Video: Sue Christoph, CFA

®

, CFP

®

, CPWA

®

discusses the purpose and value of holding regular family meetings.

Navigating the Sandwich and Grandsandwich Generations

Do you know someone caught between caring for aging parents and supporting children or grandchildren, all while trying to save for or enjoy retirement? It’s likely you do, as the “sandwich” generation has expanded, thanks to trends including longer life expectancy and adult children needing support through life transitions. 1 Many caregivers are also helping to meet the needs of further removed generations such as grandchildren, creating a new “grandsandwich” generation.

This increasing generational overlap can lead to caregiving throughout one’s entire adult life. Caring for family members can be a significant financial, emotional, and physical burden, charged with competing interests. Thankfully, there are financial and life planning considerations that can help set you up to support yourself and those you love.

Caring for Parents

Having difficult care conversations early can relieve some of the stress of managing a decline in a parent’s cognitive or physical health when the time comes. These conversations are essential to understanding and honoring a parent’s wishes, and they can also be a gift to future caretakers by clarifying a parent’s needs and expectations. Caregiving discussions can be sensitive and emotionally charged, so consider bringing in a neutral party such as your RMB financial and life advisor and an estate planning attorney to help guide these conversations.

Healthcare

- Ensure that your parents have adequate medical insurance by reviewing their current plans and coverage. If they rely on Medicare, review their plans annually during open enrollment.

- Ask your parents how they want to live as they age. If they’re incapacitated, who should make healthcare and financial decisions for them?

- Create a list of primary and specialist healthcare providers’ contact information.

Legal Documents

- Confirm your parents’ trusts, wills, healthcare power of attorney, and property power of attorney reflect their current wishes while they are of sound mind to make any changes.

- Power of attorney agents should carry an electronic copy of legal documents to provide to a medical provider or financial institution, should they need to take action.

- Know the contact information for your parents’ attorney for any questions and to help settle their estate when they pass.

Financial Accounts

- Inventory all financial accounts, insurance policies, and safe deposit boxes, and consolidate where feasible. Consider adding the financial agent as a signer to your parents’ checking account to easily pay bills in an emergency.

- List all sources of income and itemize expenses, noting whether accounts are set up for automatic deposit or payment. Reliable sources of income could include Social Security, a pension, and an annuity. Consolidate charges on one or two credit cards for efficiency and to reduce fraud risk.

- Make a list of trusted advisors (financial advisor, tax advisor, insurance agent, etc.) and their contact information.

- Document usernames and passwords for all electronic accounts, including financial and memberships. Consider using an electronic password manager like Dashlane or LastPass to keep this information accessible and secure.

Final Wishes

- Have your parents document what they would like to happen after they die. Providing last wishes can include funeral or cremation plans, body disposition preferences, an obituary, messages to loved ones, and requests for their final days.

- There are a variety of ways to formalize these wishes, including through a letter, a directive to a funeral home, an online service such as Five Wishes, or directly through an attorney.

Caring for Children and Grandchildren

It costs about $17,000 a year for the average family to raise a child—that’s over $300,000 through age 18. 2 It is important to talk with your children and grandchildren at an early age about financial responsibility and, as they get older, involve them in decision-making around major costs.

Financial Education

- Educate children on the importance of saving, budgeting, and setting priorities to achieve financial goals. Start earnings conversations early by relating them to income from chores, mowing a neighbor’s lawn, or babysitting.

- Save for education expenses, including college, with a 529 plan. These plans offer tax-deferred growth and qualified education expense withdrawals free from federal income tax, and they are generally free from state taxes. Let family and friends know about the plans so they can contribute on birthdays and holidays.

- Manage children’s expectations related to college costs, including their responsibilities and potential contributions. If they live with you during college or return home after college, make a financial agreement that ensures financial responsibility on their part and keeps you both on track with your goals.

Young Adults

- Encourage young adults to strive for financial independence by developing a plan together. This includes expenses that will eventually become their responsibility when they age out of family plans, such as health insurance and cell phone coverage.

- Your RMB financial and life advisor welcomes the opportunity to help educate children and grandchildren on financial basics, develop sound financial habits, and understand employer benefit options such as 401(k) plans.

On the upside

Caregivers in the sandwich generation are more likely than other adults to say they are very satisfied with their family life (48% vs. 43%). 3

Caring for the Caregiver

With competing demands and limited resources, it can be difficult for caregivers to stay on track with their own needs and goals. It’s just as important for caregivers to attend to themselves—financially, physically, and emotionally—so they can provide the best care for their loved ones.

Important planning for the caring generation includes:

Self-Care

- Reduce stress through physical activity, eating healthy, meditation, and getting enough sleep. Schedule time off in your daily/weekly calendar.

- Share what you are going through with a support group (try the National Alliance for Caregiving or Caring Across Generations), therapist, trusted friend, or journal.

- Talk with your doctor about your mental health or access resources in your community, such as the National Alliance on Mental Illness at http://www.nami.org.

- Recognize when you need time off from work. Understand your options for taking leave under the Family and Medical Leave Act (FMLA).

Setting Boundaries

- Consider setting financial boundaries by letting your parents, children, and grandchildren know what you can pay for and what you can’t, and by creating a timeline for them to find other solutions.

- Make sure you stick with your financial plan, so you don’t end up being a burden to your children.

Ask for help from outside your family, including geriatric care managers, social workers, your faith community, an elder law attorney, and professional caregivers. Research resources in your community to help navigate caring for aging parents.

3

- Ensure that other family members are sharing the responsibility to meet costs, fulfill care demands, and spend time with those needing care. Connecting across generations can also help reduce their loneliness!

Future Planning

- Just as you are asking parents to have difficult conversations and document their plans, make sure you are following the steps outlined above in case you find yourself in need of care. Remember, it’s never too early to plan for the future!

Intergenerational care places increased physical, emotional, and financial demands on family members. It is essential to keep an open, ongoing dialogue when making decisions relating to your family that may impact your health and plan. Your RMB financial and life advisor is here to support you and your family through life’s transitions.

Considerations for Everyone

Social Connection Is the Best Medicine

Loneliness has become an epidemic in the U.S. People of all ages are spending less time in person with their friends, compared to two decades ago. Half of adults report measurable levels of loneliness, with young people being among the most affected, despite social media and technology.

Being socially disconnected increases the risk of depression, anxiety, and suicide, and it can also worsen physical health. Lacking connection can increase the risk of premature death to levels comparable to smoking 15 cigarettes a day, according to a U.S. Surgeon General advisory. 5

Young people and older adults have an opportunity to leverage intergenerational relationships to improve cognitive function, increase empathy, and live longer lives. Invest time to rebuild social connections.

- Create sacred times and spaces in your life without technology to enable being fully present—at dinner, before bedtime, and when with friends and loved ones.

- Look for ways to help others. Service is one of the most powerful antidotes to loneliness.

Cybersecurity Health

As online scams proliferate, many explicitly target seniors. Scammers often push victims into feeling like they must act immediately, hoping to pressure victims into making rash decisions. Know that governmental agencies such as the IRS will never contact you asking for sensitive information.

Encourage parents to reach out to you if they are not sure about a message they receive. By working together, you can both develop healthy cybersecurity habits.

Email Security—Be wary of strange or unexpected messages, even if they’re from people you know, and never open attachments unless you know the sender and were expecting their message. Consider helping your parents review their email so they don’t click on links from unfamiliar senders.

Phone Security—Ignore unsolicited phone calls and robocalls. You can place your phone number on the FTC’s “Do Not Call List,” use spam-filtering apps, and block calls from unwanted numbers. Don’t respond to or click on pop-up windows on your phone or computer.

1 The “Sandwich Generation” Revisited: Global Demographic Drivers of Care Time Demands by Diego Alburez-Gutierrez, Carl Mason, and Emilio Zagheni, Population and Development Review 47(4): 997-1023 (December 2021)

2 https://www.washingtonpost.com/business/interactive/2022/cost-raising-child-calculator/

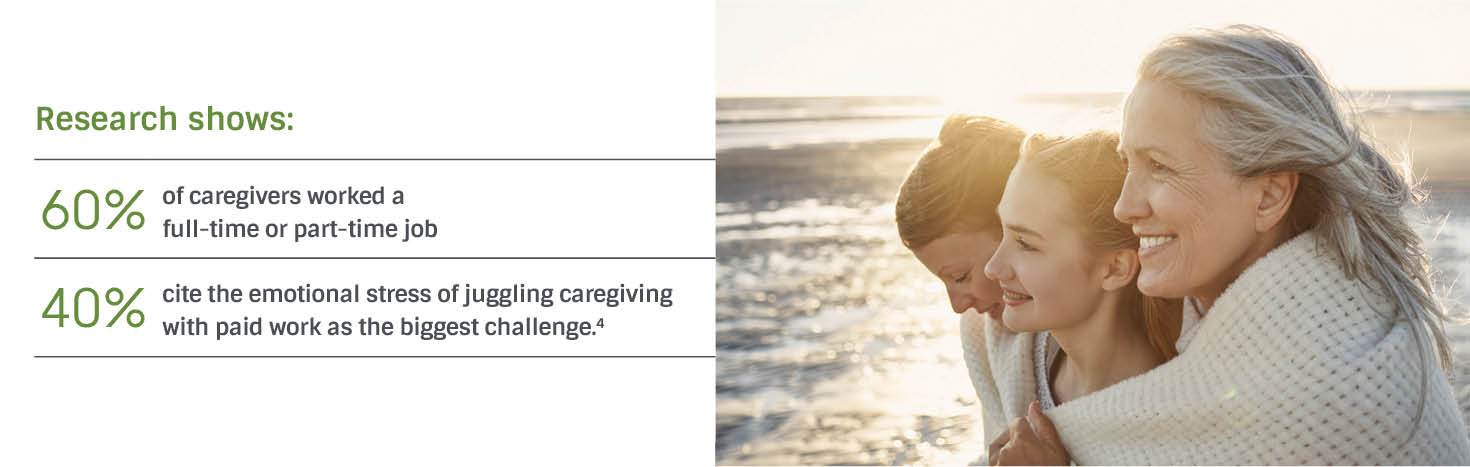

4 40 Resources for Adult Children Caring for Aging Parents, Senior Lifestyle, www.seniorlifestyle.com/resources/blog/40-resources-for-adult-children-caring-for-aging-parents

5 Valuing the invaluable: 2023 Update Strengthening Supports for Family Caregivers. Washington, D.C.: AARP Public Policy Institute, March 2023, Susan C. Reinhard, Selena Cladera, Ari Houser, Rita B. Choula, www.aarop.org/valuing

6 Our Epidemic of Loneliness and Isolation 2023. The U.S. Surgeon General’s Advisory on the Healing Effects of Social Connection and Community. https://www.hhs.gov/sites/default/files/surgeon-general-social-connection-advisory.pdf

Disclaimers

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. RMB Asset Management is a division of RMB Capital Management.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP ® , CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The CFA ® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.