When you think about real estate as an investor, it helps to take a big-picture view. Real estate supports the way we live, work, socialize and travel. And when we see major changes across society to the way we do these things, the real estate industry generally adapts and changes, too.

From an investment perspective, the composition of the institutional real estate market has changed over time. Twenty years ago, the bulk of real estate investments in the U.S. were in residential, office, or retail properties. Now, the percentage of those investments as a share of the market has declined (for example, because of the rise of online shopping and less in-person shopping at retail malls), while investments in new property types like data centers and cell towers now comprise a significant portion of the market.

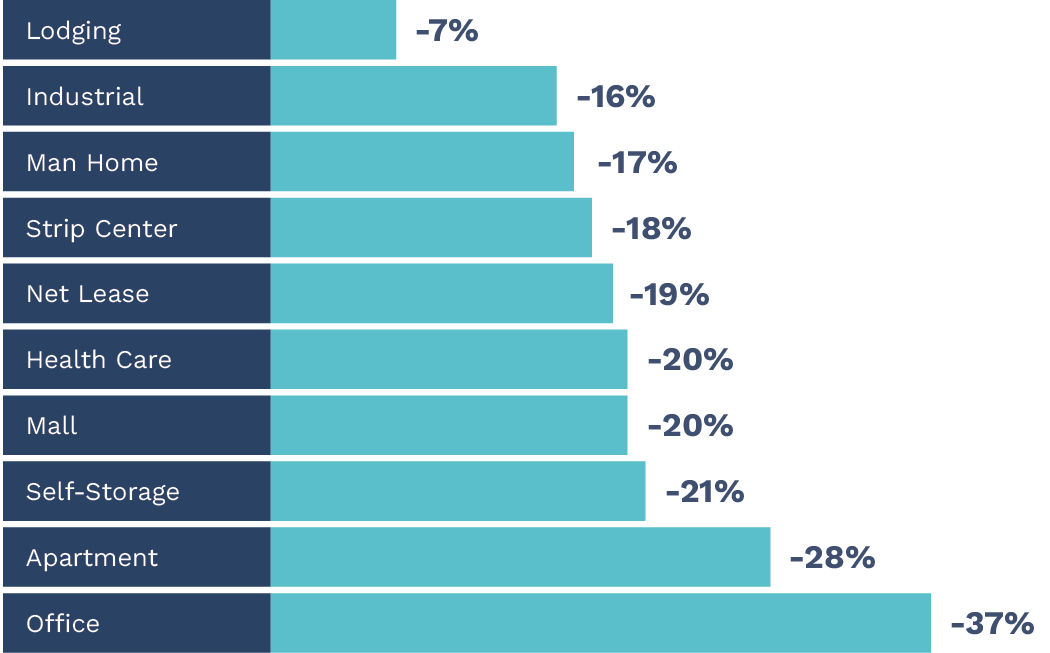

At Curi RMB Capital, we believe real estate investment strategies must adapt along with this rapidly changing sector, and drill down beyond the headlines because separating fact from perception is essential. For example, there is a common narrative of a “crisis” in commercial real estate in the media. While it’s true that office properties (particularly those of lower quality) are undergoing a paradigm shift, they only make up a small percentage of the total real estate market. Strong operating fundamentals, limited supply, and/or considerable tenant demand characterize many other sectors of the real estate market today.

A flexible approach positions investors to identify attractive opportunities across property types. Investing alongside partners who have a demonstrated ability to identify high-quality assets, leverage their operating expertise, and drive value through hands-on property management is crucial. A rigorous due diligence process is also essential, and while it doesn’t guarantee success, it can help investors have confidence that they are making every effort to ensure the quality of their investment choices.

Another key ingredient in real estate investing is a robust sourcing network. In 2023, the Curi RMB Capital team reviewed nearly 200 potential real estate investments; we ultimately made just four investments, reflecting the rigor of our approach and philosophy.

Changing generational habits in the way we work, live, and socialize are leading to opportunities in newly emerged property types. These include single-family rentals, driven by the inventory shortage and affordability issues in the residential housing market for millennials. Baby Boomers are increasing demand for senior housing complexes. Rising data consumption, cloud computing, IT outsourcing, and implementation of Artificial Intelligence mean continued growth in data center construction and leasing. On-shoring of pharmaceutical research and development means further growth in life sciences facilities. And the widespread adoption of 5G technology requires more cell towers from coast to coast.

To be sure, the Fed’s interest rate increases have had an impact on valuations, and they have broadly slowed transactions across all real estate markets. However, we believe that higher rates have largely been priced into most real estate investments at this point. Regardless of interest rates, the real estate market is clearly evolving, and our goal is to help investors capture the benefits of those changes over time.

If you have questions about Curi RMB Capital’s real estate strategies or our investment approach, please talk to your advisor today.

The opinions and analyses expressed in this presentation are based on Curi RMB Capital, LLC’s (“Curi RMB Capital”) research and professional experience are expressed as of the date of this presentation. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future performance, nor is it intended to speak to any future time periods. Curi RMB Capital makes no warranty or representation, express or implied, nor does Curi RMB Capital accept any liability, with respect to the information and data set forth herein, and Curi RMB Capital specifically disclaims any duty to update any of the information and data contained in this presentation. The information and data in this presentation does not constitute legal, tax, accounting, investment or other professional advice.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.