In our Summer 2020 issue of INVESTED, I presented an overview of private trust companies, “A Guide to Private Trust Companies Today.” That article addressed how trustee services have evolved, compared available service models, and provided guidance to consider when selecting a private trust company. This article provides a brief recap. It also serves as our formal announcement of RMB Private Trust.1 In response to our clients’ evolving needs and desires, we formed RMB Private Trust to offer directed trustee services to our clients nationwide in many situations not otherwise served by other providers. Continue reading to learn more about how RMB Private Trust benefits our clients.

Estate Planning Evolution

Given the favorable status of estate taxes (relatively high exemptions and relatively low tax rates), estate plans now focus more on the preservation of family legacies. The planning process addresses broader decisions relating to the extent, timing, and stewardship of family inheritance across many generations.

As estate planning goals have evolved, people have increasingly hired professionals to preserve their long-term family legacies. Naming corporate trustees for administration is more common than ever, as is seeking investment advisors who are best suited to attain investment goals that complement family legacies.

Corporate Trustee Role Evolution

Last summer, I explained how the role of a corporate trustee has evolved substantially over the past few decades and how people now have more choices to fill this important role.

For example, traditional corporate trustees who operate under the “delegated trust” model retain custody of all assets, control beneficiary distributions, and manage all investments in-house. This old-fashioned approach often led to a reputation for higher fees, lower beneficiary service continuity, and conservative (lower) investment performance. The delegated trust model is most commonly found in traditional banks today.

Since the late 1980s, state trust laws have evolved, and most allow corporate trustees to follow the modern “directed trust” model. RMB Private Trust has adopted and follows this directed trust model.

Under the directed trust model, the trust agreement names separate fiduciaries to manage investment, business, or distribution decisions. This model provides RMB Private Trust with greater flexibility to focus on trust administration, while involving others to take responsibility for their respective roles.

Through RMB Private Trust, this approach leads to lower fees, increased beneficiary service continuity, and strategic (higher) investment performance. It also provides our clients with more flexibility and control over their professional advisors and family legacies.

Appeal of Naming RMB Private Trust

When drafting a trust agreement following the directed trust model, our clients can now name RMB Private Trust to manage trust administration. They then can name and fill additional roles for:

- RMB Capital and other investment advisors they choose who manage assets based on their respective specialties;

- family business advisors who manage private family business interests;

- special asset advisors who manage nontraditional investments, such as oil and gas interests, real estate, or private equity; and

- distribution advisors who manage discretionary beneficiary distribution decisions.

Because family members retain control over the hiring and firing of each respective advisor, they maintain flexibility and control. Since each advisor is treated as a fiduciary, the acts of one advisor do not create additional risk for the others. The evolution of the directed trust model has created a growing industry of private trust companies that focus solely on trust administration—especially in states with the most progressive directed trust statutes, including Alaska, Delaware, Nevada, New Hampshire, South Dakota, and Tennessee. With its national charter and separate South Dakota office, RMB Private Trust can serve clients anywhere in the country, including these progressive directed trust states.

RMB Private Trust allows clients to retain more inclusive and diverse relationships with chosen professionals, including our RMB Capital advisory team, attorneys, and accountants who have served alongside their families for years.

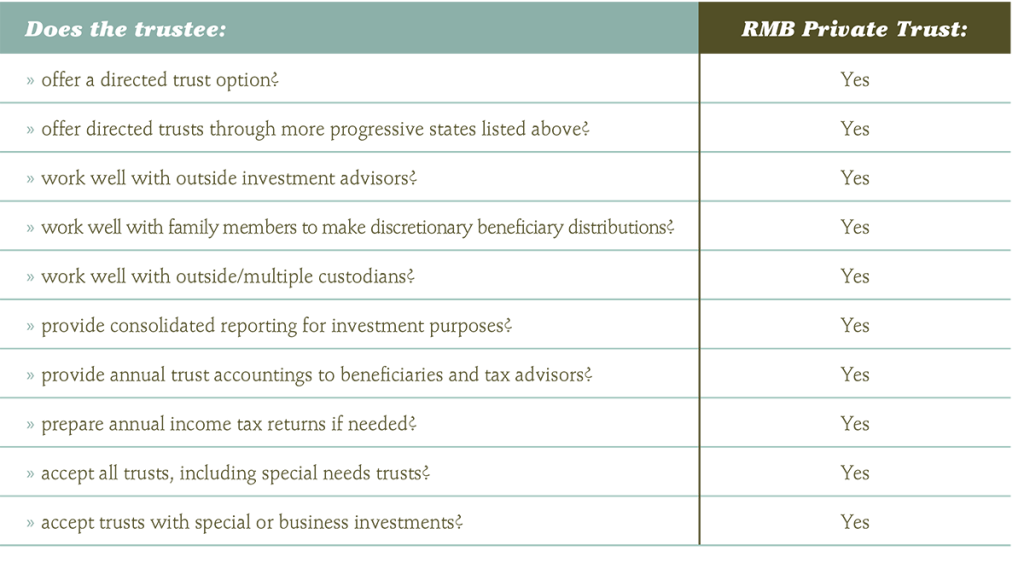

Selecting RMB Private Trust

Last summer, I provided a list of several questions to consider when naming a private trust company. Shown here are the answers to those questions in the context of RMB Private Trust.

If you decide to name RMB Private Trust, plan to take the following steps:

- Review potential options with your RMB wealth advisor.

- Review relative service options, fee schedules, and state law preferences to meet your needs.

- Review required trust language to memorialize your appointment.

- Work with your family attorney to update trust documents as needed.

RMB Private Trust offers services as a sole trustee, co-trustee, or agent for trustee. These different service levels allow our clients to get assistance with items like bill pay while they remain healthy. RMB Private Trust can then transition to shared or sole trust administration responsibility later. RMB Private Trust typically charges less for all service levels since it focuses on trust administration alone.

The evolution of the directed trust model provides families with greater control and flexibility regarding the professionals they choose to work together for their benefit. RMB Private Trust has been formed to help our clients attain these goals.

- RMB Private Trust is a Trust Representative Office of National Advisors Trust Company (NATC). NATC is federally chartered and regulated by the Office of the Comptroller of the Currency (OCC), a bureau of the U.S. Treasury Department, and is authorized to do business in all 50 states. It is a member of the Federal Deposit Insurance Corporation (FDIC). By law, client assets are segregated from the capital assets of NATC and are not subject to potential creditor claims against the trust company. As an independent trust company created by the client’s trust advisor, the trust company’s primary responsibility is to ensure the safekeeping of investment assets.

The opinions and analyses expressed in this communication are based on RMB Capital’s research and professional experience and are expressed as of the mailing date of this communication. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this communication. The information and data in this communication do not constitute legal, tax, accounting, investment, or other professional advice. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account.