With the back-to-school season upon us, this is a great time to reassess your college savings plan for your children. As a physician, we know you have unique considerations and opportunities when planning for your children’s college education. Early preparation is key, so let’s go over four key questions to help for proper and effective planning.

1. What is the estimated cost?

According to the College Board’s annual cost report found in Table CP-1, the average annual budget (tuition, fees, housing, and food) could be $24,030 for an in-state, public four-year college and $56,190 for the average four-year private college.

Even though college tuition is high, you might not need to save the total amount before your student enrolls. As a physician, you may still be working during your children’s college years, and possibly at an even higher income rate than when your child was born. Earned income could pay for some or all the costs. Additionally, it's challenging to predict the exact type of college or living arrangement that will best suit your child ahead of time.

A best practice is to plan based on a potential range of options, such as:

- Type of College Program:

- Public two-year college

- Private, for-profit colleges and certificate programs

- Two-year college + transfer to four-year college

- In-state, public four-year college

- Out-of-state, public four-year college

- Private, non-profit four-year college

- Type of Living Arrangement:

- At home or on campus

- Off-campus with roommates or relatives

- Taking a gap year or semester

2. How much should you save in advance?

With so many variables at play, it can be hard to set a funding target with confidence. It may be tempting to avoid planning and just assume high future earnings will cover the full cost. However, as a physician, you probably have variable income, increasing operating expenses, and the risk of career burnout. Disciplined saving at any amount, is one thing you can control to offer peace of mind in those moments of stress and uncertainty. Consider saving just a portion of the projected costs—such as the average cost of a public university tuition and fees—as a "down payment" on the future college tab.

Some in-state public universities are as high as $46,000 a year in estimated costs. The idea of saving $184,000 for a potential four-year experience might seem daunting. After all, there are many obstacles physicians must overcome:

- Discipline to save consistently from your paycheck

- Rising tuition costs and varying costs by school and region

- Unpredictable investment returns

- Need to periodically rebalance your investment portfolio

- Desire to avoid student loans

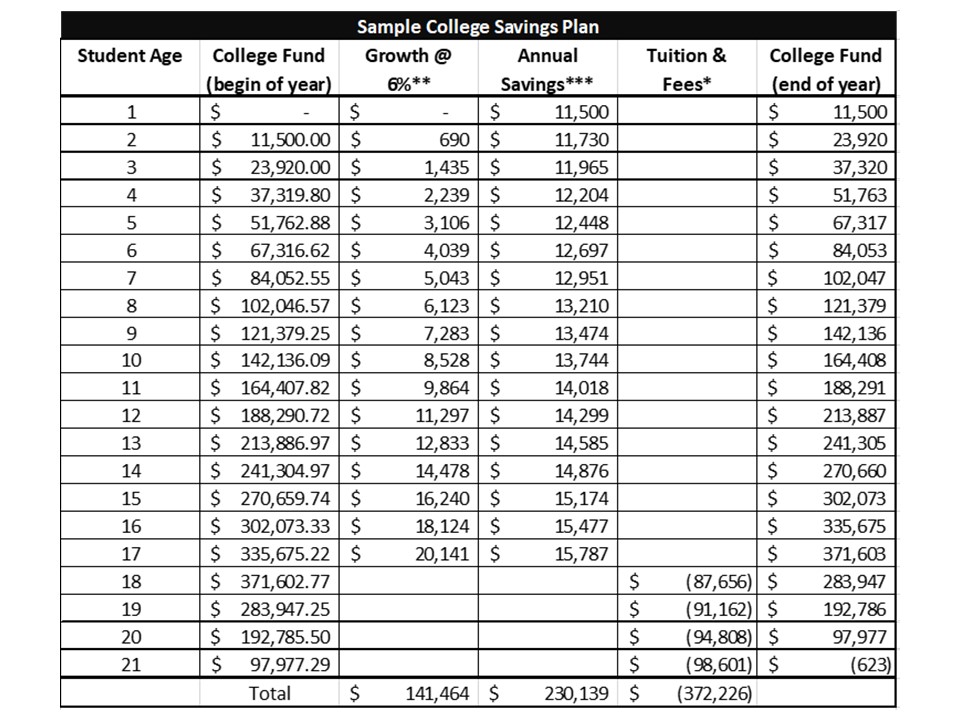

If you do plan to save only for tuition and fees, consider paying other expenses (e.g., room, board, books, supplies, transportation) as they come up to keep costs manageable. This strategy could feel too impromptu for some but very suitable for others. A financial planner can be key in helping determine the right amount of planned savings for you. Below, is a sample college savings plan to help you visualize an average.

Assumptions:

*Average of public/private four-year college is $45,000 per year, inflated by 4% per year.

**Linear return of 6% net of fees and taxes until age 18 at which time no investment returns are relied upon.

***Annual savings will go up by 2% per year and cease upon child starting college.

3. What are some ways to save?

Some physicians have irregular “moonlighting” income that they do not rely on for the day to day or monthly expenses. One could consider using that type of income for funding your college accounts. You might choose to use your annual bonus, on-call income, or medical office building rental income, for example. Associating a specific type of income with a specific savings/expense goal is the type of “mental accounting” that some physicians find motivating.

Also, consider the type of physical account needed to save and optimize for asset protection, investment risk, and provide mental reassurance.

Three options of dedicated college savings accounts for the benefit of your student that offer some asset protection are:

- 529 College Savings and Pre-paid Tuition Programs owned by non-physician spouse

- UTMA/UGMAs with the non-physician spouse as the custodian

- Health and Education Exclusion Trusts (HEET) managed by a trustee

Another option are multipurpose accounts, ordered below from greatest to least asset protection:

- Spousal and Employee Roth and Traditional IRAs (limitations apply)

- Other retirement plans such as 401(k) Savings (limitations apply)

- Life insurance (accumulated cash value) with non-physician spouse as owner and beneficiary

- Taxable investment accounts in non-physician spouse’s name or joint tenants by entirety, if possible

4. What if there is a savings gap?

Very few families have fully funded college savings accounts, but thankfully there are ways to bridge the gap between costs and savings:

- Current income from you and your student

- Early graduation using college credit earned in high school

- Earning college credit during less expensive summer sessions

- Student living at home or with relatives

- Scholarships based on academic, athletic, musical, or artistic abilities

- Applying to a college with a high percentage of admitted students with a merit scholarship

- Non-need based financial aid (e.g., Federal Parent PLUS Loan, student loans – usually unsubsidized for children of high-income physicians)

- Direct tuition gifts (e.g., from grandparents), which are income and gift tax-free to the student

- Deferring enrollment / “Gap Year” to set aside more savings

Note that FAFSA (Free Application for Federal Student Aid) guidelines may exclude certain assets from your “Student Aid Index (SAI)”, formerly the “Expected Family contribution (EFC)” calculation. This includes equity in your home, retirement plans, and life insurance cash value. However, household income can still impact eligibility for need based scholarships/grants as well as assets in bank accounts, taxable brokerage accounts, 529 plans, and equity in real estate other than your primary residence.

Final Thoughts

Before setting up any savings or investment program, it's essential to understand your full financial picture, asset protection priorities, and saving capacity. Every strategy and type of account has pros and cons, and there are many competing goals for your available cash flow and investments.

As a physician, peace of mind and stress minimization is hard earned. But by working with a comprehensive financial planner, you can prioritize goals and set realistic expectations. The earlier you plan, calculate future costs, and understand your funding options, the more financially confident you will feel as your student progresses through their academic journey.

The opinions and analyses expressed in the article are based on Curi RMB Capital, LLC's research and professional experience. The information and data in this article do not constitute legal, tax, accounting, investment or other professional advice. Investors should consult with their trusted professionals prior to taking any action.

The content contained herein was generated by Curi RMB Capital with the assistance of an AI-based system to augment the effort.

Certified Financial Planner Board of Standards, Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.