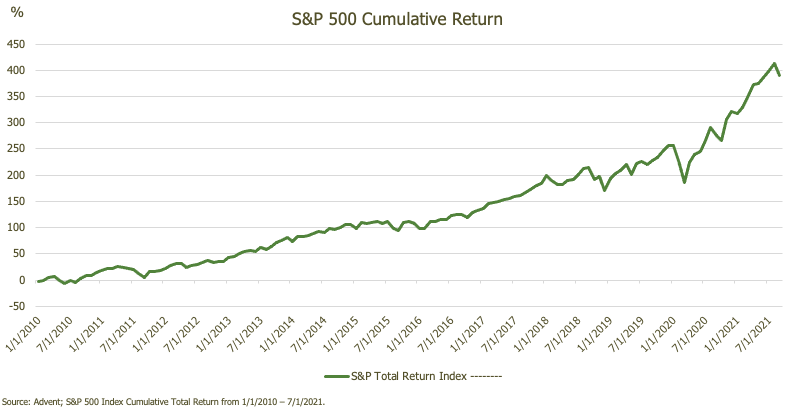

Over the past year, there have been predictions of an impending market selloff in the media. Over the past decade, during one of the strongest bull markets in history, there have been many similar predictions. During that time, the market increased significantly, though along the way, there were several selloffs, a normal function of capital markets. Despite those selloffs, the S&P 500 is up over 350% since 2009.1

We know selloffs will happen, which is why we believe time in the market is more important than timing of the market.

At RMB, we believe the best course of action for investors is to focus on the long-term view, maintaining diversified portfolios of investments that anticipate a broad range of outcomes.

Should you have any questions or concerns, please don’t hesitate to reach out to your Advisor. We appreciate your continued confidence in RMB.

1Performance based on S&P 500 Index from March 2009– August 2021. Includes dividends reinvested.

©2021 The Behavioral Finance Network. Used with Permission

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. All indices are unmanaged and may not be invested into directly.

The opinions and analyses expressed in this newsletter are based on RMB Capital Management, LLC's ("RMB Capital") research and professional experience, and are expressed as of the date of our mailing of this commentary. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future performance, nor is it intended to speak to any future time periods. RMB Capital makes no warranty or representation, express or implied, nor does RMB Capital accept any liability, with respect to the information and data set forth herein, and RMB Capital specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this commentary does not constitute legal, tax, accounting, investment, or other professional advice. This information is confidential and may not be reproduced or redistributed to any other party without the permission of RMB Capital.