances efficiency by using less memory and processing text in phrases rather than word by word, achieving faster speeds with minimal loss in accuracy. 10 A distinctive feature of the R1 model is its expert system. Instead of activating all 671 billion parameters at once, it uses only 37 million targeted parameters, making it far more efficient than traditional models that activate nearly 1.8 trillion parameters continuously. Additionally, DeepSeek made its code, papers, and methods open source, allowing public access for review or replication. 10

To quote the Greek philosopher Plato, “Necessity is the mother of invention.” The U.S. ban on exporting chips to China (which was first implemented in October 2022 and has grown to include bans on many essential tools needed for producing advanced semiconductors) seems to have prompted DeepSeek to achieve results more efficiently and at a lower cost. 12

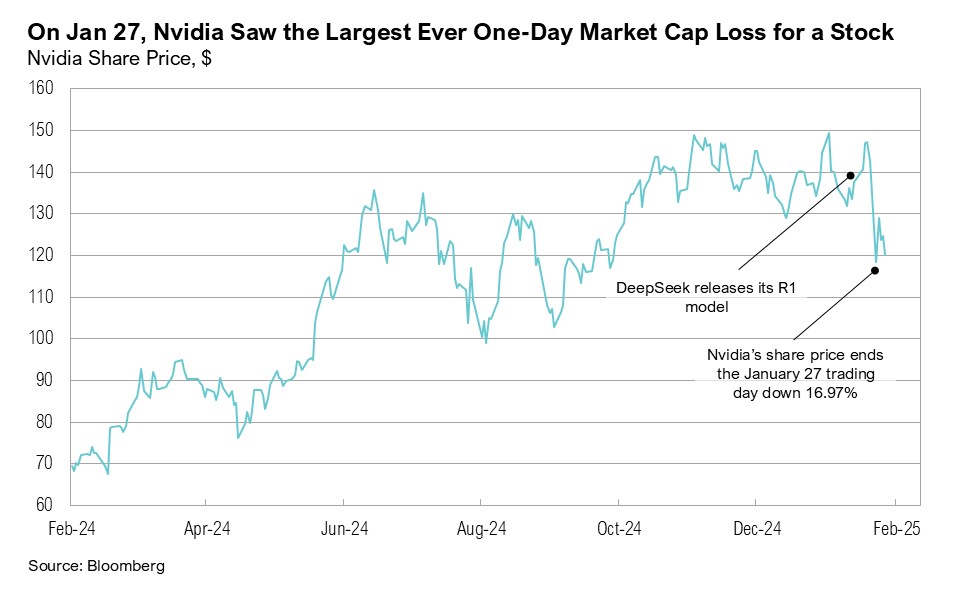

DeepSeek’s R1 model triggered a sharp sell-off in equities on Monday, January 27, one week after its release. Nvidia, whose microchips make it a key industry leader in the AI space, dropped 17%, marking the largest one-day market cap loss for a single stock in history. Nvidia ended January down 13%.

There are concerns about DeepSeek’s true development costs and privacy policy. While DeepSeek claims its setup involves only 10,000 Nvidia H100 chips, reports suggest the number may be closer to 50,000. If accurate, this would align initial training costs with those of other major AI models. 8,13 Nevertheless, DeepSeek’s pricing remains about 90% lower than that of OpenAI’s ChatGPT. China’s lax data privacy regulations and internet surveillance continue to draw attention, and they have become key issues for the future of the Chinese-owned social media app, TikTok, which was briefly banned in the U.S. in January. The U.S. Navy has already banned the use of DeepSeek “in any capacity” due to “potential security and ethical concerns.” 14

Concerns aside, it is not DeepSeek itself, but rather its approach, that has disrupted the status quo and thrown into question the future of U.S. tech dominance. By cutting costs and enabling large-scale AI training on consumer-grade hardware, DeepSeek has lowered the barrier to entry for AI innovation. It suggests that powerful and cost-effective AI models are achievable without the immense infrastructure traditionally associated with major tech companies. It has also increased the likelihood that lower-cost models are not only possible but may be just as powerful and effective as industry-leading models.

For now, at least, mega-cap tech companies seem to have little interest in scaling down on AI-related spending. Both Meta and Microsoft announced plans in the last week of January to spend billions of dollars on AI. 15,16 After his company announced a $65 billion spending plan on AI infrastructure expansion, Meta CEO Mark Zuckerberg said:

“I continue to think that investing very heavily in CapEx and infrastructure is going to be a strategic advantage over time. It’s possible that we’ll learn otherwise at some point, but I just think it’s way too early to call that.” 15

Microsoft plans to spend $80 billion on AI in its current fiscal year. Microsoft CEO Satya Nadella noted in the company’s fourth-quarter earnings call that ongoing spending would alleviate limitations that have thus far hindered the tech giant’s ability to fully leverage AI:

“As AI becomes more efficient and accessible, we will see exponentially more demand.” 16

While Meta ended January up 15%, Microsoft ended the month down 0.8%.

On January 20, coincidentally the same day that DeepSeek released its R1 model to the world, the Trump administration returned to the White House. On his first day back in office, President Trump signed over 100 executive actions, including rescinding 78 Biden-era orders, withdrawing the United States from the World Health Organization (WHO) and the Paris Agreement, implementing extensive changes to U.S. immigration policy, and establishing the Department of Government Efficiency (DOGE). 17

DOGE, which also commenced operations on January 20, was created to shed light on (and possibly lighten) the U.S. fiscal deficit, which is estimated to reach $1.9 trillion in 2025. 18 Unless addressed, the U.S. government may add over $6 billion of debt every day for the next ten years—borrowing over $268 million every hour. 19

DOGE has wasted no time in getting started. According to the department, they are already saving the federal government approximately $1 billion per day, mostly from the federal hiring freeze, eliminating DEI initiatives, and preventing improper payments to foreign organizations, per presidential executive orders. 20 DOGE has begun to scrutinize and clean up the federal real estate portfolio, which has more than 7,500 leases. According to the department, landlords in Washington, D.C. that rent to federal agencies are being paid a significant premium: the average General Services Administration (GSA) office rent per square foot in Washington is $41, while the average broader D.C. office market sits at $33. 21,22 This follows a 2023 Public Buildings Reform Board report that found that nearly 90% of U.S. government agency space in D.C. is going unused. 23 On January 21, the U.S. Debt Clock website introduced a DOGE section to monitor the department’s efforts to cut back on federal spending. 24

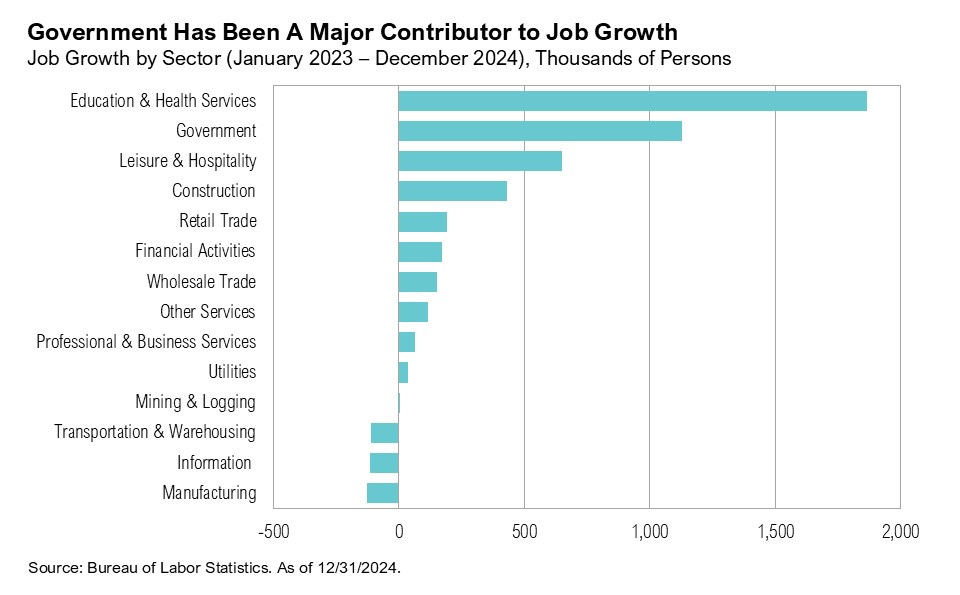

Another executive order, effective from January 20, put a hiring freeze on all federal government jobs. On January 28, the Trump administration sent out a voluntary resignation invitation to nearly every federal worker, offering employees continued payment until September 2025 if they resigned by February 6 but a federal judge ordered that paused. 25 The administration anticipated that between 5% and 10% of the federal workforce may quit, which could lead to approximately $100 billion in savings. 25,26 Over the past two years, the government sector has been the second-largest contributor to job growth, adding over 1.1 million new federal employees since January 2023.

Recent reports have also revealed misspending in various government departments. For instance, the Government Accountability Office in December released a report that nearly $100 billion in improper payments were made in the Medicare and Medicaid programs in 2023 while the Department of Justice also in December sued CVS and Walgreens for filing unlawful prescriptions of opioids and seeking reimbursements from federal healthcare programs. 27,28,29 The Federal Trade Commission in January sued CVS and Cigna for failing to provide requested documents related to the case. 30

While these recent reports and DOGE’s efforts are small changes in the context of a nearly $2 trillion deficit, changes on the margin matter, and may eventually lead to a lightening of the U.S. fiscal burden.

Markets

International equity markets fared better than their U.S. counterparts in January. U.S. large-cap stocks ended the month up 2.8%, while international developed market large cap stocks gained 5.3%. Similarly, while U.S. small-cap stocks ended the month up 2.6%, international developed market small-cap stocks ended the month up 3.5%. Emerging market stocks ended January up 1.8%, driven by strong gains in South American markets. Both U.S. intermediate-term bonds and international developed market bonds gained 0.5%.

In geopolitical developments, on January 19, a ceasefire between Israel and Hamas came into effect. After peaking at $79 per barrel on January 16, WTI crude oil ended the month down $7, easing to $72 per barrel on January 31.

Looking Forward

The incoming administration appears focused on bolstering economic growth while at the same time reducing the deficit. The most critical element of this endeavor will be curtailing the deficit and, in the process, keeping longer-term yields contained to not disrupt the economic expansion.

Although the Federal Reserve can dictate short-term interest rates through policy decisions, it has less control over longer-term rates. Since the first rate cut in September, longer-term yields have reacted with a unique vibe, moving higher than during other rate-cutting cycles. That’s not to say a rise in bond yields is bad, per se, but unless it is driven by higher long-term growth prospects that translate to higher corporate earnings, rather than fiscal irresponsibility or other perceived policy errors, it could hurt risky asset valuations. It will now be up to fiscal policymakers to thread this needle. If they can, it will allow the continuation of government policies that support economic growth, which are critical for supporting equity and credit markets. Although these are disruptive to the status quo in the short term, we view cost-saving advancements in AI and progress, even if it is marginal, on the deficit as constructive developments.

Our position on the markets remains unchanged. We continue to be cautious with risk assets as the current cycle plays out. With the official change in administration this past month, market participants continue to gain more clarity on the direction of U.S. policy. Most importantly, the new administration seems to bring a renewed focus on the deficit and better alignment with the Fed’s policy of trying to grow the U.S. out of massive deficits. We expect the yield curve to continue to normalize and inflation appears to be contained, but risk to the upside has increased.

We expect the increased volatility in markets to continue in the coming weeks and months. Although lower asset prices would be a welcome development and an opportunity to put additional capital to work, equity valuations suggest that there is no rush. Stock returns and corporate earnings have been very concentrated and equity valuation continues to be above average, even when excluding the top performing stocks. We remain biased towards high-quality companies within our core stock portfolios. We have been well-positioned within core bond portfolios with a low weight toward shorter-duration corporate bonds and a higher weight toward longer-duration treasury bonds. We believe clients are best served reminding themselves of the timeless principles of patience and diversification. The key to successful investing is often remaining committed to long-term investment plans

Citations

- BEA: https://www.bea.gov/sites/default/files/2025-01/gdp4q24-adv.pdf

- Reuters: https://www.reuters.com/markets/us/us-goods-trade-deficit-widens-sharply-december-imports-2025-01-29/

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/january/

- ISM: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/january/

- BLS: https://www.bls.gov/news.release/cpi.nr0.htm

- FactSet: https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_013125.pdf

- Liz-Ann Sonders via X: https://x.com/LizAnnSonders/status/1885310214498385943/photo/2

- Bloomberg: https://www.bloomberg.com/news/articles/2025-01-27/what-is-deepseek-r1-and-how-does-china-s-ai-model-compare-to-openai-meta

- Reuters: https://www.reuters.com/technology/us-looking-into-whether-deepseek-used-restricted-ai-chips-source-says-2025-01-31/

- Arxiv: https://arxiv.org/html/2412.19437v1

- Marc Andreessen via X: https://x.com/pmarca/status/1883640142591853011

- CNN: https://edition.cnn.com/2024/12/02/tech/china-us-chips-new-restrictions-intl-hnk/index.html

- CNBC: https://www.cnbc.com/2025/01/24/how-chinas-new-ai-model-deepseek-is-threatening-us-dominance.html

- CNBC: https://www.cnbc.com/2025/01/28/us-navy-restricts-use-of-deepseek-ai-imperative-to-avoid-using.html

- Meta Earnings Call: https://s21.q4cdn.com/399680738/files/doc_financials/2024/q4/META-Q4-2024-Earnings-Call-Transcript.pdf

- Reuters: https://www.reuters.com/technology/artificial-intelligence/microsoft-meta-ceos-defend-hefty-ai-spending-after-deepseek-stuns-tech-world-2025-01-30/

- The White House: https://www.whitehouse.gov/presidential-actions/2025/01/the-first-100-hours-historic-action-to-kick-off-americas-golden-age/

- CBO: https://www.cbo.gov/system/files/2024-06/60039-By-the-Numbers.pdf

- Committee on Homeland Security & Governmental Affairs: https://www.hsgac.senate.gov/wp-content/uploads/FESTIVUS-REPORT-2024.pdf

- Department of Government Efficiency via X: https://x.com/DOGE/status/1884396041786524032

- Department of Government Efficiency via X: https://x.com/DOGE/status/1886273522214813785

- Trepp: https://www.trepp.com/trepptalk/doge-looks-to-cut-gsa-leased-office-space-quantifying-impact-on-key-msas

- Washington Times: https://www.washingtontimes.com/news/2024/apr/11/government-report-finds-just-12-of-federal-offices/

- U.S. National Debt Clock: https://usdebtclock.org/#

- BBC: https://www.bbc.com/news/articles/cnvqe3le3z4o

- NBC News: https://www.nbcnews.com/politics/white-house/trump-administration-offer-federal-workers-buyouts-resign-rcna189661

- GAO: https://www.gao.gov/products/gao-24-107487

- Reuters: https://www.reuters.com/business/healthcare-pharmaceuticals/us-ftc-sues-drug-gatekeepers-over-high-insulin-prices-2024-09-20/

- Fortune: https://fortune.com/2024/12/19/doj-cvs-filling-unlawful-prescriptions-opioids/

- Bloomberg Law: https://news.bloomberglaw.com/pharma-and-life-sciences/ftc-says-it-sued-cvs-cigna-over-drug-documents-for-pbm-probe

Index Definitions

The S&P 500 Index is widely regarded as the best single gauge of the United States equity market. It includes 500 leading companies in leading industries of the U.S. economy. The S&P 500 focuses on the large cap segment of the market and covers approximately 75% of U.S. equities.

The Bloomberg Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Duration is roughly 5 years.

The Bloomberg U.S. Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded.

The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

The Russell 1000® Growth Index measures the performance of the large- cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. It includes approximately 2000 of the smallest US equity securities in the Russell 3000 Index based on a combination of market capitalization and current index membership. The Russell 2000 Index represents approximately 10% of the total market capitalization of the Russell 3000 Index. Because the Russell 2000 serves as a proxy for lower quality, small cap stocks, it provides an appropriate benchmark for RMB Special Situations.

MSCI EAFE Index*: an equity index which captures large and mid-cap representation across 21 of 23 Developed Markets countries around the world, excluding the U.S. and Canada. With 926 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI Emerging Markets Index* measures equity market performance in the global emerging markets universe. It covers over 2,700 securities in 21 markets that are currently classified as EM countries. The MSCI EM Index universe spans large, mid and small cap securities and can be segmented across all styles and sectors.

The U.S. Dollar Index is used to measure the value of the dollar against a basket of six foreign currencies: the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona.

The Deutsche Bank EM FX Equally Weighted Spot Index, an equal-weighted basket of 21 emerging market currencies.

MSCI U.S. REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (REITs). The index is based on the MSCI USA Investable Market Index (IMI), its parent index, which captures the large, mid and small cap segments of the USA market. With 150 constituents, it represents about 99% of the US REIT universe and securities are classified under the Equity REITs Industry (under the Real Estate Sector) according to the Global Industry Classification Standard (GICS®), have core real estate exposure (i.e., only selected Specialized REITs are eligible) and carry REIT tax status.

MSCI China NR Index: designed to measure the performance of the large and mid cap segments of the Chilean market. With 12 constituents, the index covers approximately 85% of the Chile equity universe.

MSCI South Africa NR Index: designed to measure the performance of the large and mid cap segments of the South African market. With 37 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in South Africa.

*Source: MSCI.MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Disclaimers

Performance Disclosures

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

The opinions and analyses expressed in this newsletter are based on Curi RMB Capital, LLC’s (“Curi RMB Capital”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. Curi RMB Capital makes no warranty or representation, express or implied, nor does Curi RMB Capital accept any liability, with respect to the information and data set forth herein, and Curi RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. RMB Asset Management is a division of Curi RMB Capital.