Life presents us with a series of obstacles and opportunities every single day. Recognizing them as such and responding appropriately is the heart of wisdom. I wake up, walk my labs, make coffee, pack a lunch, and drive to work. The little things I do help prepare me for a successful day. Within my routine, though, I can’t control whether it’s raining on any given morning and the dogs don’t want to go outside, or if there is a traffic jam on my way to work. These are obstacles of which I have no control. However, if I don’t acknowledge my lack of control, they could easily derail my day.

When it comes to investing, too many investors focus on obstacles and opportunities over which they have no control. How will politics this year affect stocks? What impact will the Federal Reserve interest rate decisions have on my portfolio? Is Bitcoin going up or down this month? We can’t predict what will happen in those arenas, much less their impact on investments. At Curi RMB Capital, we don’t turn investing into gambling; we focus on what we can control.

To be a successful investor, we believe you must think long-term and remove your emotion from decisions. One of the worst mistakes I see investors make is investing long-term money based on short-term events. They forget two of the fundamental rules of stock market investing: market prices can dramatically fluctuate in the short term, and market prices will typically increase over time. If my successful morning routine is walk, coffee, pack lunch, and drive, I don’t throw all that out the window because the weatherman said it might rain later today!

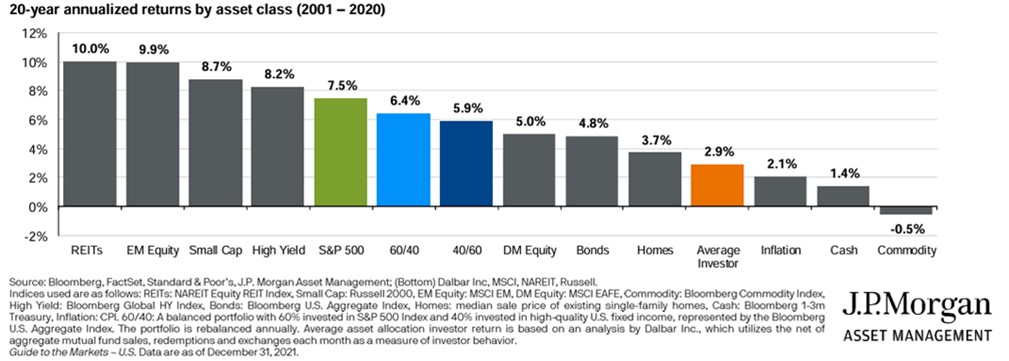

Many believe that the most impactful factor in determining your return is your investment selection (which stocks and funds you buy). This is not true. Investor behavior is the most important factor and the most significant driver of underperformance. See the chart below showing annualized returns by asset class from 2001 to 2020. The average investor is shown in orange.

The average investor annualized 2.9% versus the 6.4% diversified 60/40 portfolio. To put that into perspective, based on a $1,000,000 initial investment, the diversified 60/40 portfolio made over $1,600,000 more than the average investor over the specified timeframe ($3,458,060 vs $1,686,697). Why does the average investor underperform? They invested their long-term money based on short-term noise.

How do you shift your perspective? Think long-term. Be comfortable knowing you are invested correctly for the timeframe in which you will need the money. Remove recent performance bias. Honestly, most folks can’t do those things for very long before they trip up—and that’s why we suggest hiring a wealth advisor. Aside from helping create a retirement plan or implementing tax strategies, a wealth advisor will create a portfolio of investments tailored to your needs. This will help you stay invested through the unknowns to come.

Our routines become habits, which become the rituals by which our success is determined. Working with a wealth advisor will keep the focus on “the things that matter” and “the things you can control,” which can make the difference between an early retirement and having to work into your 70’s.

The opinions and analyses expressed in this newsletter are based on Curi RMB Capital, LLC’s (“Curi RMB”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. Curi RMB makes no warranty or representation, express or implied, nor does Curi RMB accept any liability, with respect to the information and data set forth herein, and Curi RMB specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. RMB Asset Management is a division of Curi RMB Capital.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.