Markets

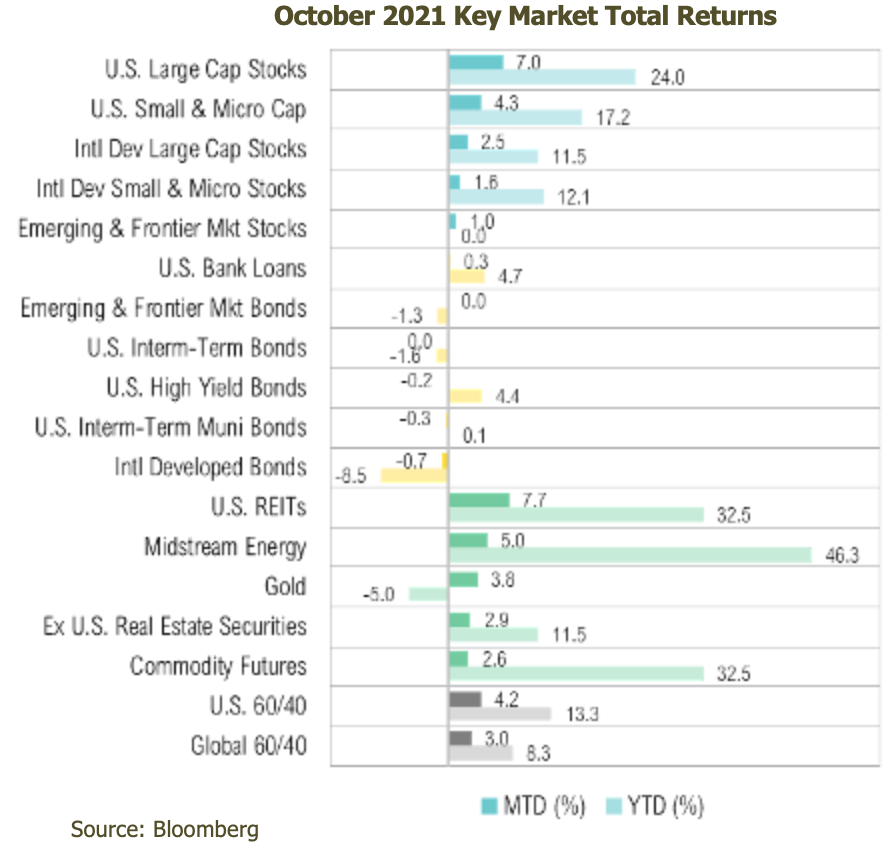

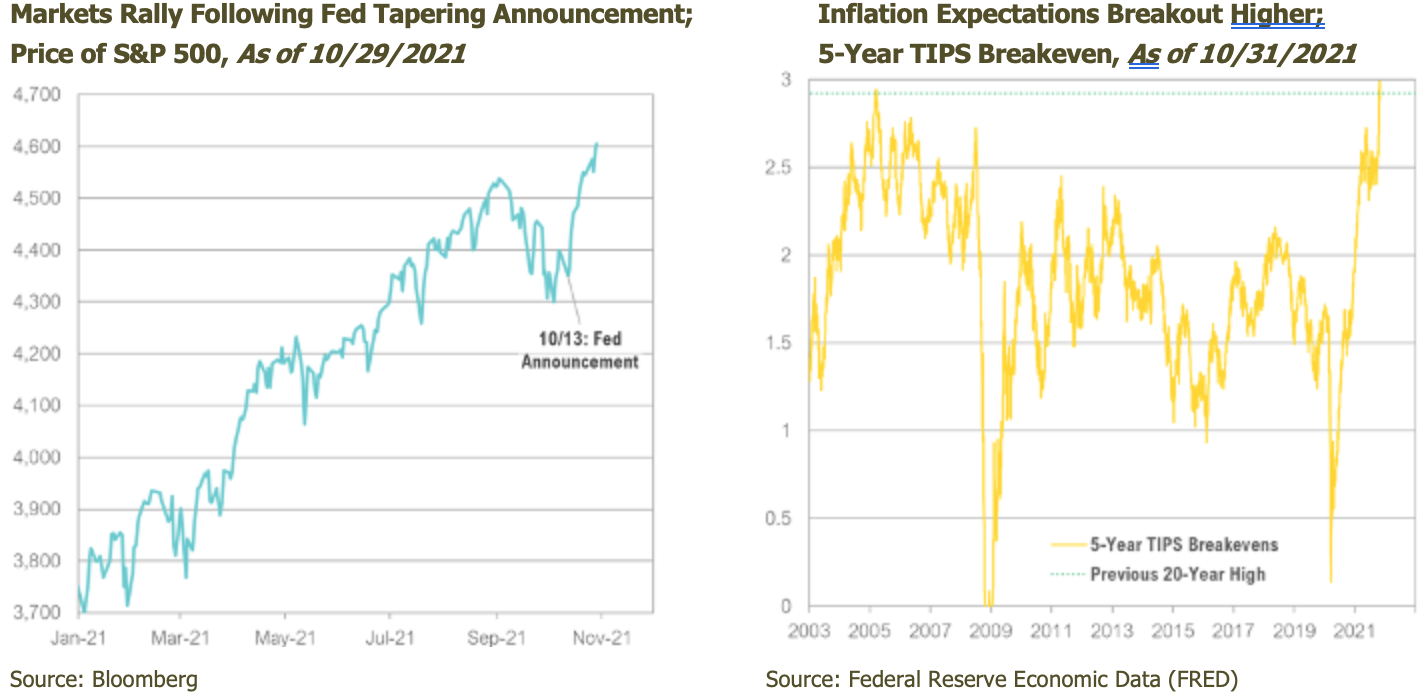

The S&P 500 Index had its best month of the year in October, rising 7% and bouncing back significantly from September’s 4.7% loss, which was its worst month since March 2020. The large cap index ended October at an all-time high, adding to an impressive run of 59 new daily closing highs in 2021, the third-highest annual total since the Great Depression.1 While valuations are unquestionably high,2 the recent rally has been supported by higher-than-expected earnings and profitability. As of the end of the month, the blended third-quarter earnings growth rate for the S&P 500 is 39.1% on a year-over-year basis, the third-highest growth rate since 2010.3 Further, operating margins are 13.3%, substantially higher than the 8.1% average since 1993.1 Equity markets also responded favorably to a dovish interpretation of the Federal Reserve’s mid-October interest rate decision, as well as decreasing COVID-19 cases and hospitalizations in the United States.4

Despite the good news, investors remain fixated on the government’s unprecedented monetary policy support. The S&P 500 was up just 1% month-to-date through October 12. On October 13, the Fed announced that it would continue with the status quo of purchasing $120 billion Treasury and mortgage-backed securities per month. However, it hinted that at the November meeting, if the decision were made to begin slowing purchases, the tapering cycle could be completed around mid-2022.5 (As suggested, the Fed did indeed decide in early November to start tapering asset purchases in late November.)6

International developed market and emerging market stocks lagged behind U.S. equities, despite posting absolute returns of 2.5% and 1.0%, respectively. As a result, emerging market stocks have bounced back to flat for 2021.

Within fixed income markets, longer duration bonds underperformed, as interest rates rose due to inflation concerns. Five-year market-implied inflation, as proxied by the yield spread between Treasuries and Treasury Inflation-Protected Securities (TIPS), finished October at a multi-decade high of 2.9%. Real assets, often viewed as a hedge against the declining purchasing power inflation causes, posted impressive gains. U.S. REITs led the way, up 7.7% for the month. The price of crude oil jumped higher by over 20%, reaching $85/barrel for the first time since 2014. The demand for energy continues to climb; total world petroleum consumption was estimated to be 98.9 million barrels per day in the third quarter, a post-pandemic high.7

Biden’s Approval Slide

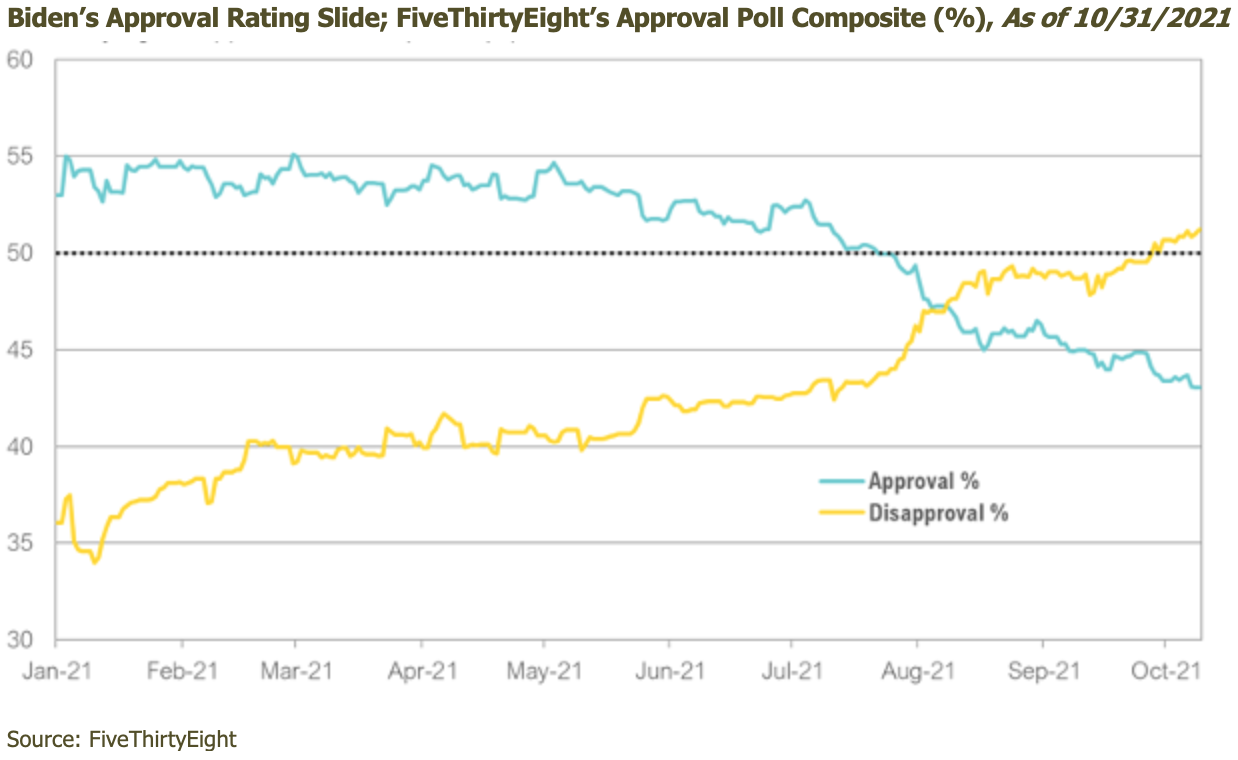

As with his two predecessors, U.S. President Joe Biden’s net approval rating has declined since his inauguration, dropping steadily from +17% at the start of his presidency to -8.2% by the end of October.8 This represents the second-worst net approval rating by any president 285 days into their first term since World War II.8 Some blame the delta variant COVID-19 surge, while others point to delays surrounding key agenda items, like the bipartisan infrastructure bill and a multi-trillion-dollar social spending package focused on health care, education, and climate change policies.9

Biden and his cabinet have their work cut out for them if they hope to turn public perception around. One big ticket item, the aforementioned $1 trillion bipartisan infrastructure bill, was nearing a conclusion at the end of October (and finally passed and signed into law in early November).10

As Congress debates how to pay for this legislation, the United States government once again finds itself up against its debt limit.11 The prior extension of the limit to $28.4 trillion, agreed upon in 2019, was reached at the end of July, which means the Treasury can no longer issue additional debt to fund obligations until a new limit is set.11 Since then, the Treasury used its cash surplus to fund its day-to-day operations, but this was scheduled to run out by the end of October.11 As the clock wound down, the House voted to increase the debt ceiling by $480 billion, an amount expected to allow the U.S. to pay its bills through December 3.12 Since then, the debt debate has mostly taken a backseat to the “Build Back Better” legislation. At the end of the month, Treasury Secretary Janet Yellen brought the debate to the forefront once again by saying Democratic Congressional leaders could push through the debt ceiling bill on their own via the reconciliation process:

“Should it be done on a bipartisan basis? Absolutely. Now if [the republicans] are not going to cooperate, I don’t want to play chicken and end up not raising the debt ceiling. I think that’s the worst possible outcome. If Democrats have to do it themselves [through reconciliation], that’s better than defaulting on the debt to teach the Republicans a lesson.”13

Bond markets in particular will remain attentive to how Congress will deal with the federal debt ceiling and how this issue will affect Treasury issuance (supply) for the coming quarters. From an economic and market perspective, interest rates must remain contained.

Energy Price Spike

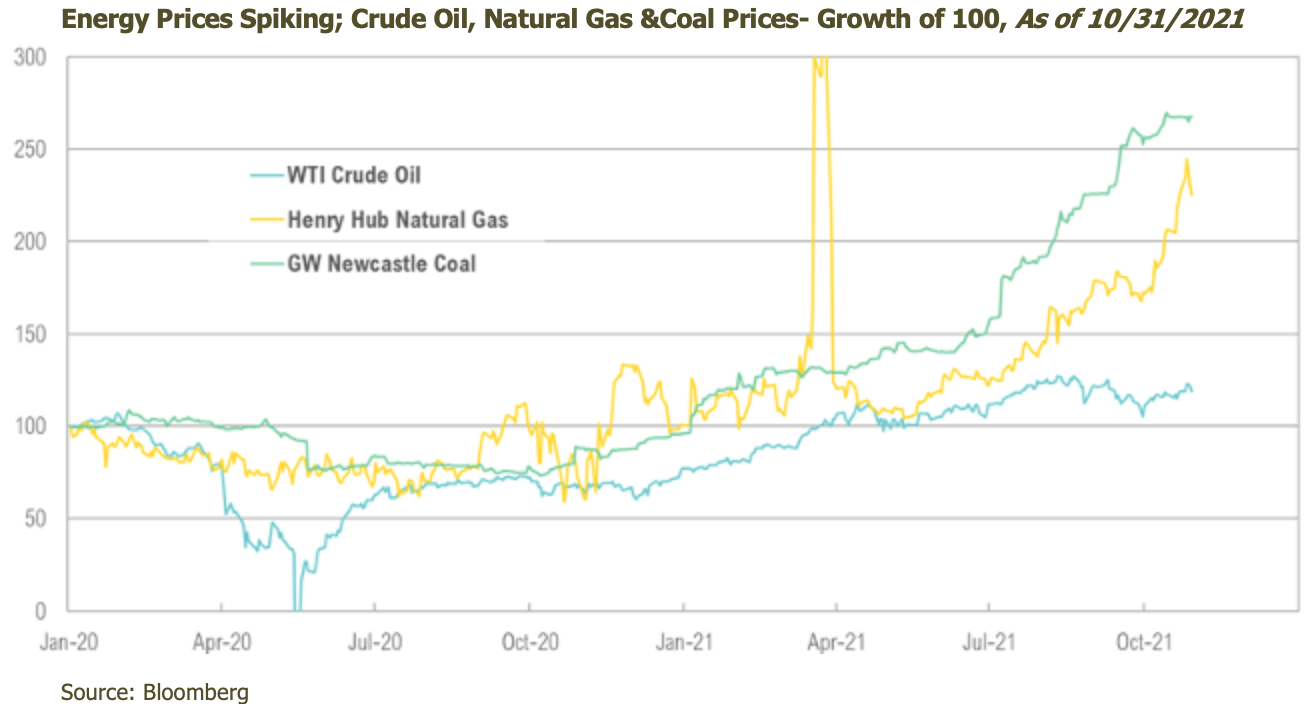

Energy prices shot higher in October. Crude oil, natural gas, and coal prices increased 13%, 30% and 6%, respectively. Year-to-date increases have been even more surprising—crude oil is up 54%, natural gas up 125%, and coal up 178%. Heading into the winter months in the northern hemisphere, natural gas prices are particularly concerning outside the U.S., as spot prices have more than quadrupled and hit record levels in Europe and Asia.14 The price of natural gas typically reflects seasonal and localized factors, but we could be experiencing the beginning of an unprecedented global price shock.14

Despite higher prices, demand for natural gas remains strong. This year, 36% of electricity generation is expected to come from natural gas—only a small dip from last year’s 39%.15 Coal will likely benefit the most from this 3% decline. It is projected to generate 18% more electricity this year than in 2020, hitting its highest level since 2001.15 Its price is also soaring. However, constraints on coal supply and low coal reserves are limiting consumption, compared to previous periods of natural gas price increases.15 Oil also seems unlikely to provide an alternative heating and power source due to high prices and the October announcement from OPEC+ that its production targets will remain unchanged.16 The International Monetary Fund (IMF), which promotes global economic growth and financial stability, has warned that global growth may soon be impacted if energy prices remain elevated.14

This macro environment stands in stark contrast to conditions 18 months ago, when May 2020 WTI oil futures contracts plummeted to -$37.63/barrel due to a massive supply glut following global lockdowns.17 As a result, energy producers cut production and slashed their investments. However, consumption rebounded faster than anticipated, led by the industrial sector. Yet due to labor shortages, maintenance backlogs, longer lead times for new projects, and investors’ lackluster interest in fossil fuels, companies were slow to increase supply when demand suddenly jumped, and as a result, energy prices shot upward. At the end of October, natural gas production in the U.S. remains below pre-crisis levels.14

With winter rapidly approaching and markets struggling to correct themselves, a bipartisan group of senators from New England sent a letter on October 28 to the White House urging “targeted actions” to provide relief “given the current state of energy markets.”18 The letter goes on to suggest “releasing inventory from the Strategic Petroleum Reserve and the Northeast Home Heating Oil Reserve and limiting natural gas exports to lessen the effect of potential residential energy price increases.”18 It’s worth noting that both the IMF and the U.S. Energy Information Administration expect prices to normalize by sometime next year, but both agencies predict volatile conditions in the near term.14,15

Looking Forward

Across the globe, communities continue to recover from the effects of the COVID-19 pandemic and lockdowns, but challenges persist. Although record levels of stimulus were initially welcome and likely necessary, continued stimulus – exacerbated by a multitude of supply issues – is leading to overheating in some sectors, most notably in energy.

As we explained in our September commentary, we expect market participants—and bond vigilantes—to start paying more attention to price shifts in the energy complex. At the end of October, a barrel of WTI crude oil traded for a little over $83, a price not exceeded since 2014. Similarly, the national average gas price is now well over $3 per gallon, a seven-year high.19 Finally, natural gas prices are at 13-year highs. If bond vigilantes stay quiet, unsustainable policy accommodation can likely continue. If they do not, investors should expect elevated volatility—at least relative to what has been an extraordinarily good year for asset prices. Another scenario is that the economic pain of higher energy prices could become so acute that a new breed of vigilantes may emerge—the energy vigilantes—who could force policymakers’ hands.

At RMB, we continue to recommend maintaining diversified portfolios of investments that have the potential to perform well in a broad range of market outcomes. As we move forward from here, we are closely watching the labor market dynamics in the U.S., as unemployment has continued to fall yet job openings remain at historical highs. Consumers are faced with empty shelves in stores and long lead times for other purchases, such as vehicles, as labor and supply chain shortages have made delivery of goods difficult for companies. Many investors view these issues as a sign that the inflationary pressures seen over the last six months are likely to continue in coming months. Concerns about the job market, supply shortages, and inflation have all contributed to the uneven economic recovery, which is likely to persist in the near future. Corrections in equity markets and continued interest rate volatility remain a possibility in this environment. Given this, RMB believes investors should evaluate risk exposures in portfolios. One way for investors to respond in this type of environment is to maintain long-term asset allocation targets to stocks and bonds, but to reduce risk through a focus on high quality core investments within these allocations. While remaining cognizant of the increasing risks, we continue to focus on balancing opportunities in the current environment and taking advantage of niche markets that present attractive risk/reward opportunities.

1S&P Global: https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes/

2Multpl: https://www.multpl.com/shiller-pe

4Our World in Data: https://ourworldindata.org/coronavirus#all-charts-preview

5Federal Reserve: https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20210922.pdf

7EIA: https://www.eia.gov/outlooks/steo/

8FiveThirtyEight: https://projects.fivethirtyeight.com/biden-approval-rating/

9The Economist: https://www.economist.com/graphic-detail/2021/10/14/joe-bidens-approval-rating-reaches-a-new-low

10NY Times: https://www.nytimes.com/2021/08/10/us/politics/infrastructure-bill-passes.html

11NY Times: https://www.nytimes.com/2021/09/27/us/politics/us-debt-ceiling.html

12WSJ: https://www.wsj.com/articles/house-set-to-temporarily-raise-debt-limit-11634036401

13The Washington Post: https://www.washingtonpost.com/us-policy/2021/11/01/yellen-debt-ceiling-biden/

14IMF: https://blogs.imf.org/2021/10/21/surging-energy-prices-may-not-ease-until-next-year/

15EIA: https://www.eia.gov/outlooks/steo/

17Bloomberg: https://www.bloomberg.com/news/articles/2020-04-20/negative-prices-for-oil-here-s-what-that-means-quicktake

18U.S. Senate: https://www.collins.senate.gov/sites/default/files/211028.bidenhassancollinsreedwinterfuels.pdf

19CNBC: https://www.cnbc.com/2021/10/06/americans-are-paying-the-most-for-gas-in-seven-years.html

All market pricing and performance data from Bloomberg, unless otherwise cited. Asset class and sector performance are gross of fees unless otherwise indicated.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC’s (“RMB Capital”) research and professional experience, and are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account. The S&P 500 Index is widely regarded as the best single gauge of the U.S equity market. It includes 500 leading companies in leading industries of the U.S economy. The S&P 500 focuses on the large cap segment of the market and covers 75% of U.S. equities. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade. The Bloomberg Commodity Indices (BCOM) are a family of financial benchmarks designed to provide liquid and diversified exposure to physical commodities via futures contracts. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available The Russell 1000® Growth Index measures the performance of the large- cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russel 1000® companies with lower price-to-book ratios and lower expected growth values. The Russell 2000® Value Index measures the performance of small-cap value segment of the US equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values The Russell 2000® Growth Index measures the performance of the small- cap growth segment of the US equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the US and Canada. The Bloomberg Barclays 1-10 Year Municipal Blend Index is a market value-weighted index which covers the short and intermediate components of the Barclays Municipal Bond Index—an unmanaged, market value-weighted index which covers the U.S. investment-grade tax-exempt bond market. The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.